Question: Napo Itd has a geared k structure as follows Vd= M200m Ve= M300m Kd before tax = 12.5% Ke=20% Tax rate= 40% The co

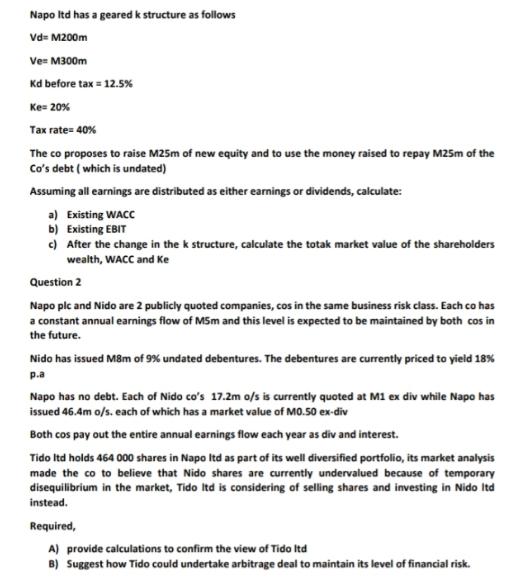

Napo Itd has a geared k structure as follows Vd= M200m Ve= M300m Kd before tax = 12.5% Ke=20% Tax rate= 40% The co proposes to raise M25m of new equity and to use the money raised to repay M25m of the Co's debt (which is undated) Assuming all earnings are distributed as either earnings or dividends, calculate: a) Existing WACC b) Existing EBIT c) After the change in the k structure, calculate the totak market value of the shareholders wealth, WACC and Ke Question 2 Napo plc and Nido are 2 publicly quoted companies, cos in the same business risk class. Each co has a constant annual earnings flow of M5m and this level is expected to be maintained by both cos in the future. Nido has issued M8m of 9% undated debentures. The debentures are currently priced to yield 18% p.a Napo has no debt. Each of Nido co's 17.2m o/s is currently quoted at M1 ex div while Napo has issued 46.4m o/s. each of which has a market value of M0.50 ex-div Both cos pay out the entire annual earnings flow each year as div and interest. Tido Itd holds 464 000 shares in Napo Itd as part of its well diversified portfolio, its market analysis made the co to believe that Nido shares are currently undervalued because of temporary disequilibrium in the market, Tido Itd is considering of selling shares and investing in Nido Itd instead. Required, A) provide calculations to confirm the view of Tido Itd B) Suggest how Tido could undertake arbitrage deal to maintain its level of financial risk.

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

a To calculate the existing Weighted Average Cost of Capital WACC for Napo Itd we need to determine the weights of debt and equity in the capital stru... View full answer

Get step-by-step solutions from verified subject matter experts