Question: ndicate the answer choice that best completes the statement or answers the question Theresa worked this summer as a lifeguard at a community pool. She

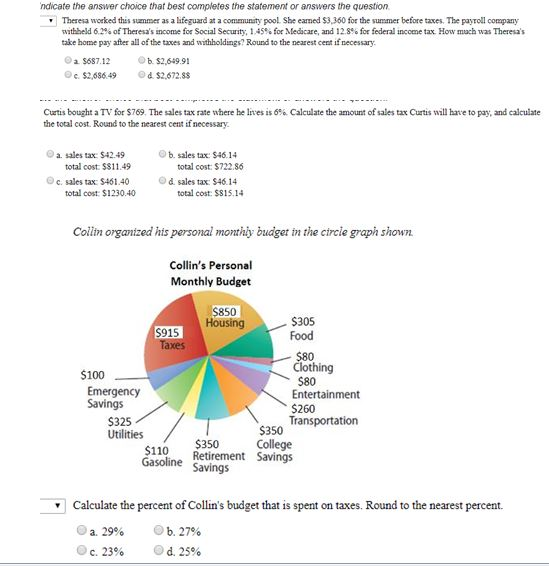

ndicate the answer choice that best completes the statement or answers the question Theresa worked this summer as a lifeguard at a community pool. She camed $3.360 for the summer before taxes. The payroll company withheld 6.2% of Theresa's income for Social Security, 145% for Medicare, and 12.8% for federal income tax How much was Theresa's take home pay after all of the taxes and withholdings? Round to the nearest cent if necessary a $687.12 $2,649.91 c. $2,686.49 ed $2.672.85 Curtis bought a TV for $769. The sales tax rate where he lives is 6% Calculate the amount of sales tax Curtis will have to pay, and calculate the total cost. Round to the nearest cent if necessary a. sales tax: $42.49 total cost $$11.49 c. sales tax: $461,40 total cost: $1230,40 b. sales tax: $46.14 total cost: $722.86 d sales tax: $46.14 total cost: $$15.14 Collin organized his personal monthly budget in the circie graph shown. Collin's Personal Monthly Budget $850 5915 Taxes $100 Emergency Savings $325 Utilities $110 Gasoline Housing $305 Food $80 Clothing $80 Entertainment $260 $350 Transportation $350 College Retirement Savings Savings Calculate the percent of Collin's budget that is spent on taxes. Round to the nearest percent. a 29% b. 27% c. 23% d. 25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts