Question: need help with 1 and 2 Question 1 (1 point) Ford Motor Co. has BB rated bonds outstanding that mature in 27 years, and have

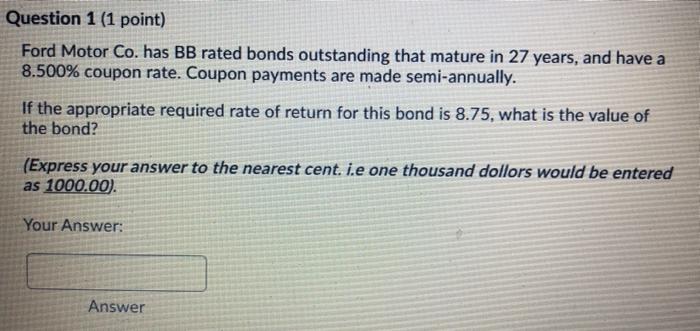

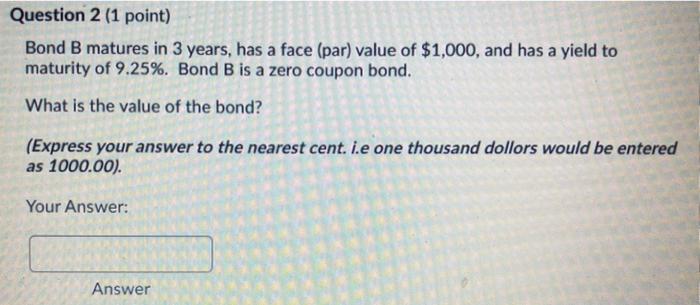

Question 1 (1 point) Ford Motor Co. has BB rated bonds outstanding that mature in 27 years, and have a 8.500% coupon rate. Coupon payments are made semi-annually. If the appropriate required rate of return for this bond is 8.75, what is the value of the bond? (Express your answer to the nearest cent. i.e one thousand dollors would be entered as 1000.00 Your Answer: Answer Question 2 (1 point) Bond B matures in 3 years, has a face (par) value of $1,000, and has a yield to maturity of 9.25%. Bond B is a zero coupon bond. What is the value of the bond? (Express your answer to the nearest cent. i.e one thousand dollors would be entered as 1000.00). Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts