Question: In the Content Section under Assignment is a Powerpoint file with audio input. It sets out the structure of the assignment material. In summary, the

In the Content Section under Assignment is a Powerpoint file with audio input. It sets out the structure of the assignment material. In summary, the task is to examine and compare the performance of three investment portfolios with respect to rate of return and price volatility. Each of the three portfolios is made up of two investment funds. You will assess ten years of historical price information for three investment funds and combine these into the three investment portfolios as follows: Portfolio One Portfolio Two Portfolio Three Canadian Fixed income Fund Canadian Equity Fund Canadian Fixed Income Fund Canadian Equity Fund Global Equity Fund Global Equity Fund To access each fund's ten-year performance record, use the following link: Morningstar.ca.ca Click: Funds Tools Fund Screener Morningstar Category In Morningstar Category, choose one fund with a ten-year performance history from each of the following three groups: Canadian Corporate Fixed Income Canadian Focused Equity Global Equity In order to establish the content - either Domestic (Canadian) or Global, of the funds you are selecting for the assignment, you need to hit the Distribution tab under Performance on the Morningstar fund page. . The securities in the fund will not be entirely domestic or global but your choice should indicate that a majority of the holdings reflect what you are seeking. As an example, the following is a Global Equity fund I have chosen that has been operating since 2006. https://www.morningstar.ca/ca/report/fund/performance.aspx?t=0P0000NCQK&fundservcode=undefined&lang=en-CA#:~:text=-14.90,10.44 The relevant data to extract is the latest ten-year performance history which for this fund is: 2011 (14.90) 2012 12.65 2013 7.77 2014 2.02 2015 1.19 2016 6.90 2017 17.14 2018 (1.51) 2019 14.50 2020 (4.94) Average 4.08

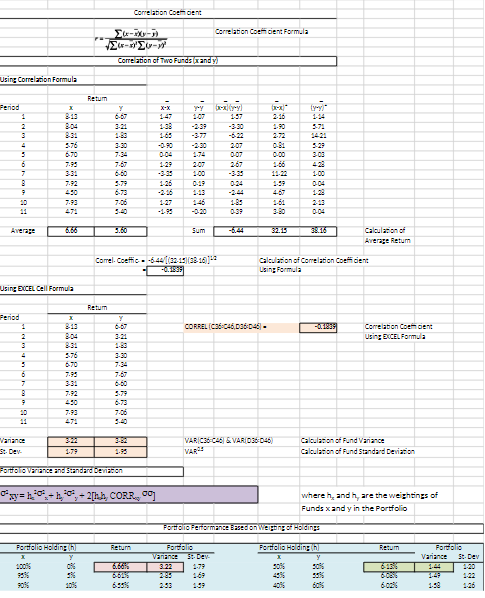

Using Correlation Formula Correlation Comcent x-xx-5) -20- Correlation of Two Funds (x and y) Correlation Coefficient Formula Return Period x Y x-x yy {yy)" 1 813 6-67 1-47 1.07 157 2-16 114 2 8.04 3-21 1-38 -2-39 -3:30 1-90 5.71 3 8.31 1-83 1-65 -3-77 -6-22 2-72 14:21 4 576 3-30 -0-90 -2-30 207 0-81 5:29 5 670 7-34 0.04 1-74 0.07 0.00 3.03 6 7.95 7-67 1.29 2:07 267 1-66 428 7 3-31 6-60 -3-35 1.00 -3-35 11-22 1.00 B 7-92 5-79 1-26 0-19 0:24 1-59 0-04 9 450 6-73 -216 1-13 -2-44 4-67 128 20 7.93 7-06 1-27 146 1-85 1-61 213 11 471 5-40 -195 -0-20 0-39 3-80 0.04 Average 6.66 3.60 Sum -6.44 32.15 38.16 Using EXCEL Cell Formula Correl. Coeffic-6-44/[(32-15)(38-16)]** -0.1839 Calculation of Average Return Calculation of Correlation Coefficient Using Formula Return Period x Y 1 813 6-67 CORREL (C36-C46,036046- -0.1839 2 8:04 3-21 Correlation Comcent Using EXCEL Formula 3 8:31 1-83 4 576 3-30 5 6-70 7-34 6 7.95 7-67 7 3-31 6-60 B 7-92 5-79 9 450 6-73 20 7-93 7-06 11 471 5-40 "Variance St-Dev- 322 179 1-95 VAR C36-C46) & VAR 036-046) VAR Calculation of Fund Variance Calculation of Fund Standard Deviation Portfolio Variance and Standard Deviation xy= h + h0, + 2[h.h, CORR., 0] where h, and h, are the weightings of Funds x and y in the Portfolio Portfolio Performance Based on Weighing of Holdings Portfolio Holding (h) Return Fortfolio Portfolio Holding (h) Return Portfolio - Variance St-Dev- Variance St-Dev 100% 086 6.66% 3.22 1-79 50% 50% 6-136 1-44 1-20 95% 596 6.61% 2.35 1-69 45% 55% 6-0856 1-49 1-22 90% 10% 2:53 139 40% 60% 6.00% 1.58 1-26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts