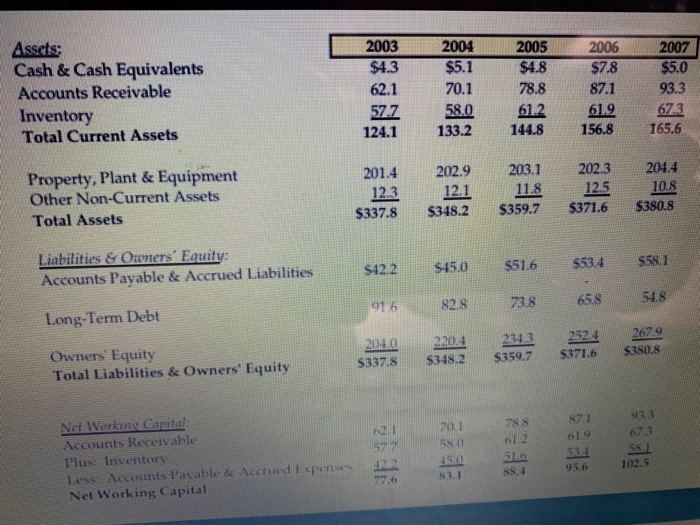

Question: Need an analysis to describe this financial statement. This is for Hansson Private Label Case Study 2004 55.1 Assets: Cash & Cash Equivalents Accounts Receivable

2004 55.1 Assets: Cash & Cash Equivalents Accounts Receivable Inventory Total Current Assets 2003 $4.3 62.1 57.7 124.1 2005 $4.8 78.8 87.1 70.1 58.0 133.2 93.3 6743 61.9 61.2 144.8 156.8 165.6 201.4 202.9 203.1 202.3 Property, Plant & Equipment Other Non-Current Assets Total Assets 123 204.4 10.8 $380.8 $337.8 S318.2 $359.7 $371.6 Liabilities & Orners' Equity: Accounts Payable & Accrued Liabilities $42.2 $450 551.6 $53.4 $58.1 658 016 82.8 51.8 73.8 Long-Term Debt 2343 Owners' Equity Total Liabilities & Owners' Equity 220.4 $348.2 $337.8 Net Wetkin Capital Accounts Receivable Plus Inventory Less Accounts Payable & Accrued Expenses Net Working Capital 87.1 61.9 534 95.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts