Question: only need help with #9 A & B 8. We will derive a two-state put option value in this problem. Data: S0=100;X=110;1+r=1.10. The two possibilit

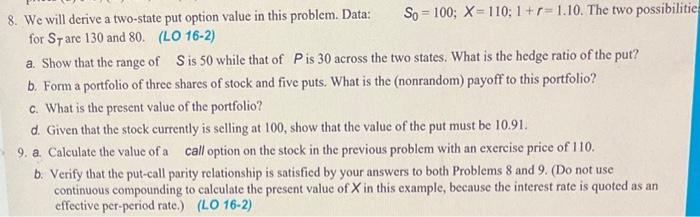

8. We will derive a two-state put option value in this problem. Data: S0=100;X=110;1+r=1.10. The two possibilit for ST are 130 and 80 . (LO 16-2) a. Show that the range of S is 50 while that of P is 30 across the two states. What is the hedge ratio of the put? b. Form a portfolio of three shares of stock and five puts. What is the (nonrandom) payoff to this portfolio? c. What is the present value of the portfolio? d. Given that the stock currently is selling at 100 , show that the value of the put must be 10.91. 9. a. Calculate the value of a call option on the stock in the previous problem with an exercise price of 110. b. Verify that the put-call parity relationship is satisfied by your answers to both Problems 8 and 9 . (Do not use continuous compounding to calculate the present value of X in this example, because the interest rate is quoted as an effective per-period rate.) (LO 16-2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts