Question: Need help with question 12, 13, 14, 15? Please 12) Historical data indicates that securities with a higher return tend to have a higher A)

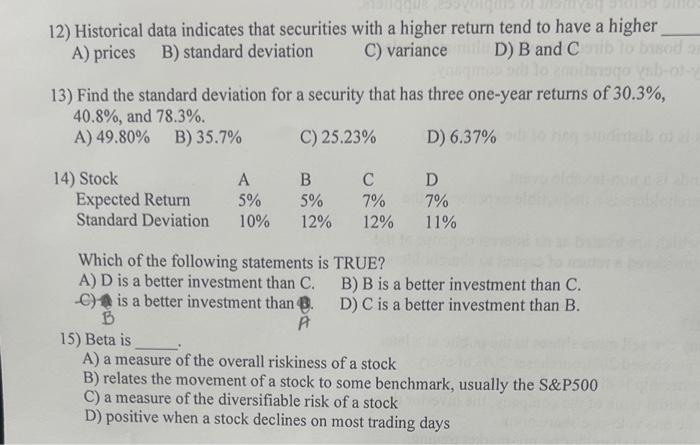

12) Historical data indicates that securities with a higher return tend to have a higher A) prices B) standard deviation C) variance D) B and C 13) Find the standard deviation for a security that has three one-year returns of 30.3%, 40.8%, and 78.3%. A) 49.80% B) 35.7% C) 25.23% D) 6.37% Which of the following statements is TRUE? A) D is a better investment than C. B) B is a better investment than C. -C) is a better investment than B. D) C is a better investment than B. B A 15) Beta is A) a measure of the overall riskiness of a stock B) relates the movement of a stock to some benchmark, usually the S\&P500 C) a measure of the diversifiable risk of a stock D) positive when a stock declines on most trading days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts