Question: Need computation for this :) thanks prof Mr. Jojo, married, supporting his 6 children (2 of which are gainfully employed) had the following data for

Need computation for this :) thanks prof

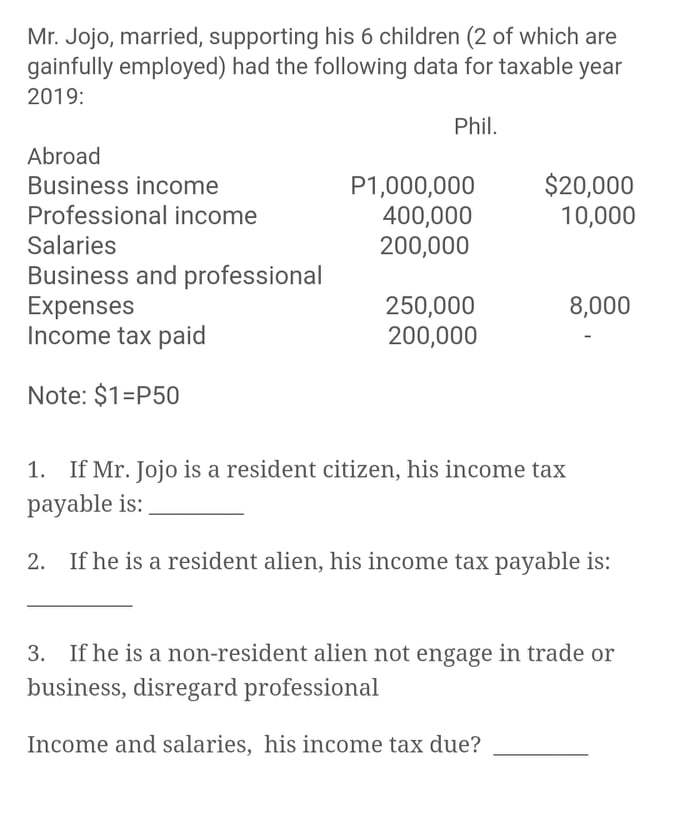

Mr. Jojo, married, supporting his 6 children (2 of which are gainfully employed) had the following data for taxable year 2019: Phil. Abroad Business income P1,000,000 $20,000 Professional income 400,000 10,000 Salaries 200,000 Business and professional Expenses 250,000 8,000 Income tax paid 200,000 Note: $1=P50 1. If Mr. Jojo is a resident citizen, his income tax payable is: 2. If he is a resident alien, his income tax payable is: 3. If he is a non-resident alien not engage in trade or business, disregard professional Income and salaries, his income tax due? ? Mr. Jojo, married, supporting his 6 children (2 of which are gainfully employed) had the following data for taxable year 2019: Phil. Abroad Business income P1,000,000 $20,000 Professional income 400,000 10,000 Salaries 200,000 Business and professional Expenses 250,000 8,000 Income tax paid 200,000 Note: $1=P50 1. If Mr. Jojo is a resident citizen, his income tax payable is: 2. If he is a resident alien, his income tax payable is: 3. If he is a non-resident alien not engage in trade or business, disregard professional Income and salaries, his income tax due

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts