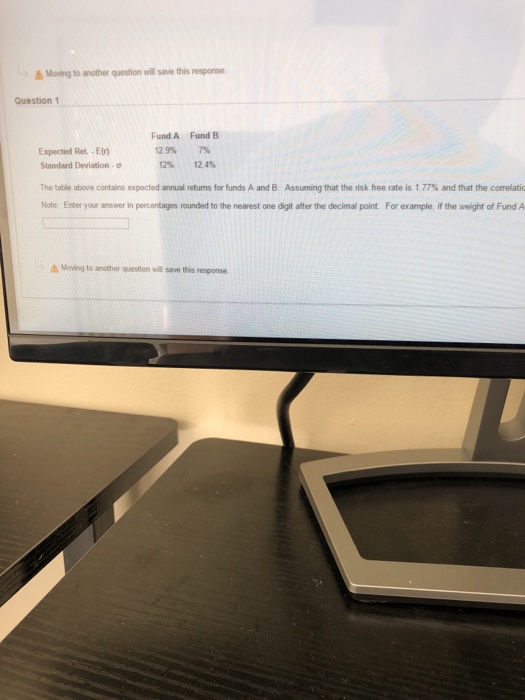

Question: Movingt0 another question will save this response Question 1 Fund A 129% Fund B 7% Expected Ret.-E Standard Deviation . 12% 124% The table above

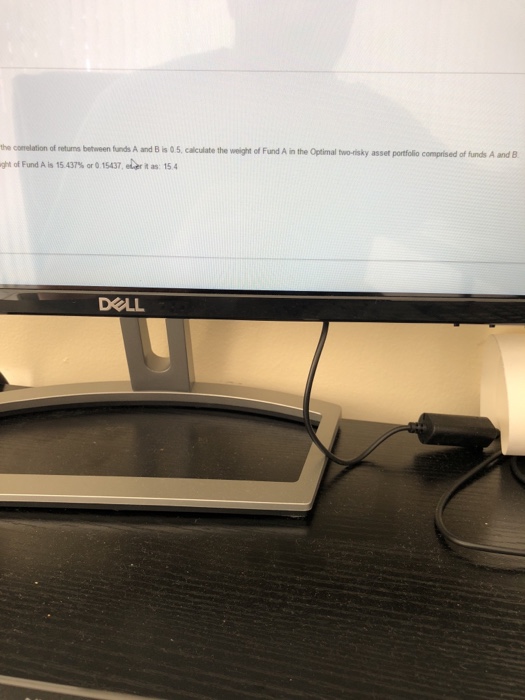

Movingt0 another question will save this response Question 1 Fund A 129% Fund B 7% Expected Ret.-E Standard Deviation . 12% 124% The table above contains expected annual returns for funds A and B Assuming that the nsk free rate is 1.77% and that the corelati Note: Enter your answer in percentages rounded to the nearest one digit after the decimal point. For example, if the weight of FundA Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts