Question: Need done ASAP please In the Content Section under Assignment is a Powerpoint file with audio input. It sets out the structure of the assignment

Need done ASAP please

Need done ASAP please

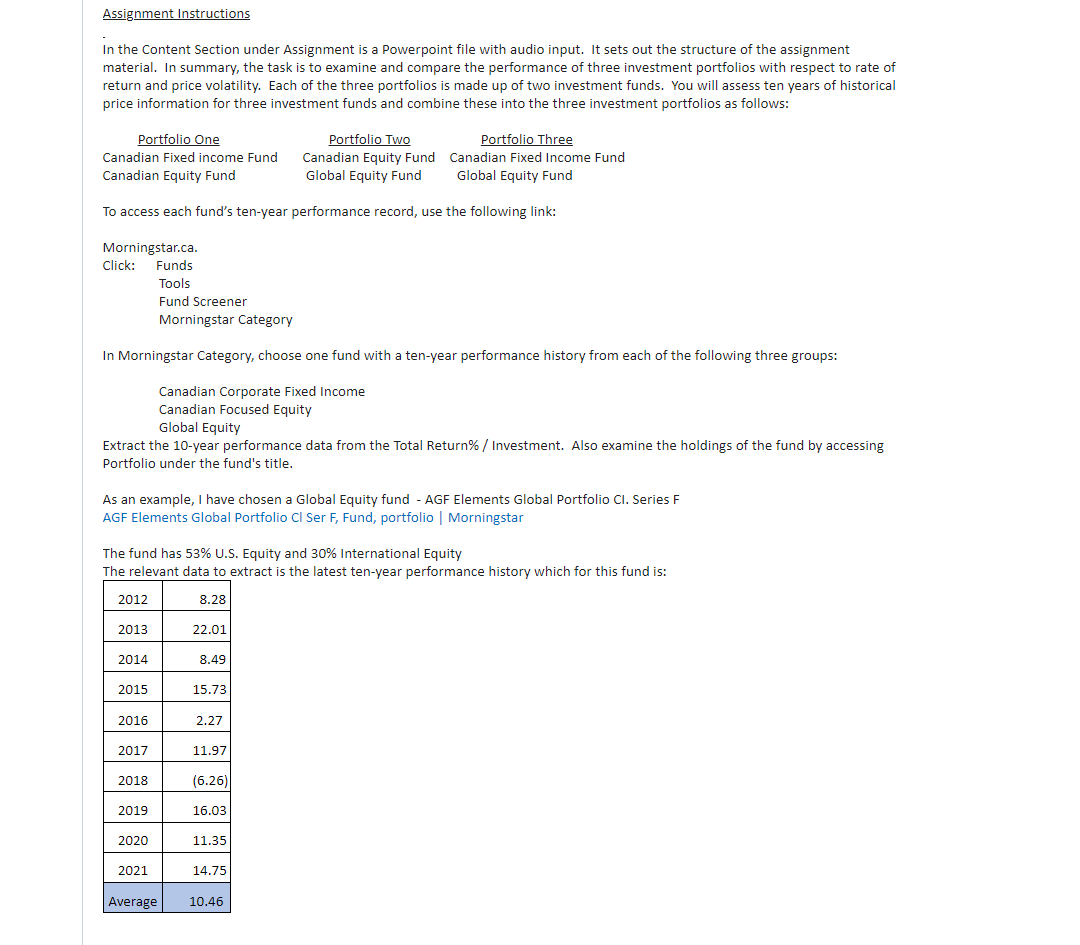

In the Content Section under Assignment is a Powerpoint file with audio input. It sets out the structure of the assignment material. In summary, the task is to examine and compare the performance of three investment portfolios with respect to rate of return and price volatility. Each of the three portfolios is made up of two investment funds. You will assess ten years of historical price information for three investment funds and combine these into the three investment portfolios as follows: To access each fund's ten-year performance record, use the following link: Morningstar.ca. Click: Funds Tools Fund Screener Morningstar Category In Morningstar Category, choose one fund with a ten-year performance history from each of the following three groups: Canadian Corporate Fixed Income Canadian Focused Equity Global Equity Extract the 10-year performance data from the Total Return\% / Investment. Also examine the holdings of the fund by accessing Portfolio under the fund's title. As an example, I have chosen a Global Equity fund - AGF Elements Global Portfolio CI. Series F AGF Elements Global Portfolio Cl Ser F, Fund, portfolio | Morningstar The fund has 53% U.S. Equity and 30% International Equity In the Content Section under Assignment is a Powerpoint file with audio input. It sets out the structure of the assignment material. In summary, the task is to examine and compare the performance of three investment portfolios with respect to rate of return and price volatility. Each of the three portfolios is made up of two investment funds. You will assess ten years of historical price information for three investment funds and combine these into the three investment portfolios as follows: To access each fund's ten-year performance record, use the following link: Morningstar.ca. Click: Funds Tools Fund Screener Morningstar Category In Morningstar Category, choose one fund with a ten-year performance history from each of the following three groups: Canadian Corporate Fixed Income Canadian Focused Equity Global Equity Extract the 10-year performance data from the Total Return\% / Investment. Also examine the holdings of the fund by accessing Portfolio under the fund's title. As an example, I have chosen a Global Equity fund - AGF Elements Global Portfolio CI. Series F AGF Elements Global Portfolio Cl Ser F, Fund, portfolio | Morningstar The fund has 53% U.S. Equity and 30% International Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts