Question: need help with the graph Value 4.00% CAPM Elements Risk-free rate (R) Market risk premium (RPM) Happy Corp. stock's beta Required rate of return on

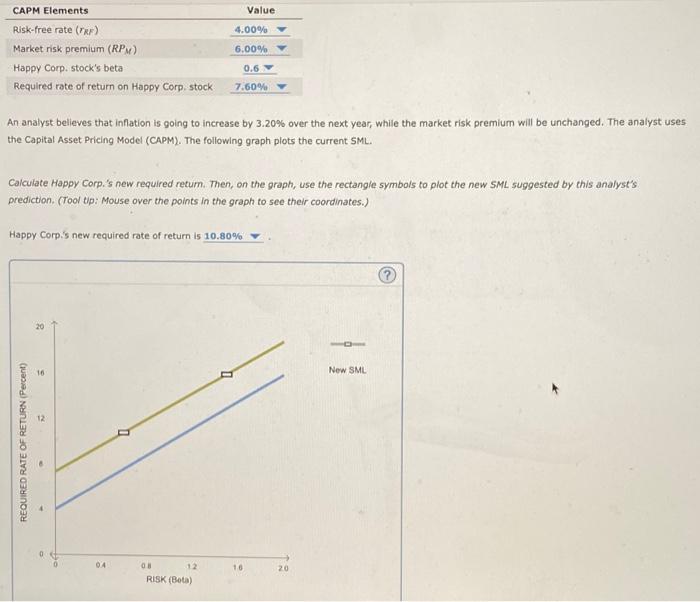

Value 4.00% CAPM Elements Risk-free rate (R) Market risk premium (RPM) Happy Corp. stock's beta Required rate of return on Happy Corp, stock 6.00% 0.6 7.60% An analyst believes that inflation is going to increase by 3.20% over the next year, while the market risk premium will be unchanged. The analyst uses the Capital Asset Pricing Model (CAPM). The following graph plots the current SML. Calculate Happy Corp.'s new required retum Then, on the graph, use the rectangle symbols to plot the new SML suggested by this analyst's prediction. (Tooltip: Mouse over the points in the graph to see their coordinates.) Happy Corp's new required rate of return is 10.80% 20 - 16 New SML 12 REQUIRED RATE OF RETURN (Percent) 0 04 16 20 08 12 RISK (Beta)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts