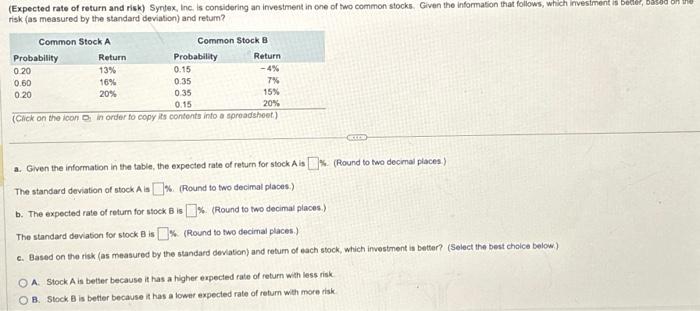

Question: need help on this question, thanks in advance a. Given the information in that table, the expected rate of return for stock A is 15.

a. Given the information in that table, the expected rate of return for stock A is 15. (Round to two decimal places.) The standard deviation of stock A is K. (Round to two decimal places.) b. The expected rate of return for stock B is \%. (Round to two decimal places.) The standard deviation for stock B is 1. (Round to two decimat places.) c. Based on the risk (as measured by the standard deviation) and return of each stock, which investment is better? (Select the best choice below.) A. Stock A is better because it has a higher expected rate of return with less risk B. Stock B is betier because it has a lower expected rate of retum with more risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts