Question: Need help figuring out the IRR which is question 3.b ..... I've gotten 4.12% , 4.47% , 13.34% and 13.52% the first three are wrong

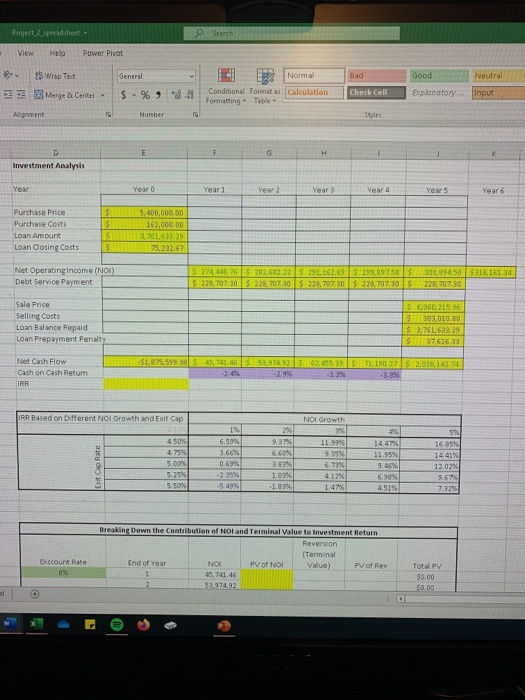

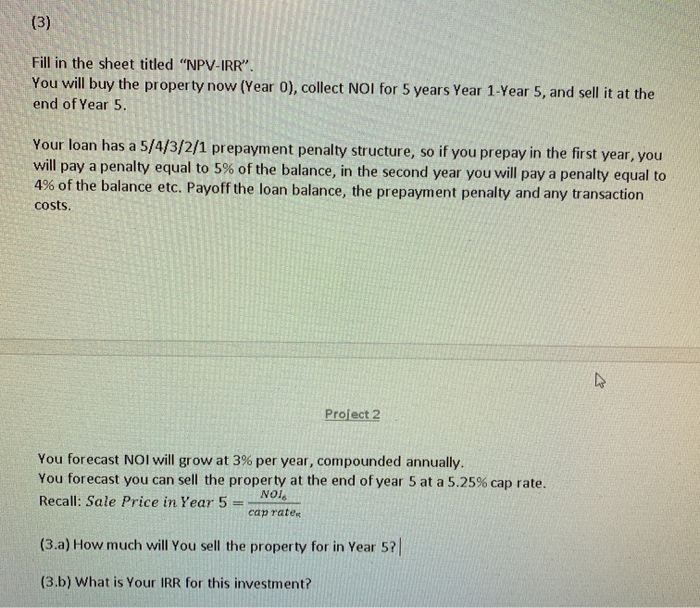

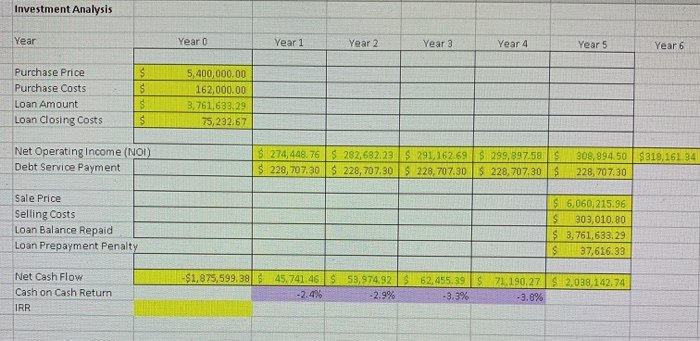

Project 2 preadsheet Search View Hel Power Pivot General 02 Normal Good Neutral 29 Wrap Test Merge Center $ - % *78-81 Conditional Formats calculation Formatting Check Cell Explanatory... Number Investment Analysis 500.000.00 Purchase Price Purchase costs Loan Amount Loan Closing Costs S 30251.639.25 722257 $818, 15134 Net Operating income (NOU) Debt Service Payment $ 274 40 76 282.682 221 2911629 $ 228,707.30 $ 228.707.30 $ 228.707.30 0 7 228.707.10 308.89 450 228.707.30 Sale Price Selling Costs Loan Balance Repaid Loan Prepayment Penalty IS COCOS S 302010.30 $ 3.781,683.29 S10 0 45741.46 $9.97492 62,55 1.110.272 142.14 Net Cash Flow Cash on Cash Return IRR Based on Different NOI Orowth and Exit Cap Break Down the contribution of NO and Terminal value to lavestment Return Reversion (Terminal BTC Value) Pyotrov 45,741.45 53,974.92 Descount Tot PV $0.00 (3) Fill in the sheet titled "NPV-IRR". You will buy the property now (Year O), collect NOI for 5 years Year 1-Year 5, and sell it at the end of Year 5. Your loan has a 5/4/3/2/1 prepayment penalty structure, so if you prepay in the first year, you will pay a penalty equal to 5% of the balance, in the second year you will pay a penalty equal to 4% of the balance etc. Payoff the loan balance, the prepayment penalty and any transaction costs. Project 2 You forecast NOI will grow at 3% per year, compounded annually. You forecast you can sell the property at the end of year 5 at a 5.25% cap rate. Recall: Sale Price in Year 5 = caprates (3.a) How much will You sell the property for in Year 5? (3.b) What is Your IRR for this investment? Investment Analysis Year Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Purchase Price Purchase Costs Loan Amount Loan Closing Costs $ IS $ $ 5,400,000.00 162,000.00 3.761,633.29 75,232.67 $818,161.34 Net Operating Income (NOI) Debt Service Payment $ 274,448.76 S 282,682.23 $ 291,162.69 S 299,897.58 220,707.30 $ 228,707.30 $ 228,707.30 S 228,707.30 308,894.50 228,707.30 S $ Sale Price Selling Costs Loan Balance Repaid Loan Prepayment Penalty $ 6,060,215.96 S 303,010.80 $ 3,761,633.29 $ 37,616.33 $1,875,599.38 $ $ $ $ 2,038,142.74 Net Cash Flow Cash on Cash Return IRR 45,741.46 -2.4% 53,974.92 2.9% 62.455.39 .3.3% 71,190,27 -3.8% Project 2 preadsheet Search View Hel Power Pivot General 02 Normal Good Neutral 29 Wrap Test Merge Center $ - % *78-81 Conditional Formats calculation Formatting Check Cell Explanatory... Number Investment Analysis 500.000.00 Purchase Price Purchase costs Loan Amount Loan Closing Costs S 30251.639.25 722257 $818, 15134 Net Operating income (NOU) Debt Service Payment $ 274 40 76 282.682 221 2911629 $ 228,707.30 $ 228.707.30 $ 228.707.30 0 7 228.707.10 308.89 450 228.707.30 Sale Price Selling Costs Loan Balance Repaid Loan Prepayment Penalty IS COCOS S 302010.30 $ 3.781,683.29 S10 0 45741.46 $9.97492 62,55 1.110.272 142.14 Net Cash Flow Cash on Cash Return IRR Based on Different NOI Orowth and Exit Cap Break Down the contribution of NO and Terminal value to lavestment Return Reversion (Terminal BTC Value) Pyotrov 45,741.45 53,974.92 Descount Tot PV $0.00 (3) Fill in the sheet titled "NPV-IRR". You will buy the property now (Year O), collect NOI for 5 years Year 1-Year 5, and sell it at the end of Year 5. Your loan has a 5/4/3/2/1 prepayment penalty structure, so if you prepay in the first year, you will pay a penalty equal to 5% of the balance, in the second year you will pay a penalty equal to 4% of the balance etc. Payoff the loan balance, the prepayment penalty and any transaction costs. Project 2 You forecast NOI will grow at 3% per year, compounded annually. You forecast you can sell the property at the end of year 5 at a 5.25% cap rate. Recall: Sale Price in Year 5 = caprates (3.a) How much will You sell the property for in Year 5? (3.b) What is Your IRR for this investment? Investment Analysis Year Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Purchase Price Purchase Costs Loan Amount Loan Closing Costs $ IS $ $ 5,400,000.00 162,000.00 3.761,633.29 75,232.67 $818,161.34 Net Operating Income (NOI) Debt Service Payment $ 274,448.76 S 282,682.23 $ 291,162.69 S 299,897.58 220,707.30 $ 228,707.30 $ 228,707.30 S 228,707.30 308,894.50 228,707.30 S $ Sale Price Selling Costs Loan Balance Repaid Loan Prepayment Penalty $ 6,060,215.96 S 303,010.80 $ 3,761,633.29 $ 37,616.33 $1,875,599.38 $ $ $ $ 2,038,142.74 Net Cash Flow Cash on Cash Return IRR 45,741.46 -2.4% 53,974.92 2.9% 62.455.39 .3.3% 71,190,27 -3.8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts