Question: Name Chapter #6 MULTIPLE CHOICE QUESTIONS 1. Items waiting to be used in production are considered to be a. raw materials b. work in progress

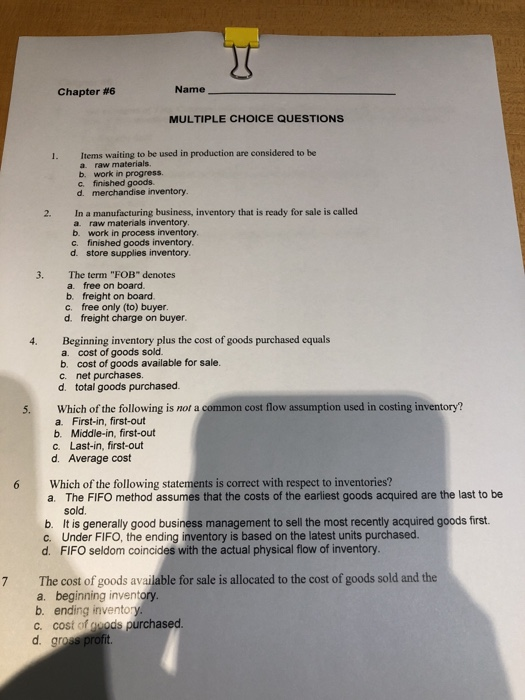

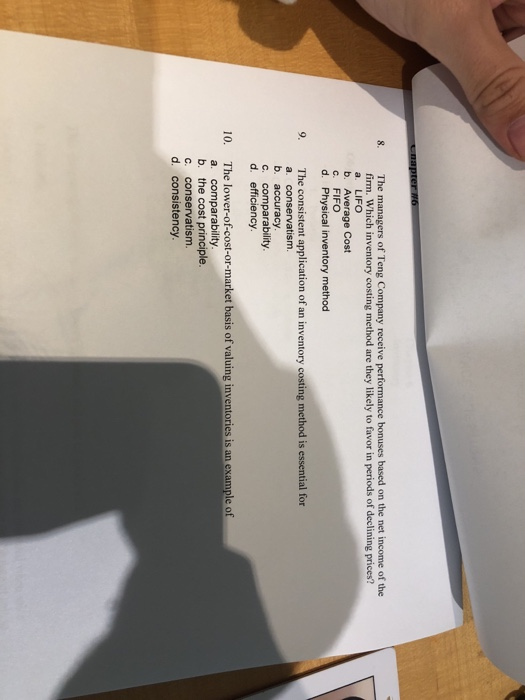

Name Chapter #6 MULTIPLE CHOICE QUESTIONS 1. Items waiting to be used in production are considered to be a. raw materials b. work in progress c. finished goods 2. In a manufacturing business, inventory that is ready for sale is called a. raw materials inventory b. work in process inventory c. finished goods inventory d. store supplies inventory 3. The term "FOB" denotes a. free on board. b. freight on board c. free only (to) buyer d. freight charge on buyer Beginning inventory plus the cost of goods purchased equals a. cost of goods sold. b. cost of goods available for sale. c. net purchases. d. 4. total goods purchased. Which of the following is not a common cost flow assumption used in costing inventory? a. First-in, first-out b. Middle-in, first-out c. Last-in, first-out d. Average cost 5. 6 Which of the following statements is correct with respect to inventories? a. The FIFO method assumes that the costs of the earliest goods acquired are the last to be sold. b. It is generally good business management to sell the most recently acquired goods first. c. Under FIFO, the ending inventory is based on the latest units purchased. d. FIFO seldom coincides with the actual physical flow of inventory. 7 The cost of goods available for sale is allocated to the cost of goods sold and the a. beginning inventory b. ending invento c. cost of ods purchased d. gross profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts