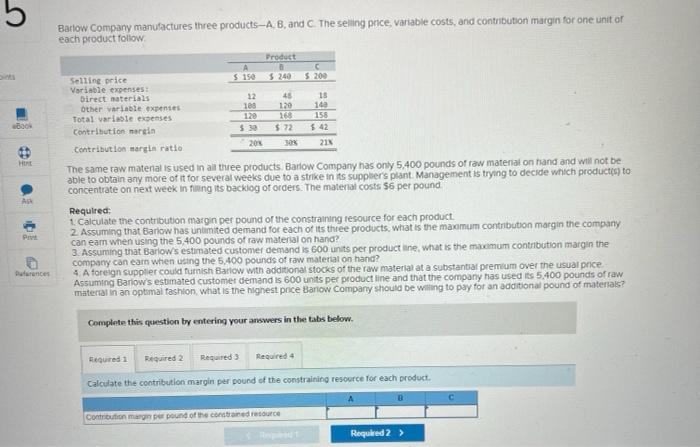

Question: Need help with both questions please. If you cant help with both pics can you leave it for someone who can! Barlow Company manufactures three

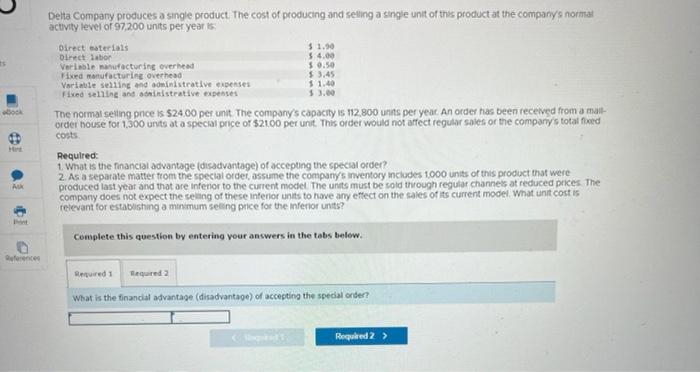

Barlow Company manufactures three products-A,B, and C. The seling pnce, variable costs, and contribution margin for one unit of each product follow. The same raw matenal is used in ali tree products. Barlow Company has only 5,400 pounds of raw material on hand and wil not be. able to obtain any more of it for several weeks due to a strke in ts suppler's plant Management is trying to decide which productig) to: concentrate on next week in filing its backiog of orders. The material costs $5 per pound Required: 1. Calculate the contribution margin per pound of the constraining resource for each product. 2. Assuming that barlow has untimited demand for each of its thiee products, what is the maxomum contribution margin the company can eam when using the 5,400 pounds of raw material on hand? 3. Assuming that bariows estimated customer demand is 600 units per product ane, what is the maximum contribution margin the company can earn when using the 5,400 pounds of raw material on hand? 4. A foreign supplier could furnish Barlow with additional stocks of the row material at a substantal premurn over the usuar pnce. Assuming Barlows estimated customer demand is 600 units per product line and that the company nas used iss 5.400 pounds of raw matertal in an optimai fashion, what is the highest pnce Banow Compary should be witting to pay for an additional pound of materals? Complete this question by entering your answers in the tabs below. Calculate the contribution margin per pound of the constraining resource for each oroduct. Delta Compary produces a single product. The cost of producing and seling a single unit of this product at the company's norarat activity lever of 97,200 units per year is. The normal seiing pnce is $24.00 per unit. The company's capacily is 112,800 units per year Ari order has been recelvegd from a maill order house for 1,300 units at a speclal poice of $2100 per unit. This order would not affect regular saies or the company's total fixed costs Required: 1. What is the financiat advantage (disadvantage) of accepting the special order? 2. As a separate matter from the special order, assume the companys inventory includes 1,000 units of this product that were. produced last year and that are infenor to the current model. The units must be sold through regular channets at reduced prices. The company does not expect the seaing of these intenor units to have any effect on the sales of its current model. What unit cost is felevant for establishing a minemum seleng pice for the inferior units? Complete this question by entering vour answers in the tabs below. What is the finandal advantage (diradvantage) of accesting the special order

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts