Question: n i e HELUNGILION & DLDOSAS Challenge Exercise 12 C12-1, China COMPANY, RECEIVABLES, PAYABLES, INVENTORY & SERVICES, and BANKING (Reconciliation) This challenge exercise is using

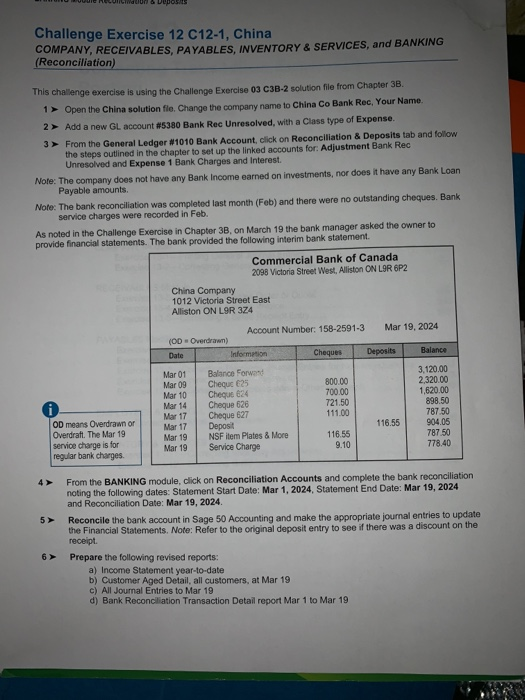

n i e HELUNGILION & DLDOSAS Challenge Exercise 12 C12-1, China COMPANY, RECEIVABLES, PAYABLES, INVENTORY & SERVICES, and BANKING (Reconciliation) This challenge exercise is using the Challenge Exercise 03 C3B-2 solution file from Chapter 3B. 1 Open the China solution fle. Change the company name to China Co Bank Rec, Your Name 2 Add a new GL account #5380 Bank Rec Unresolved, with a Class type of Expense. 3 > From the General Ledger #1010 Bank Account, click on Reconciliation & Deposits tab and follow the steps outlined in the chapter to set up the linked accounts for: Adjustment Bank Rec Unresolved and Expense 1 Bank Charges and Interest Note: The company does not have any Bank Income earned on investments, nor does it have any Bank Loan Payable amounts Note: The bank reconciliation was completed last month (Feb) and there were no outstanding cheques. Bank service charges were recorded in Feb. As noted in the Challenge Exercise in Chapter 3B, on March 19 the bank manager asked the owner to provide financial statements. The bank provided the following interim bank statement. Commercial Bank of Canada 2098 Victoria Street West, Alliston ON LOR6P2 China Company 1012 Victoria Street East Alliston ON LOR 324 Account Number: 158-2591-3 Mar 19, 2024 (OD Overdrawn) Date Information Balance Cheques Deposits Mar 01 Balance Forward 3.120.00 Mar 09 Cheque 25 800.00 2.320.00 Mar 10 1.620.00 Cheque 624 700.00 Mar 14 Cheque 626 721.50 898.50 Mar 17 Cheque 627 111.00 787 50 Mar 17 Deposit 116.55 904.05 Mar 19 NSF item Plates & More 116.55 787 50 Mar 19 Service Charge 778.40 OD means Overdrawn or Overdraft. The Mar 19 service charge is for regular bank charges 9.10 From the BANKING module, click on Reconciliation Accounts and complete the bank reconciliation noting the following dates: Statement Start Date: Mar 1, 2024, Statement End Date: Mar 19, 2024 and Reconciliation Date: Mar 19, 2024. Reconcile the bank account in Sage 50 Accounting and make the appropriate journal entries to update the Financial Statements. Note: Refer to the original deposit entry to see if there was a discount on the receipt. Prepare the following revised reports: a) Income Statement year-to-date b) Customer Aged Detail, all customers, at Mar 19 c) All Journal Entries to Mar 19 d) Bank Reconciliation Transaction Detail report Mar 1 to Mar 19 n i e HELUNGILION & DLDOSAS Challenge Exercise 12 C12-1, China COMPANY, RECEIVABLES, PAYABLES, INVENTORY & SERVICES, and BANKING (Reconciliation) This challenge exercise is using the Challenge Exercise 03 C3B-2 solution file from Chapter 3B. 1 Open the China solution fle. Change the company name to China Co Bank Rec, Your Name 2 Add a new GL account #5380 Bank Rec Unresolved, with a Class type of Expense. 3 > From the General Ledger #1010 Bank Account, click on Reconciliation & Deposits tab and follow the steps outlined in the chapter to set up the linked accounts for: Adjustment Bank Rec Unresolved and Expense 1 Bank Charges and Interest Note: The company does not have any Bank Income earned on investments, nor does it have any Bank Loan Payable amounts Note: The bank reconciliation was completed last month (Feb) and there were no outstanding cheques. Bank service charges were recorded in Feb. As noted in the Challenge Exercise in Chapter 3B, on March 19 the bank manager asked the owner to provide financial statements. The bank provided the following interim bank statement. Commercial Bank of Canada 2098 Victoria Street West, Alliston ON LOR6P2 China Company 1012 Victoria Street East Alliston ON LOR 324 Account Number: 158-2591-3 Mar 19, 2024 (OD Overdrawn) Date Information Balance Cheques Deposits Mar 01 Balance Forward 3.120.00 Mar 09 Cheque 25 800.00 2.320.00 Mar 10 1.620.00 Cheque 624 700.00 Mar 14 Cheque 626 721.50 898.50 Mar 17 Cheque 627 111.00 787 50 Mar 17 Deposit 116.55 904.05 Mar 19 NSF item Plates & More 116.55 787 50 Mar 19 Service Charge 778.40 OD means Overdrawn or Overdraft. The Mar 19 service charge is for regular bank charges 9.10 From the BANKING module, click on Reconciliation Accounts and complete the bank reconciliation noting the following dates: Statement Start Date: Mar 1, 2024, Statement End Date: Mar 19, 2024 and Reconciliation Date: Mar 19, 2024. Reconcile the bank account in Sage 50 Accounting and make the appropriate journal entries to update the Financial Statements. Note: Refer to the original deposit entry to see if there was a discount on the receipt. Prepare the following revised reports: a) Income Statement year-to-date b) Customer Aged Detail, all customers, at Mar 19 c) All Journal Entries to Mar 19 d) Bank Reconciliation Transaction Detail report Mar 1 to Mar 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts