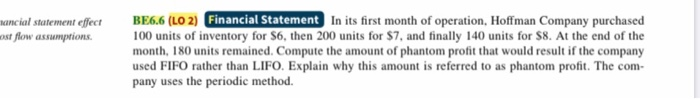

Question: nancial statement effect cost flow assumptions BE6.6 (LO 2) Financial Statement In its first month of operation, Hoffman Company purchased 100 units of inventory for

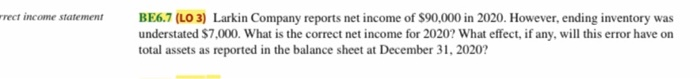

nancial statement effect cost flow assumptions BE6.6 (LO 2) Financial Statement In its first month of operation, Hoffman Company purchased 100 units of inventory for $6, then 200 units for $7, and finally 140 units for $8. At the end of the month, 180 units remained. Compute the amount of phantom profit that would result if the company used FIFO rather than LIFO. Explain why this amount is referred to as phantom profit. The com- pany uses the periodic method. rrect income statement BE6.7 (LO 3) Larkin Company reports net income of $90,000 in 2020. However, ending inventory was understated $7,000. What is the correct net income for 2020? What effect, if any, will this error have on total assets as reported in the balance sheet at December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

It seems like the image youve uploaded contains a question about phantom profit in FIFO and LIFO Let me help you with this Phantom Profit Calculation ... View full answer

Get step-by-step solutions from verified subject matter experts