Question: need 8d. except solve assuming its for a call option 8. We will derive a two-state put option value in this problem. Data: So =

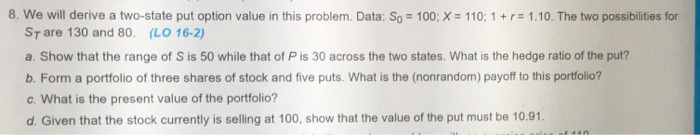

8. We will derive a two-state put option value in this problem. Data: So = 100; X = 110; 1 + r = 1.10. The two possibilities for Stare 130 and 80. (LO 16-2) a. Show that the range of Sis 50 while that of Pis 30 across the two states. What is the hedge ratio of the put? b. Form a portfolio of three shares of stock and five puts. What is the (nonrandom) payoff to this portfolio? c. What is the present value of the portfolio? d. Given that the stock currently is selling at 100, show that the value of the put must be 10.91

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts