Question: need help with these two questions 1. Given: i= 9%, iz = 8%, is = 7%, i4=6%, is= 5%, a. Calculate iz and Ist using

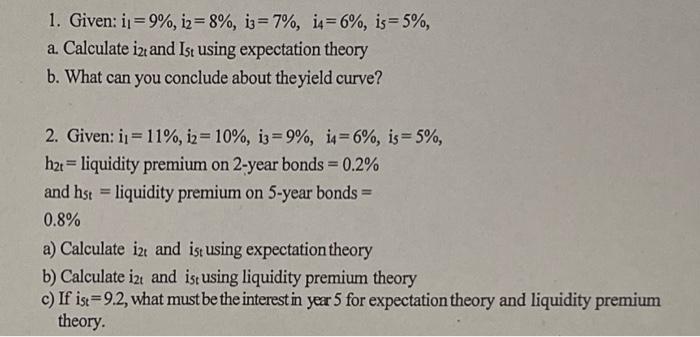

1. Given: i= 9%, iz = 8%, is = 7%, i4=6%, is= 5%, a. Calculate iz and Ist using expectation theory b. What can you conclude about the yield curve? 2. Given: ii = 11%, i2= 10%, is = 9%, i4=6%, is = 5%, hat = liquidity premium on 2-year bonds = 0.2% and hst = liquidity premium on 5-year bonds = 0.8% a) Calculate it and is using expectation theory b) Calculate it and is using liquidity premium theory c) If ist=9.2, what must be the interest in year 5 for expectation theory and liquidity premium theory. 1. Given: i= 9%, iz = 8%, is = 7%, i4=6%, is= 5%, a. Calculate iz and Ist using expectation theory b. What can you conclude about the yield curve? 2. Given: ii = 11%, i2= 10%, is = 9%, i4=6%, is = 5%, hat = liquidity premium on 2-year bonds = 0.2% and hst = liquidity premium on 5-year bonds = 0.8% a) Calculate it and is using expectation theory b) Calculate it and is using liquidity premium theory c) If ist=9.2, what must be the interest in year 5 for expectation theory and liquidity premium theory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts