Question: need help with this 3 part question. let me know if i need to make the pictures clearer, however, if you zoom in they become

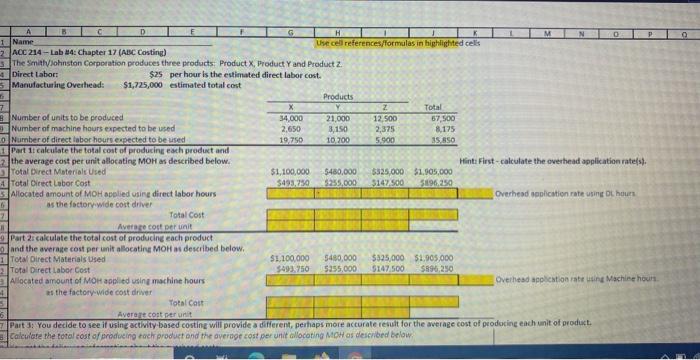

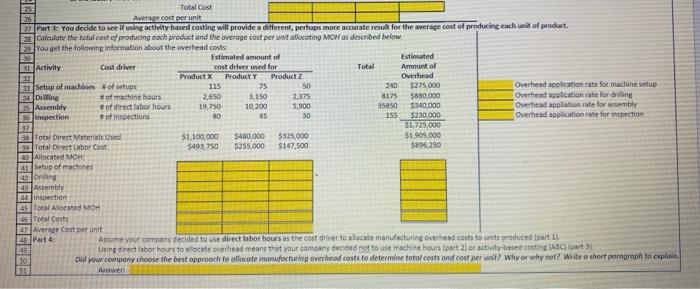

D G H M NI 1 Name Use cell references formulas in highlighted cells ACC 214 -Lab #4: Chapter 17 (ABC Costing) The Smith Johnston Corporation produces three products Product X, Product Y and Product Direct Labor: $25 per hour is the estimated direct labor cost. Manufacturing Overhead: $1,725,000 estimated total cost Products 7 X Z Total Number of units to be produced 34,000 21,000 12.500 67,500 Number of machine hours expected to be used 2,650 3,150 2,375 8.175 Number of direct tobor hours expected to be used 19.750 10.200 5.900 35.850 Part 1t calculate the total cost of producing each product and the average cost per unit allocating MOH as described below. Hint: First-calculate the overhead application rates). Total Direct Materials Used $1,100,000 5480,000 $325,000 $1,905,000 Total Direct Labor Cost $493,750 5235,000 $147.500 $196,250 Allocated amount of MOH applied using direct labor hours Overhead aplication rate using Others 6 as the factory wide cost driver 7 Total Cost Average cost per unit Part 2: calculate the total cost of producing each product and the average cost per unit allocating MOH described below. 1 Total Direct Materials Used $1,100,000 5480,000 $325,000 $1,905,000 Total Direct Labor Cost $493,750 5255,000 5147.500 $896,250 Allocated amount of MOH applied using machine hours Overhead application rate using Machine hours as the factory wide cost driver Total Cost Average cost per unit Part 3: You decide to see if using activity based costing will provide a different, perhaps more accurate result for the average cost of producing each unit of product. Calculate the total cost of broducing och product and the average cost per unit allocating MOH os described below 26 Total Cost Average cost per unit 22 Part 3You decide to see iting activity based costing will provide a different, perhaps more accurate rest for the average cost of producing each unit of product 28Calculate the total cost of producing each product and the average cost per unit allocating MW as described below You get the following information about the overhead costs 30 Estimated amount of Estimated 31 Activity Cost driver cost driver used for Total Amount of 22 Product Product Y Product Z Overhead 33 Setup of machine of setups 115 75 50 240 $275.000 Overhead application rate for machine setup 30 Drilling of machine hours 2,650 3.150 2,375 8175 5880,000 Overhead application rate for drilling 35. Assembly of direct labor hours 19.750 10.200 5.900 35850 $340,000 Overhead appliation rate for assembly Inspection of inspection 80 45 30 155 $230,000 Overhead application rate for inspection 51.725,000 Total Direct Materials Used 51.100.000 5480,000 $325,000 $1,905,000 39 Total Direct Labor Cost $493,750 S255,000 $147,500 $98.250 Allocated MOR 1 Setup of machine 49 Driling LB Assembly ad inspection 45 Total Allocated MOH 46 Total Costs 4 Average cost per unit 16 Part 4 Asume your company decided to use direct labor hours as the cost dve to locate manufacturing overhead costs to units produced fait) 19 Using orect sbor hours to locate serhead means that your commany decided not to use machine hours Court 2) or activity-based casting Apart 90 Did your company choose the best approach to allocate manufacturing overhead costs to determine total costs and cost per unit? Why or why not? Write a short paragraph to explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts