Question: Multiple choice. Please answer 4 - 8. The following multiple-choice questions are worth two points each. 4. All of the following statements concerning the Social

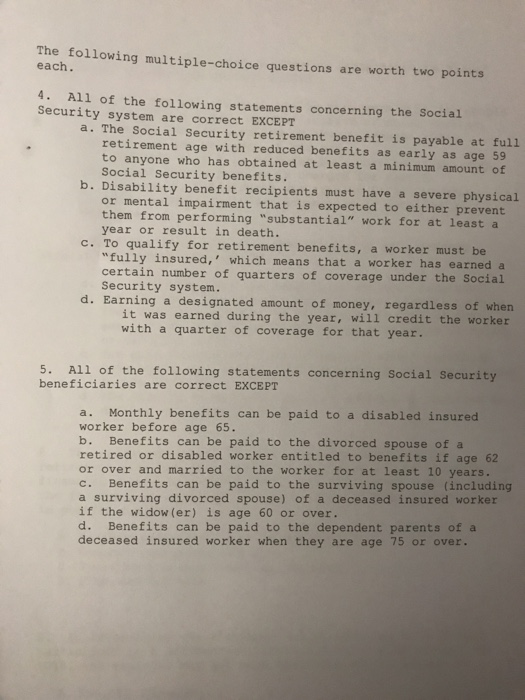

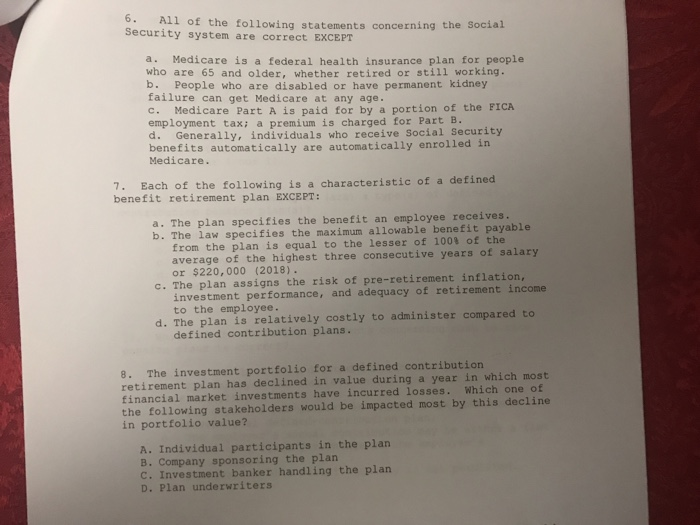

The following multiple-choice questions are worth two points each. 4. All of the following statements concerning the Social Security system are correct EXCEPT a. The Social Security retirement benefit is payable at full retirement age with reduced benefits as early as age 59 to anyone who has obtained at least a minimum amount of Social Security benefits. b. Disability benefit recipients must have a severe physical or mental impairment that is expected to either prevent them from performing "substantial" work for at least a year or result in death. c. To qualify for retirement benefits, a worker must be fully insured,' which means that a worker has earned a certain number of quarters of coverage under the Social Security system d. Earning a designated amount of money, regardless of when it was earned during the year, will credit the worker with a quarter of coverage for that year. 5. All of the following statements concerning Social Security beneficiaries are correct EXCEPT a. Monthly benefits can be paid to a disabled insured worker before age 65. b. Benefits can be paid to the divorced spouse of a retired or disabled worker entitled to benefits if age 62 or over and married to the worker for at least 10 years. c. Benefits can be paid to the surviving spouse (including a surviving divorced spouse) of a deceased insured worker if the widow (er) is age 60 or over. d. Benefits can be paid to the dependent parents of a deceased insured worker when they are age 75 or over. 6. All of the tollowing statements concerning the social Security system are correct EXCEPT a. Medicare is a federal health insurance plan for people who are 65 and older, whether retired or still working. b. People who are disabled or have permanent kidney failure can get Medicare at any age c. Medicare Part A is paid for by a portion of the FICA employment tax; a premium is charged for Part B. d. Generally, individuals who receive Social Security benefits automatically are automatically enrolled in Medicare. 7. Each of the following is a characteristic of a defined benefit retirement plan EXCEPT: a. The plan specifies the benefit an employee receives. b. The law specifies the maximum allowable benefit payable from the plan is equal to the lesser of 100% of the average of the highest three consecutive years of salary or $220,000 (2018). c. The plan assigns the risk of pre-retirement inflation, investment performance, and adequacy of retirement income to the employee. d. The plan is relatively costly to administer compared to defined contribution plans 8. The investment portfolio for a defined contribution retirement plan has declined in value during a year in which most financial market investments have incurred losses. Which one of the following stakeholders would be impacted most by this decline in portfolio value? A. Individual participants in the plan B. Company sponsoring the plan c. Investment banker handling the plan D. Plan underwriters

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts