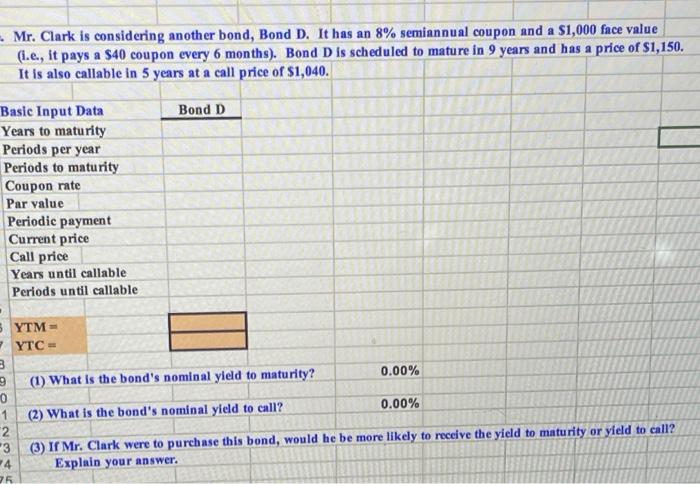

Question: Mr. Clark is considering another bond, Bond D. It has an 8% semiannual coupon and a $1,000 face value (..e, it pays a $40 coupon

Mr. Clark is considering another bond, Bond D. It has an 8% semiannual coupon and a $1,000 face value (..e, it pays a $40 coupon every 6 months). Bond D is scheduled to mature in 9 years and has a price of $1,150. It is also callable in 5 years at a call price of $1,040. Bond D Basic Input Data Years to maturity Periods per year Periods to maturity Coupon rate Par value Periodic payment Current price Call price Years until callable Periods until callable 5 YTM YTC= 3 99 (1) What is the bond's nominal yield to maturity? 0.00% 0 1 (2) What is the bond's nominal yield to call? 0.00% 2 *3 (3) If Mr. Clark were to purchase this bond, would he be more likely to receive the yield to maturity or yield to call? 4 Explain your answer. 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts