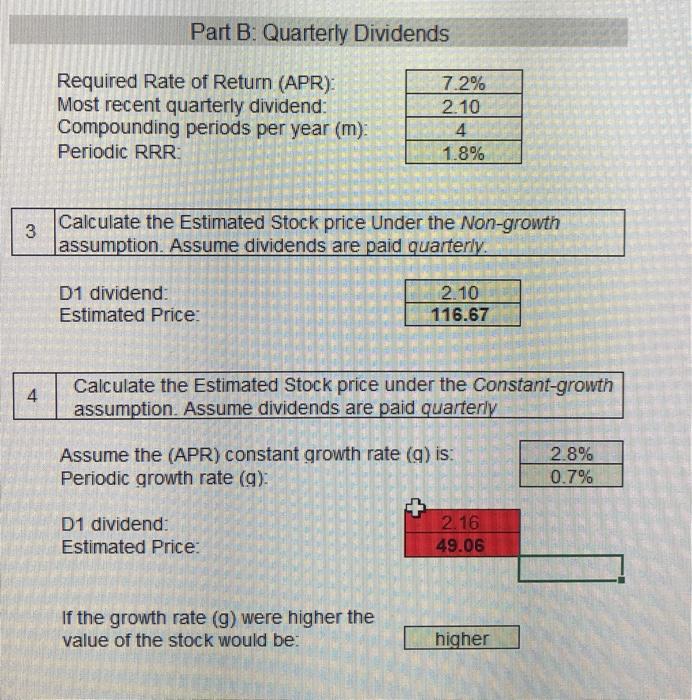

Question: need help with only red boxes please. Part B: Quarterly Dividends Required Rate of Return (APR) Most recent quarterly dividend: Compounding periods per year (m)

Part B: Quarterly Dividends Required Rate of Return (APR) Most recent quarterly dividend: Compounding periods per year (m) Periodic RRR: 7.2% 2.10 4 1.8% 3 Calculate the Estimated Stock price Under the Non-growth assumption. Assume dividends are paid quarterly. D1 dividend: Estimated Price: 2.10 116.67 4 Calculate the Estimated Stock price under the Constant-growth assumption. Assume dividends are paid quarterly Assume the (APR) constant growth rate (9) is: Periodic growth rate (g): 2.8% 0.7% D1 dividend: Estimated Price: 2.16 49.06 If the growth rate (9) were higher the value of the stock would be: higher

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts