Question: need help with question 17 and 18 Question 17 (1 point) Firm Z has outstanding bonds with a 7% yield to maturity. The firm's managers

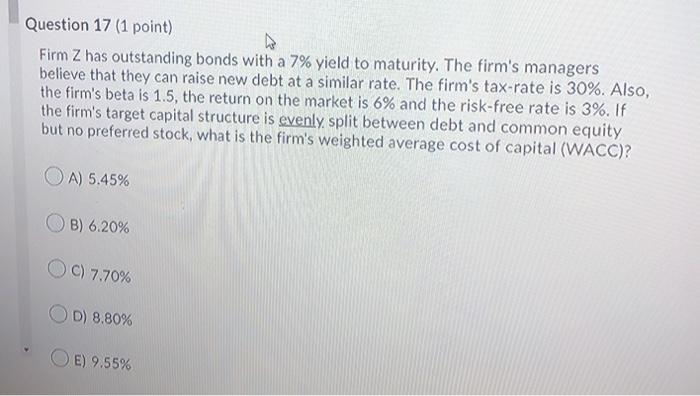

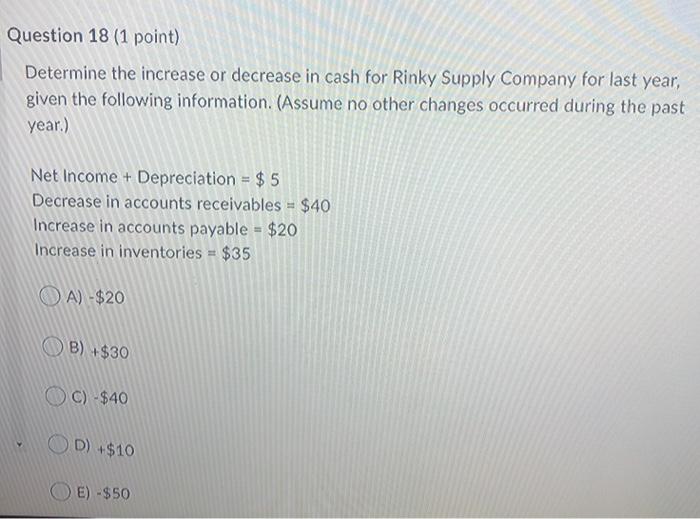

Question 17 (1 point) Firm Z has outstanding bonds with a 7% yield to maturity. The firm's managers believe that they can raise new debt at a similar rate. The firm's tax-rate is 30%. Also, the firm's beta is 1.5, the return on the market is 6% and the risk-free rate is 3%. If the firm's target capital structure is evenly, split between debt and common equity but no preferred stock, what is the firm's weighted average cost of capital (WACC)? OA) 5.45% B) 6.20% C) 7.70% OD) 8.80% O E) 9.55% Question 18 (1 point) Determine the increase or decrease in cash for Rinky Supply Company for last year, given the following information. (Assume no other changes occurred during the past year.) Net Income + Depreciation = $5 Decrease in accounts receivables - $40 Increase in accounts payable - $20 Increase in inventories $35 OA) -$20 B) +$30 OC) - $40 D) +$10 OE) -$50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts