Question: need help with 12 & 13 thanks. 5 points Please answer the following question based on the information provided for the firm ABC: What comes

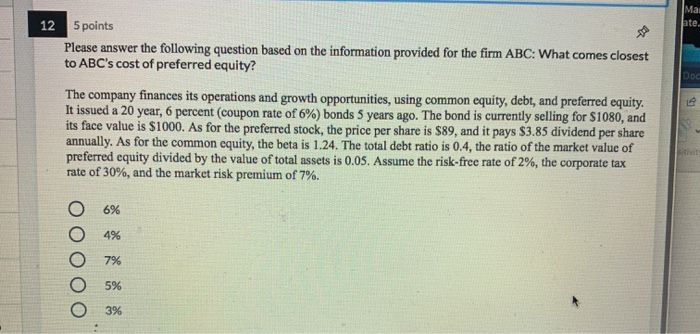

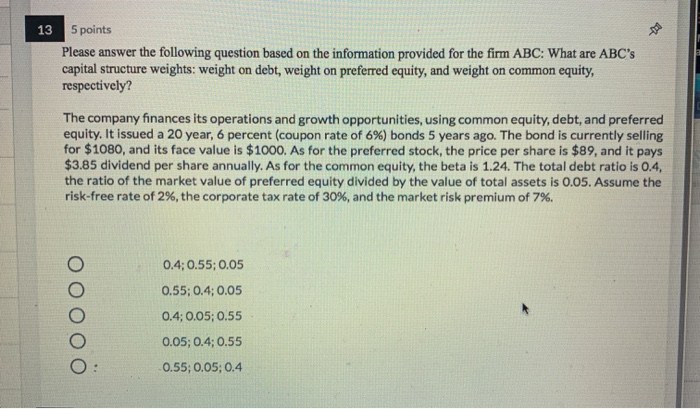

5 points Please answer the following question based on the information provided for the firm ABC: What comes closest to ABC's cost of preferred equity? The company finances its operations and growth opportunities, using common equity, debt, and preferred equity. It issued a 20 year, 6 percent (coupon rate of 6%) bonds 5 years ago. The bond is currently selling for $1080, and its face value is $1000. As for the preferred stock, the price per share is $89, and it pays $3.85 dividend per share annually. As for the common equity, the beta is 1.24. The total debt ratio is 0.4, the ratio of the market value of preferred equity divided by the value of total assets is 0.05. Assume the risk-free rate of 2%, the corporate tax rate of 30%, and the market risk premium of 7%. O 6% 04% O 7% O 5% 13 5 points Please answer the following question based on the information provided for the firm ABC: What are ABC's capital structure weights: weight on debt, weight on preferred equity, and weight on common equity, respectively? The company finances its operations and growth opportunities, using common equity, debt, and preferred equity. It issued a 20 year, 6 percent (coupon rate of 6%) bonds 5 years ago. The bond is currently selling for $1080, and its face value is $1000. As for the preferred stock, the price per share is $89, and it pays $3.85 dividend per share annually. As for the common equity, the beta is 1.24. The total debt ratio is 0.4, the ratio of the market value of preferred equity divided by the value of total assets is 0.05. Assume the risk-free rate of 2%, the corporate tax rate of 30%, and the market risk premium of 7%. oooo 0.4;0.55; 0,05 0.55; 0.4;0.05 0.4;0.05; 0.55 0.05; 0.4; 0.55 0.55; 0.05; 0.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts