Question: Ms. Calhoun is age 48 and single. Required: a. What is the maximum contribution that she can make to a Roth IRA If her AGI

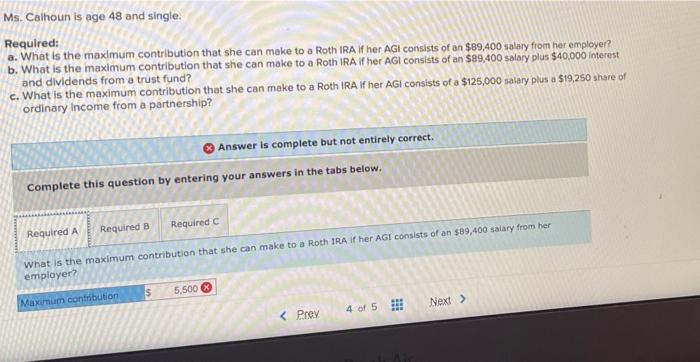

Ms. Calhoun is age 48 and single. Required: a. What is the maximum contribution that she can make to a Roth IRA If her AGI consists of an $89,400 salary from her employer? b. What is the maximum contribution that she can make to a Roth IRA If her AGI consists of an $89,400 salary plus $40,000 interest and dividends from a trust fund? c. What is the maximum contribution that she can make to a Roth IRA if her AGI consists of a $125,000 salary plus a $19,250 share of ordinary Income from a partnership? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Required What is the maximum contribution that she can make to a Roth IRA If her AGI consists of an $89,400 salary from her employer? $ 5.500 Maximum contribution 4 of 5 BRE Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts