Question: Need a help to make sure I solved this right. Thanks in Advance 14. Suppose a Foreign Exchange call option is available on the Euro

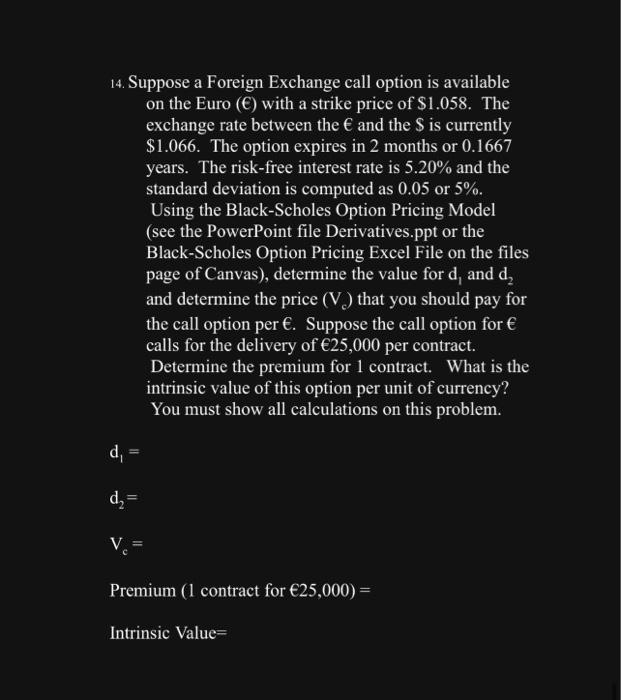

14. Suppose a Foreign Exchange call option is available on the Euro () with a strike price of $1.058. The exchange rate between the and the $ is currently $1.066. The option expires in 2 months or 0.1667 years. The risk-free interest rate is 5.20% and the standard deviation is computed as 0.05 or 5%. Using the Black-Scholes Option Pricing Model (see the PowerPoint file Derivatives.ppt or the Black-Scholes Option Pricing Excel File on the files page of Canvas), determine the value for d1 and d2 and determine the price (Vc) that you should pay for the call option per . Suppose the call option for calls for the delivery of 25,000 per contract. Determine the premium for 1 contract. What is the intrinsic value of this option per unit of currency? You must show all calculations on this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts