Question: need an explanation the correct answer is already there First National Bank currently offers traditional banking services, from which they generate an average return of

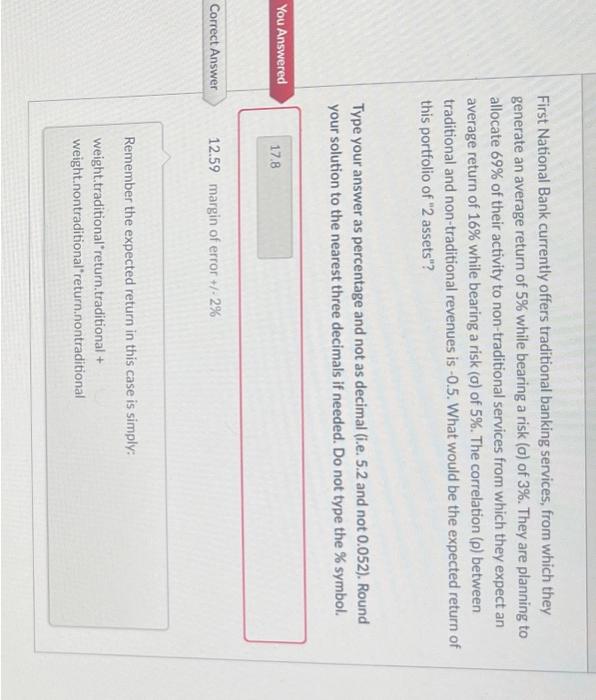

First National Bank currently offers traditional banking services, from which they generate an average return of 5% while bearing a risk (o) of 3%. They are planning to allocate 69% of their activity to non-traditional services from which they expect an average return of 16% while bearing a risk ( ( ) of 5%. The correlation () between traditional and non-traditional revenues is 0.5. What would be the expected return of this portfolio of " 2 assets"? Type your answer as percentage and not as decimal (i.e. 5.2 and not 0.052 ). Round your solution to the nearest three decimals if needed. Do not type the \% symbol. 12.59 margin of error +1.2% Remember the expected return in this case is simply: weight.traditional" return.traditional + weight.nontraditional"return.nontraditional

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts