Question: Need full answer ... Thanks MIT 430 Final Assignment Instruction: 1. For each of the following problems, conduct the engineering economic analysis then prepare a

Need full answer ... Thanks

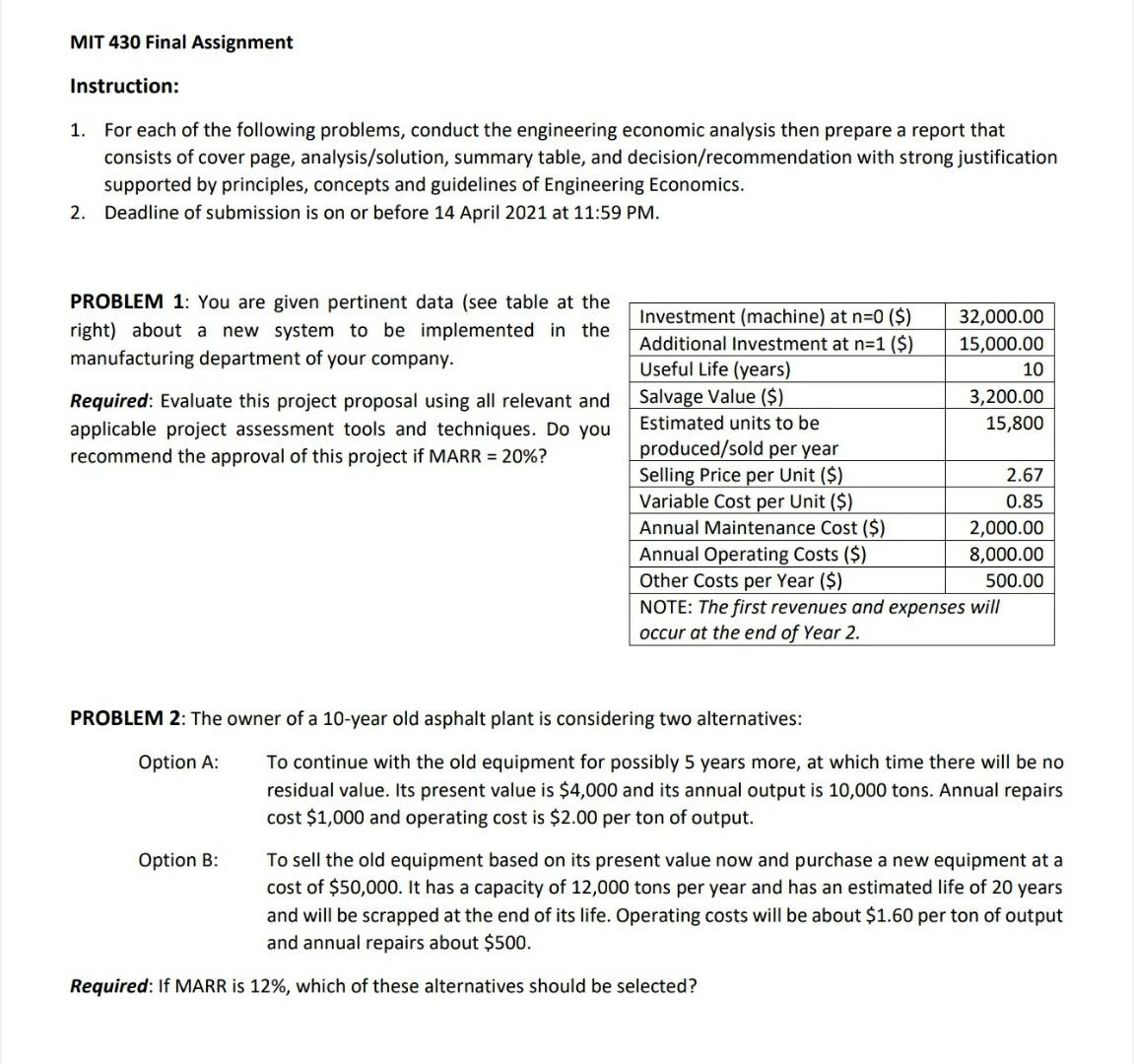

MIT 430 Final Assignment Instruction: 1. For each of the following problems, conduct the engineering economic analysis then prepare a report that consists of cover page, analysis/solution, summary table, and decision/recommendation with strong justification supported by principles, concepts and guidelines of Engineering Economics. 2. Deadline of submission is on or before 14 April 2021 at 11:59 PM. PROBLEM 1: You are given pertinent data (see table at the right) about a new system to be implemented in the manufacturing department of your company. Required: Evaluate this project proposal using all relevant and applicable project assessment tools and techniques. Do you recomme approval project = 20% Investment (machine) at n=0 ($) 32,000.00 Additional Investment at n=1 ($) 15,000.00 Useful Life (years) 10 Salvage Value ($) 3,200.00 Estimated units to be 15,800 produced/sold per year Selling Price per Unit ($) 2.67 Variable Cost per Unit ($) 0.85 Annual Maintenance Cost ($) 2,000.00 Annual Operating Costs ($) 8,000.00 Other Costs per Year ($) 500.00 NOTE: The first revenues and expenses will occur at the end of Year 2. PROBLEM 2: The owner of a 10-year old asphalt plant is considering two alternatives: Option A: To continue with the old equipment for possibly 5 years more, at which time there will be no residual value. Its present value is $4,000 and its annual output is 10,000 tons. Annual repairs cost $1,000 and operating cost is $2.00 per ton of output. Option B: To sell the old equipment based on its present value now and ase a new equipment at a cost of $50,000. It has a capacity of 12,000 tons per year and has an estimated life of 20 years and will be scrapped at the end of its life. Operating costs will be about $1.60 per ton of output and annual repairs about $500. Required: If MARR is 12%, which of these alternatives should be selected? MIT 430 Final Assignment Instruction: 1. For each of the following problems, conduct the engineering economic analysis then prepare a report that consists of cover page, analysis/solution, summary table, and decision/recommendation with strong justification supported by principles, concepts and guidelines of Engineering Economics. 2. Deadline of submission is on or before 14 April 2021 at 11:59 PM. PROBLEM 1: You are given pertinent data (see table at the right) about a new system to be implemented in the manufacturing department of your company. Required: Evaluate this project proposal using all relevant and applicable project assessment tools and techniques. Do you recomme approval project = 20% Investment (machine) at n=0 ($) 32,000.00 Additional Investment at n=1 ($) 15,000.00 Useful Life (years) 10 Salvage Value ($) 3,200.00 Estimated units to be 15,800 produced/sold per year Selling Price per Unit ($) 2.67 Variable Cost per Unit ($) 0.85 Annual Maintenance Cost ($) 2,000.00 Annual Operating Costs ($) 8,000.00 Other Costs per Year ($) 500.00 NOTE: The first revenues and expenses will occur at the end of Year 2. PROBLEM 2: The owner of a 10-year old asphalt plant is considering two alternatives: Option A: To continue with the old equipment for possibly 5 years more, at which time there will be no residual value. Its present value is $4,000 and its annual output is 10,000 tons. Annual repairs cost $1,000 and operating cost is $2.00 per ton of output. Option B: To sell the old equipment based on its present value now and ase a new equipment at a cost of $50,000. It has a capacity of 12,000 tons per year and has an estimated life of 20 years and will be scrapped at the end of its life. Operating costs will be about $1.60 per ton of output and annual repairs about $500. Required: If MARR is 12%, which of these alternatives should be selected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts