Question: need answer for part C. thank you D Sullivan Ranch Corporation has purchased a new tractor on Jan 1, year 1 paying 10% of the

need answer for part C. thank you

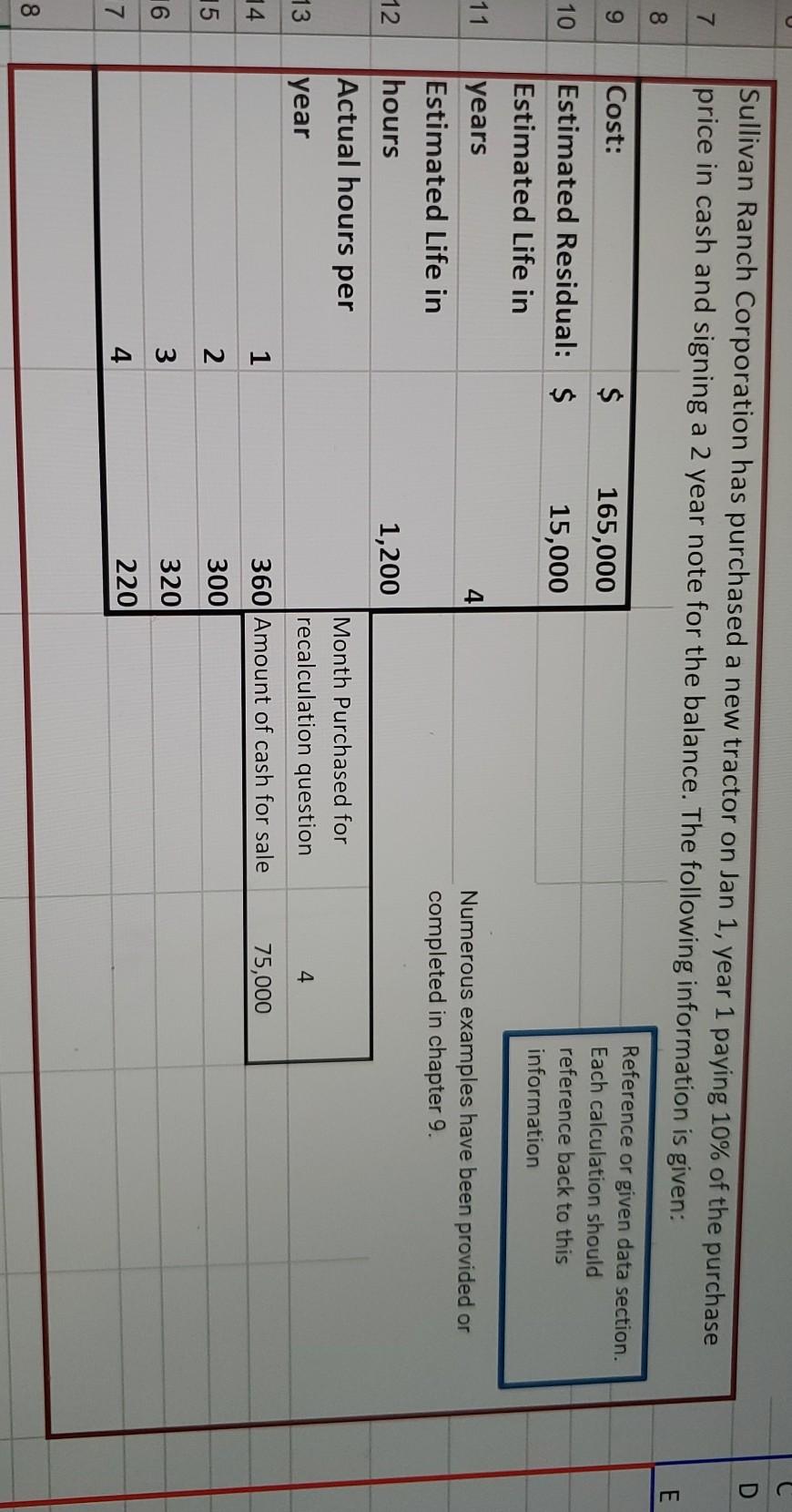

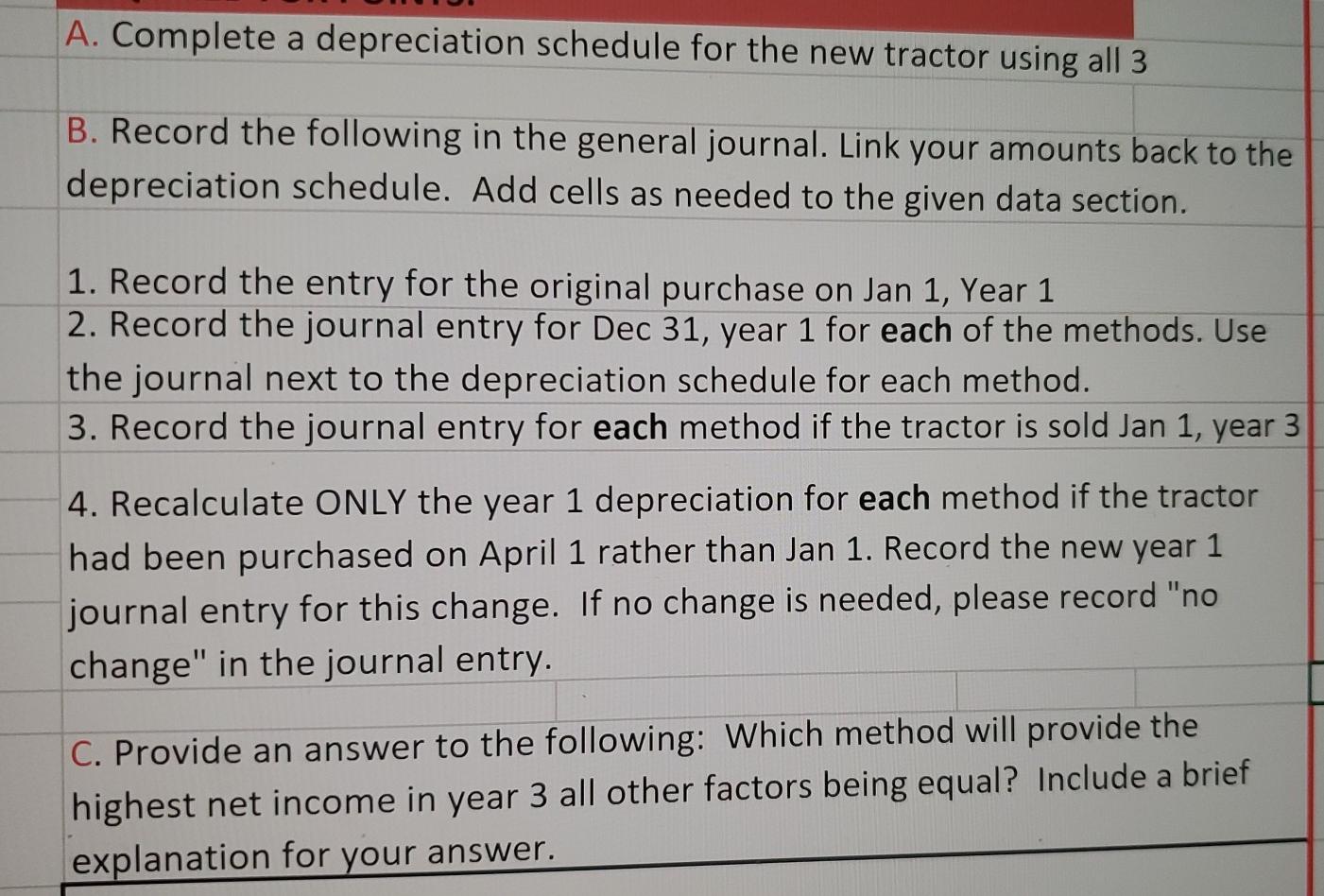

D Sullivan Ranch Corporation has purchased a new tractor on Jan 1, year 1 paying 10% of the purchase price in cash and signing a 2 year note for the balance. The following information is given: 7 E 8 9 Cost: $ Estimated Residual: $ Estimated Life in 10 Reference or given data section. Each calculation should reference back to this information 165,000 15,000 11 4 Numerous examples have been provided or completed in chapter 9. years Estimated Life in hours Actual hours per 12 1,200 13 year Month Purchased for recalculation question 360 Amount of cash for sale 4 1 75,000 14 15 2 300 16 3 3 320 220 4 7 8 A. Complete a depreciation schedule for the new tractor using all 3 B. Record the following in the general journal. Link your amounts back to the depreciation schedule. Add cells as needed to the given data section. 1. Record the entry for the original purchase on Jan 1, Year 1 2. Record the journal entry for Dec 31, year 1 for each of the methods. Use the journal next to the depreciation schedule for each method. 3. Record the journal entry for each method if the tractor is sold Jan 1, year 3 4. Recalculate ONLY the year 1 depreciation for each method if the tractor had been purchased on April 1 rather than Jan 1. Record the new year 1 journal entry for this change. If no change is needed, please record "no change" in the journal entry. C. Provide an answer to the following: Which method will provide the highest net income in year 3 all other factors being equal? Include a brief explanation for your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts