Question: need answer to part a and c Q2: A. Weight of Stock A = 0.28, Weight of Stock B = 0.32, weight of stock C

need answer to part a and c

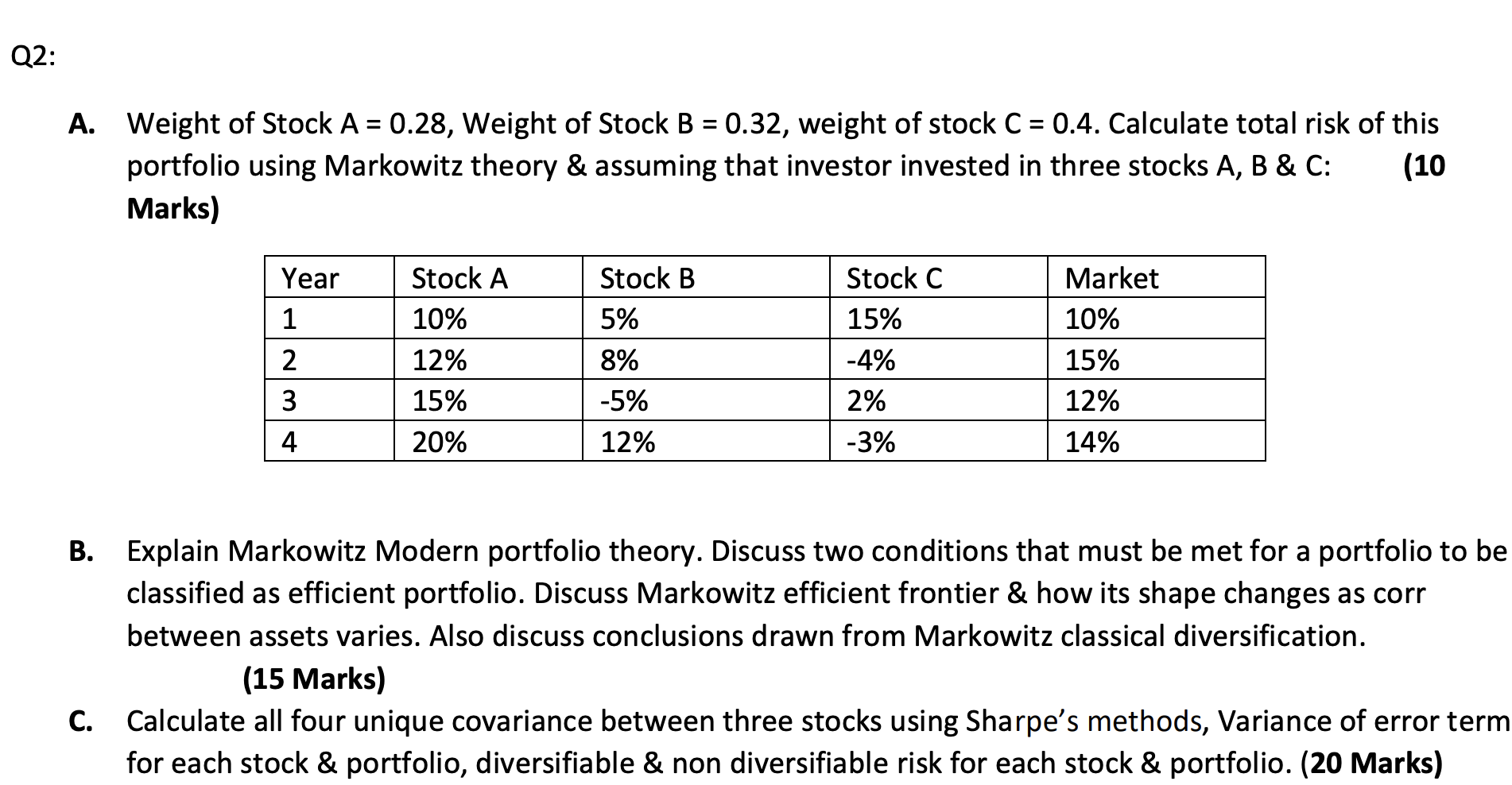

Q2: A. Weight of Stock A = 0.28, Weight of Stock B = 0.32, weight of stock C = 0.4. Calculate total risk of this portfolio using Markowitz theory & assuming that investor invested in three stocks A, B & C: (10 Marks) Year Stock B 1 2 3 Stock A 10% 12% 15% 20% 5% 8% -5% Stock C 15% -4% 2% -3% Market 10% 15% 12% 14% 3 4 12% B. Explain Markowitz Modern portfolio theory. Discuss two conditions that must be met for a portfolio to be classified as efficient portfolio. Discuss Markowitz efficient frontier & how its shape changes as corr between assets varies. Also discuss conclusions drawn from Markowitz classical diversification. (15 Marks) C. Calculate all four unique covariance between three stocks using Sharpe's methods, Variance of error term for each stock & portfolio, diversifiable & non diversifiable risk for each stock & portfolio. (20 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts