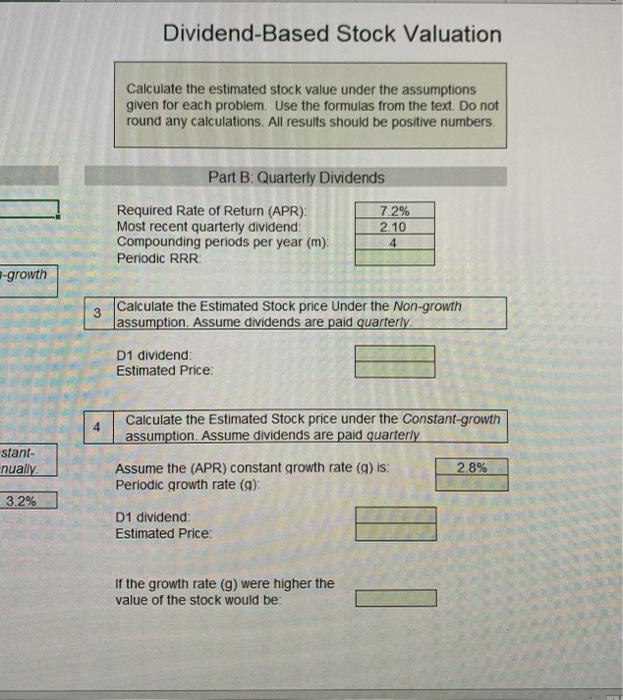

Question: Part B: Quarterly Dividends, with formulas please! Dividend-Based Stock Valuation Calculate the estimated stock value under the assumptions given for each problem. Use the formulas

Dividend-Based Stock Valuation Calculate the estimated stock value under the assumptions given for each problem. Use the formulas from the text. Do not round any calculations. All results should be positive numbers. Part B: Quarterly Dividends Required Rate of Return (APR) Most recent quarterly dividend: Compounding periods per year (m) Periodic RRR 7.2% 2.10 4 -growth Calculate the Estimated Stock price Under the Non-growth assumption. Assume dividends are paid quarterly D1 dividend Estimated Price: stant- nually Calculate the Estimated Stock price under the Constant-growth assumption. Assume dividends are paid quarterly Assume the (APR) constant growth rate (g) is: 2.8% Periodic growth rate (g): 3.2% D1 dividend: Estimated Price: If the growth rate (9) were higher the value of the stock would be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts