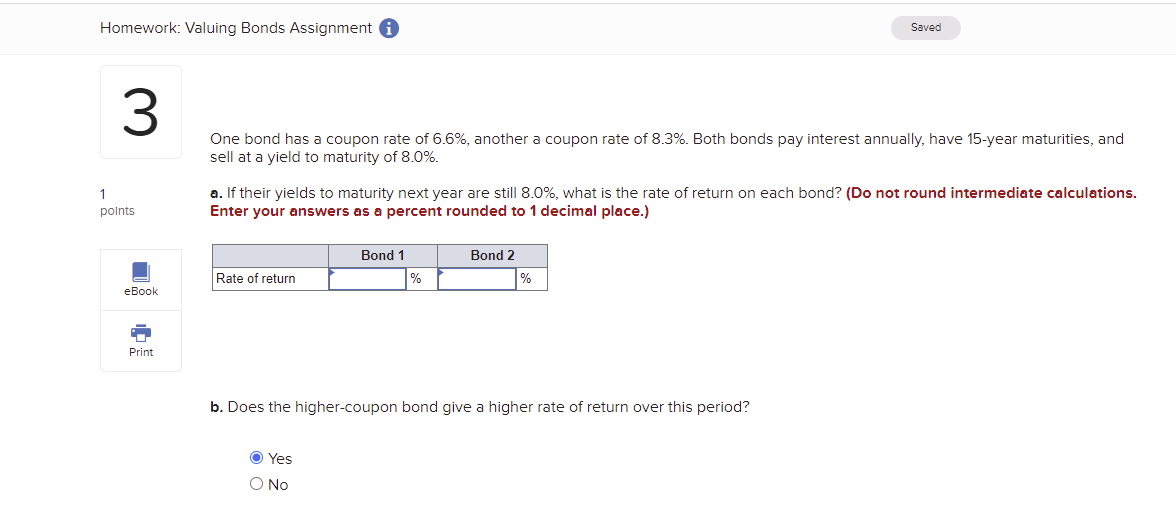

Question: Need help with a Homework: Valuing Bonds Assignment 0 Saved One bond has a coupon rate of 6.6%, another a coupon rate of 8.3%. Both

Need help with a

Homework: Valuing Bonds Assignment 0 Saved One bond has a coupon rate of 6.6%, another a coupon rate of 8.3%. Both bonds pay interest annually, have 15year maturities, and sell at a yield to maturity of 8.0%. 'I a. If their yields to maturity next year are still 8.0%, what is the rate of return on each bond? [Do not round intermediate calculations. polnts Enter your answers as a percent rounded to 1 decimal place.} El Bond 1 Bond 2 Rate of retum % em -W- E! Prim b. Does the highercoupon bond give a higher rate of return over this period? G) Yes 0 No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts