Question: Mrs. Patel opens a non-qualified contract from a 1035 Exchange. Her contract at the other company did not do well. She originally put a

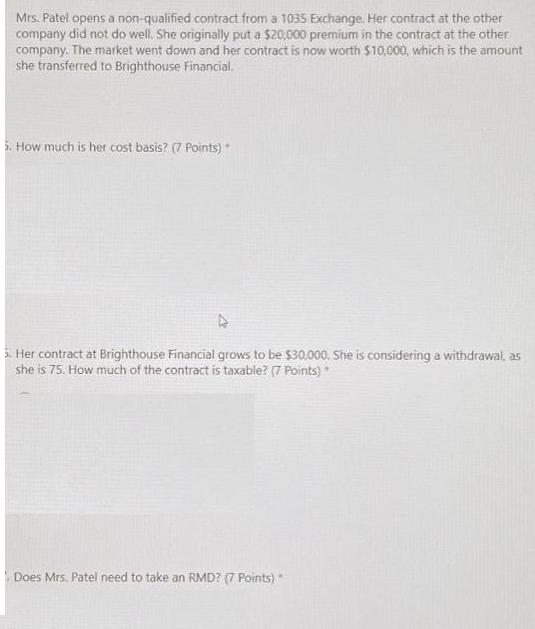

Mrs. Patel opens a non-qualified contract from a 1035 Exchange. Her contract at the other company did not do well. She originally put a $20,000 premium in the contract at the other company. The market went down and her contract is now worth $10,000, which is the amount she transferred to Brighthouse Financial. 5. How much is her cost basis? (7 Points) 5. Her contract at Brighthouse Financial grows to be $30,000. She is considering a withdrawal, as she is 75. How much of the contract is taxable? (7 Points) Does Mrs. Patel need to take an RMD? (7 Points)

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

1 To determine Mrs Patels cost basis we need to consider the amount she originally invested in the c... View full answer

Get step-by-step solutions from verified subject matter experts