Question: Need help with question 5 a and b but posted question 4 as b is tied to that question 4. Consider the two projects whose

Need help with question 5 a and b but posted question 4 as b is tied to that question

Need help with question 5 a and b but posted question 4 as b is tied to that question

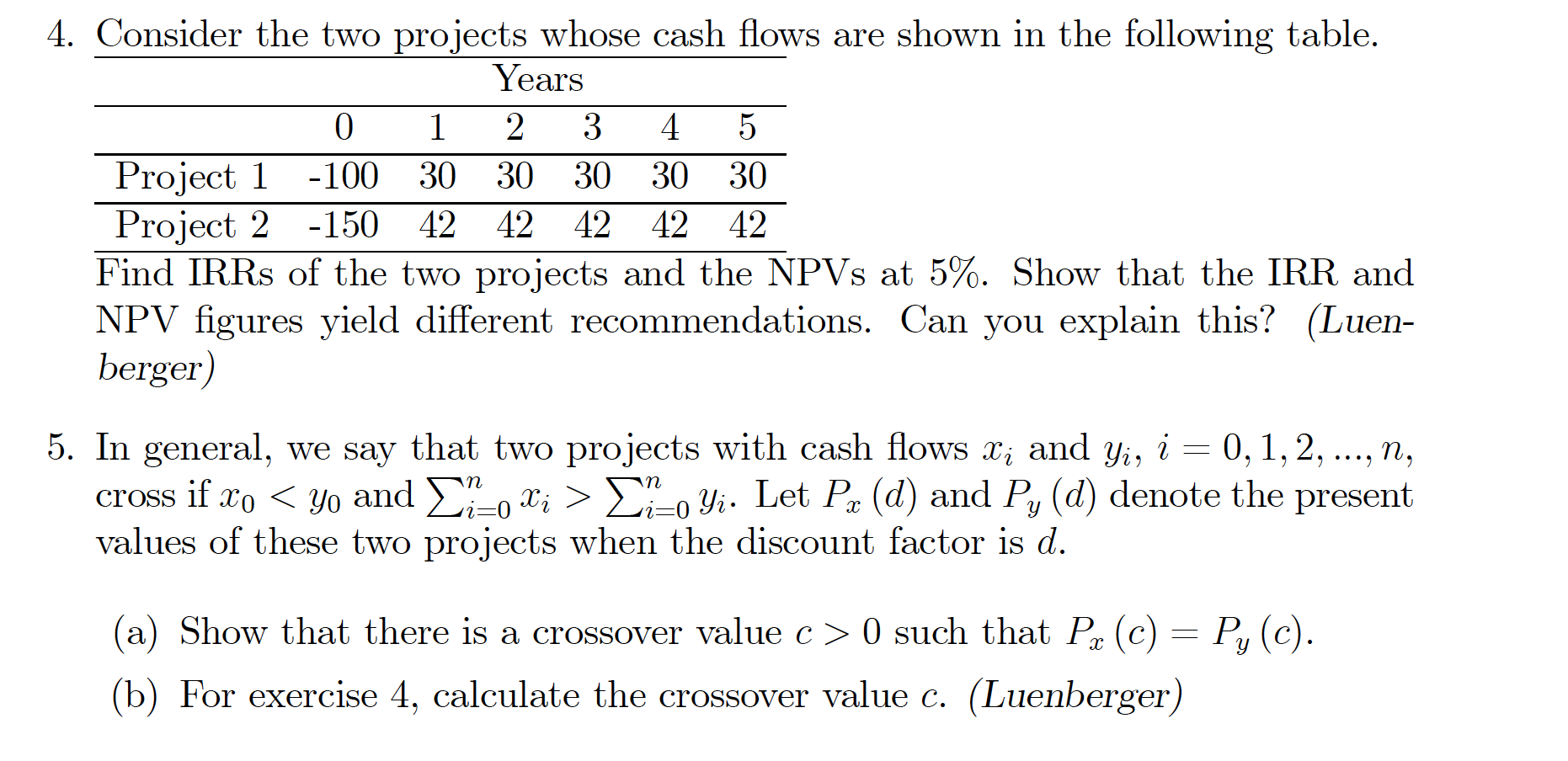

4. Consider the two projects whose cash flows are shown in the following table. Years 0 1 2 3 4 5 Project 1 -100 30 30 30 30 30 Project 2 -150 42 42 42 42 42 Find IRRs of the two projects and the NPVs at 5%. Show that the IRR and NPV figures yield different recommendations. Can you explain this? (Luen- berger) 5. In general, we say that two projects with cash flows Xi and Yi, i = 0,1, 2, ..., n, cross if xo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts