Question: please dont use excel. use the present worth or annual worth analysis. You have been assigned to determine the rate of return for a large,

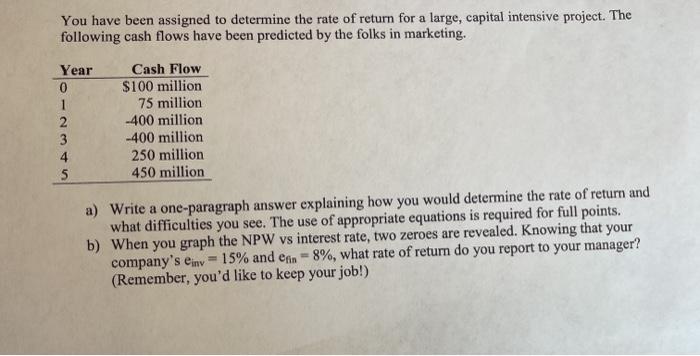

You have been assigned to determine the rate of return for a large, capital intensive project. The following cash flows have been predicted by the folks in marketing. Year 0 1 2 3 4 5 Cash Flow $100 million 75 million -400 million -400 million 250 million 450 million a) Write a one-paragraph answer explaining how you would determine the rate of return and what difficulties you see. The use of appropriate equations is required for full points. b) When you graph the NPW vs interest rate, two zeroes are revealed. Knowing that your company's einy = 15% and enn - 8%, what rate of return do you report to your manager? (Remember, you'd like to keep your job!) You have been assigned to determine the rate of return for a large, capital intensive project. The following cash flows have been predicted by the folks in marketing. Year 0 1 2 3 4 5 Cash Flow $100 million 75 million -400 million -400 million 250 million 450 million a) Write a one-paragraph answer explaining how you would determine the rate of return and what difficulties you see. The use of appropriate equations is required for full points. b) When you graph the NPW vs interest rate, two zeroes are revealed. Knowing that your company's einy = 15% and enn - 8%, what rate of return do you report to your manager? (Remember, you'd like to keep your job!)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts