Question: Need help with solving 3-6 , and 3-7 : Chapter 3: Financial Statement Analysis 63 3-4 The sales, total assets, and net income for five

Need help with solving 3-6, and 3-7:

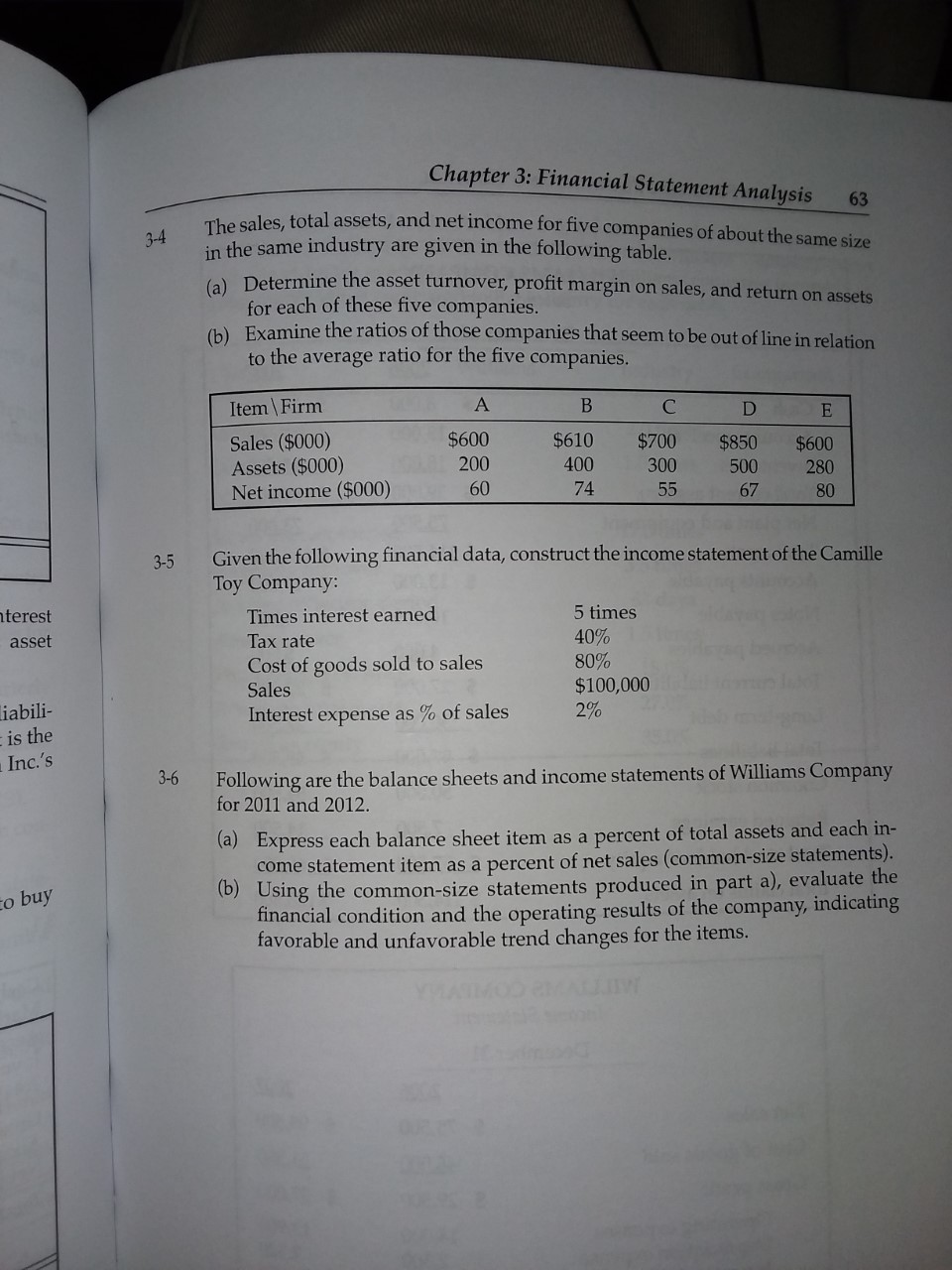

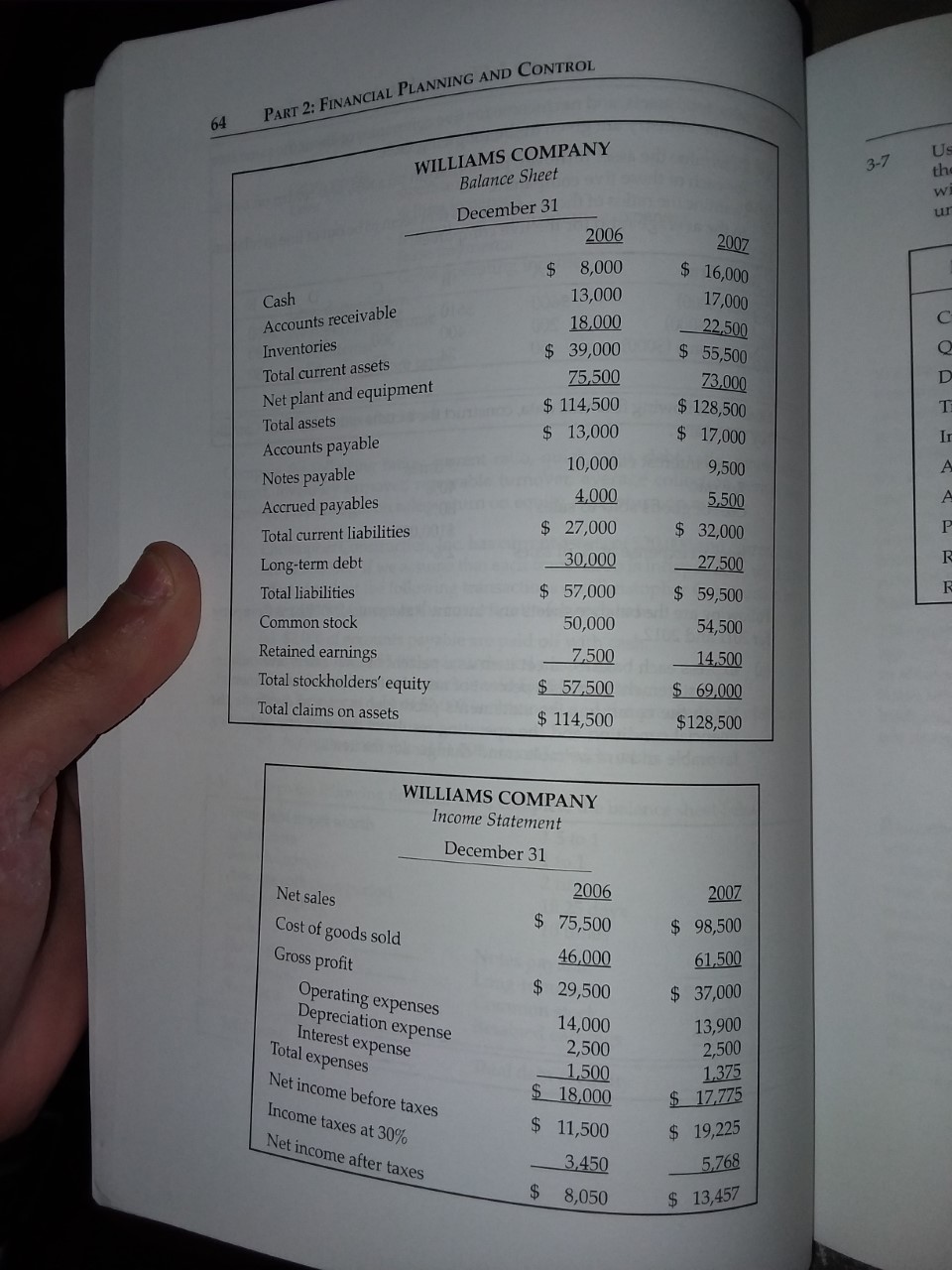

Chapter 3: Financial Statement Analysis 63 3-4 The sales, total assets, and net income for five companies of about the same size in the same industry are given in the following table. (a) Determine the asset turnover, profit margin on sales, and return on assets for each of these five companies. (b) Examine the ratios of those companies that seem to be out of line in relation to the average ratio for the five companies. Item\\Firm A B C D E Sales ($000) $600 $610 $700 $850 Assets ($000) 200 $600 400 300 500 Net income ($000) 280 60 74 55 67 80 3-5 Given the following financial data, construct the income statement of the Camille Toy Company: terest Times interest earned 5 times asset Tax rate 40% Cost of goods sold to sales 80% Sales $100,000 iabili- 2% is the Interest expense as % of sales Inc.'s 3-6 Following are the balance sheets and income statements of Williams Company for 2011 and 2012. (a) Express each balance sheet item as a percent of total assets and each in- come statement item as a percent of net sales (common-size statements). to buy (b) Using the common-size statements produced in part a), evaluate the financial condition and the operating results of the company, indicating favorable and unfavorable trend changes for the items. AMOD eMALLTYPART 2: FINANCIAL PLANNING AND CONTROL 64 WILLIAMS COMPANY 3-7 U Balance Sheet th wi December 31 2006 2007 $ 8,000 $ 16,000 Cash 13,000 17,000 Accounts receivable 18,000 22,500 Inventories $ 39,000 $ 55,500 Total current assets 75,500 Net plant and equipment 73,000 $ 114,500 $ 128,500 Total assets Accounts payable $ 13,000 $ 17,000 Notes payable 10,000 9,500 Accrued payables 4,000 5,500 Total current liabilities $ 27,000 $ 32,000 Long-term debt 30,000 27,500 Total liabilities $ 57,000 $ 59,500 Common stock 50,000 54,500 Retained earnings 7,500 14,500 Total stockholders' equity $ 57.500 $ 69,000 Total claims on assets $ 114,500 $128,500 WILLIAMS COMPANY Income Statement December 31 Net sales 2006 2007 Cost of goods sold $ 75,500 $ 98,500 Gross profit 46,000 61,500 Operating expenses $ 29,500 $ 37,000 Depreciation expense 14,000 Interest expense 13,900 Total expenses 2,500 2,500 1,500 1,375 Net income before taxes 18,000 $ 17,775 Income taxes at 30% $ 11,500 $ 19,225 Net income after taxes 3,450 5,768 $ 8,050 $ 13,457Chapter 3: Financial Statement Analysis 65 3-7 Using the financial data in Problem 3-6, (a) calculate the following ratios of the Williams Company for 2012 and (b) compare Williams Company ratios with the industry averages. Indicate whether Williams compares favorably or unfavorably when compared to the industry for each ratio. Ratio Williams Industry Comparison Current ratio 2.0 times Quick ratio 1.0 times Debt to total assets 45.5% Times interest earned 17.0 times Inventory turnover 3.5 times Average collection period 63 days Asset turnover 1.5 times Profit margin on sales 18.0% Return on total assets 27.0% Return on equity 35.0%