Question: Please tell if the answer is correct or not. Explain the difference between a long position in a put and a short position in a

Please tell if the answer is correct or not.

Please tell if the answer is correct or not.

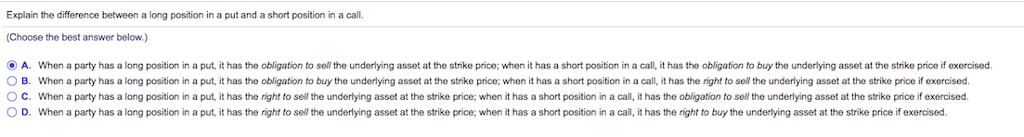

Explain the difference between a long position in a put and a short position in a call. Choose the best answer below.) A. When a party has a long position in a put, it has the obligation to sell the underlying asset at the strike price; when it has a short position in a call, it has the obligation to buy the underlying asset at the strike price if exercised OB. When a party has a long position in a put, it has the obligation to buy the underlying asset at the strike price; when it has a short position in a call, it has the right to sell the underlying asset at the strike price if exercised. OC. When a party has a long position in a put, it has the right to sell the underlying asset at the strike price; when it has a short position in a call, it has the obligation to sell the underlying asset at the strike price if exercised. ? D when a party has a long position a put, it has the ht to sell the under ying asset at the strike prce: he it has a short posti in a ca it has the n ht to buy the undert gas set a the stri epnce fe erased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts