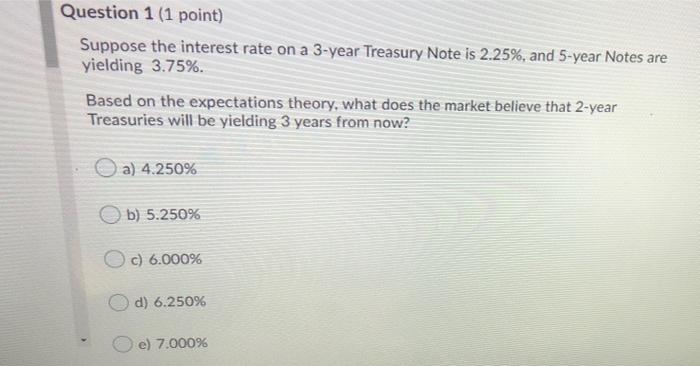

Question: need help on 1 and 3 Question 1 (1 point) Suppose the interest rate on a 3-year Treasury Note is 2.25%, and 5-year Notes are

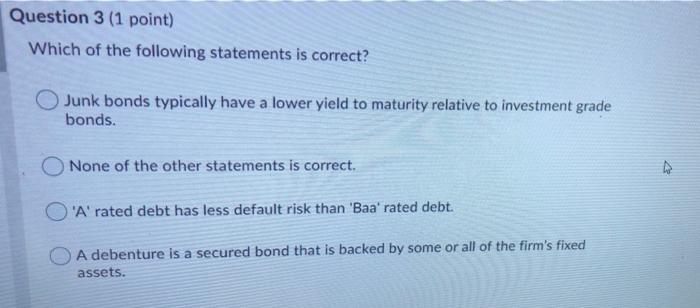

Question 1 (1 point) Suppose the interest rate on a 3-year Treasury Note is 2.25%, and 5-year Notes are yielding 3.75%. Based on the expectations theory, what does the market believe that 2-year Treasuries will be yielding 3 years from now? a) 4.250% b) 5.250% Oc) 6.000% d) 6.250% e) 7.000% Question 3 (1 point) Which of the following statements is correct? Junk bonds typically have a lower yield to maturity relative to investment grade bonds. None of the other statements is correct. O'A' rated debt has less default risk than 'Baa' rated debt. A debenture is a secured bond that is backed by some or all of the firm's fixed a assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts