Question: Need help with this question PLEASE ANSWER ON PAPER: On October 22nd, Dealer A purchased $1 million face amount of a 7.25% May 15, 2028,

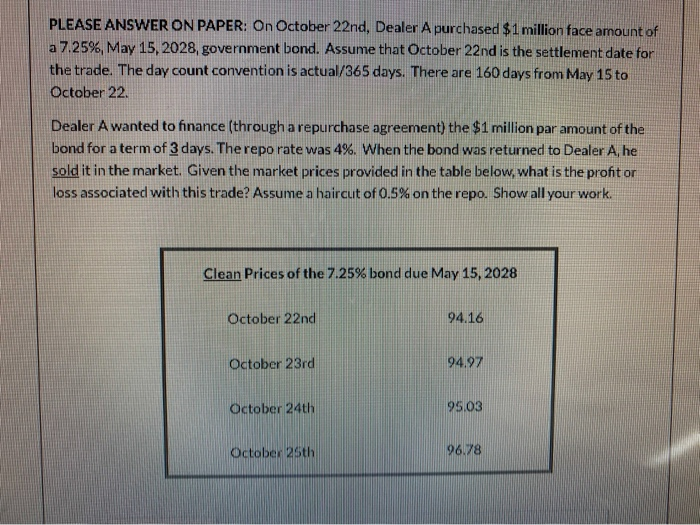

PLEASE ANSWER ON PAPER: On October 22nd, Dealer A purchased $1 million face amount of a 7.25% May 15, 2028, government bond. Assume that October 22nd is the settlement date for the trade. The day count convention is actual/365 days. There are 160 days from May 15 to October 22. Dealer A wanted to finance (through a repurchase agreement) the $1 million par amount of the bond for a term of 3 days. The repo rate was 4%. When the bond was returned to Dealer A, he sold it in the market. Given the market prices provided in the table below, what is the profit or loss associated with this trade? Assume a haircut of 0.5% on the repo. Show all your work. Clean Prices of the 7.25% bond due May 15, 2028 October 22nd 94.16 October 23rd 94.97 October 24th 95.03 October 25th 96.78 PLEASE ANSWER ON PAPER: On October 22nd, Dealer A purchased $1 million face amount of a 7.25% May 15, 2028, government bond. Assume that October 22nd is the settlement date for the trade. The day count convention is actual/365 days. There are 160 days from May 15 to October 22. Dealer A wanted to finance (through a repurchase agreement) the $1 million par amount of the bond for a term of 3 days. The repo rate was 4%. When the bond was returned to Dealer A, he sold it in the market. Given the market prices provided in the table below, what is the profit or loss associated with this trade? Assume a haircut of 0.5% on the repo. Show all your work. Clean Prices of the 7.25% bond due May 15, 2028 October 22nd 94.16 October 23rd 94.97 October 24th 95.03 October 25th 96.78

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts