Question: Need help on part a, b & c. thank you so much in advance! :) A machine that cost $126,500 has an estimated residual value

Need help on part a, b & c. thank you so much in advance! :)

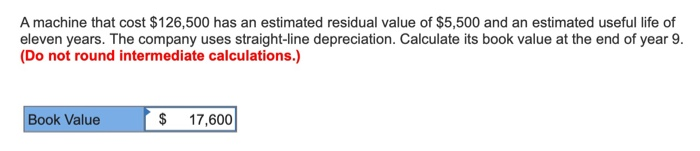

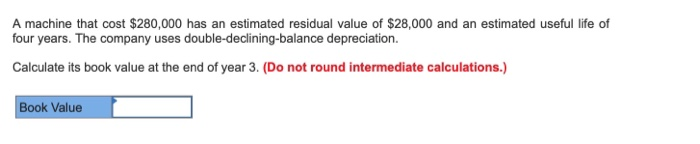

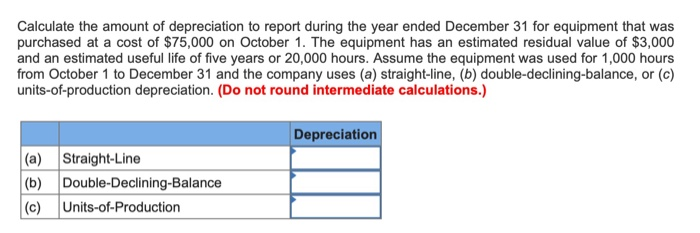

Need help on part a, b & c. thank you so much in advance! :)A machine that cost $126,500 has an estimated residual value of $5,500 and an estimated useful life of eleven years. The company uses straight-line depreciation. Calculate its book value at the end of year 9. (Do not round intermediate calculations.) $ 17,600 Book Value A machine that cost $280,000 has an estimated residual value of $28,000 and an estimated useful life of four years. The company uses double-declining-balance depreciation Calculate its book value at the end of year 3. (Do not round intermediate calculations.) Book Value Calculate the amount of depreciation to report during the year ended December 31 for equipment that was purchased at a cost of $75,000 on October 1. The equipment has an estimated residual value of $3,000 and an estimated useful life of five years or 20,000 hours. Assume the equipment was used for 1,000 hours from October 1 to December 31 and the company uses (a) straight-line, (b) double-declining-balance, or (c) units-of-production depreciation. (Do not round intermediate calculations.) Depreciation (a) Straight-Line (b) Double-Declining-Balance (c) Units-of-Production

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts