Question: need details steps QUESTION 1 1 points Save A zero-coupon bond with a time until maturity of 10 years has on a Monday a continuously-compounded

need details steps

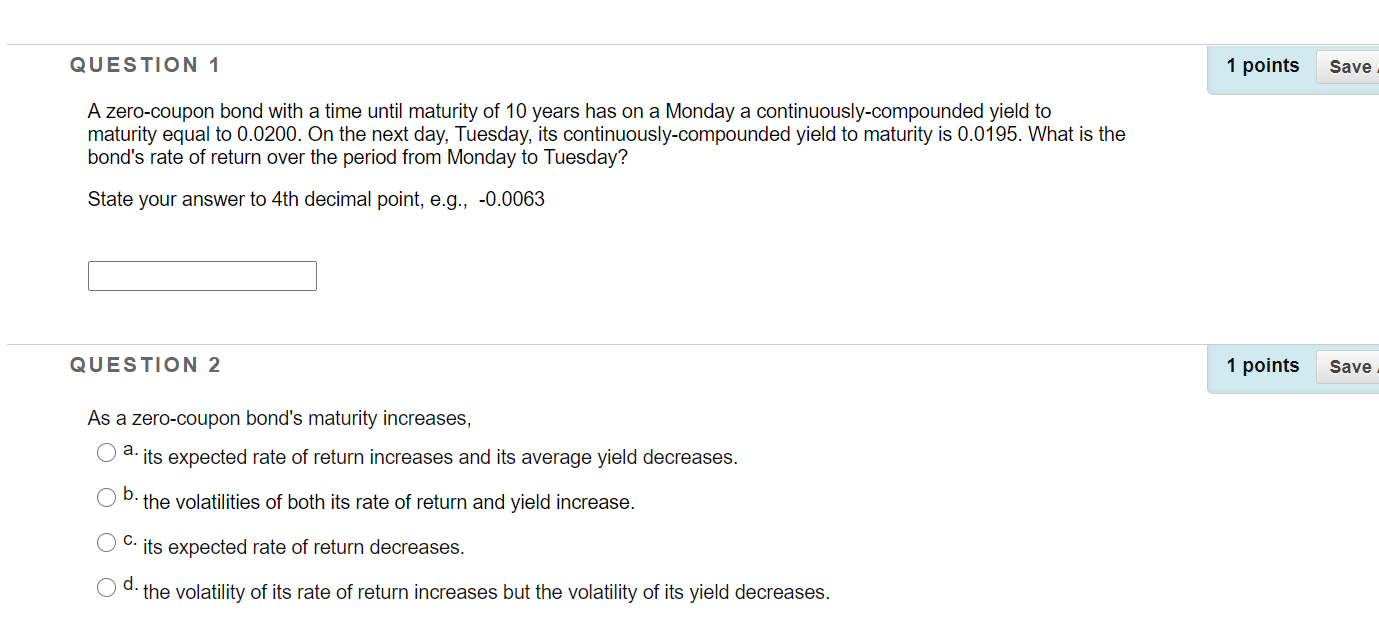

QUESTION 1 1 points Save A zero-coupon bond with a time until maturity of 10 years has on a Monday a continuously-compounded yield to maturity equal to 0.0200. On the next day, Tuesday, its continuously-compounded yield to maturity is 0.0195. What is the bond's rate of return over the period from Monday to Tuesday? State your answer to 4th decimal point, e.g., -0.0063 QUESTION 2 1 points Save As a zero-coupon bond's maturity increases, a. its expected rate of return increases and its average yield decreases. the volatilities of both its rate of return and yield increase. C. its expected rate of return decreases. d. the volatility of its rate of return increases but the volatility of its yield decreases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts