Question: Need help with this worksheet. please see files attached. 030 $ 6802 SERVICES LLC ERATING ACCT PO BOX 3057 MARIETTA GA 30061-305- SOI 410 Proli

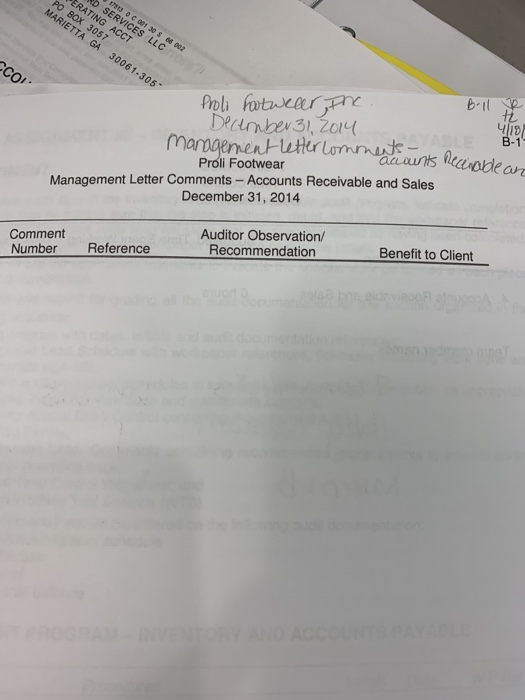

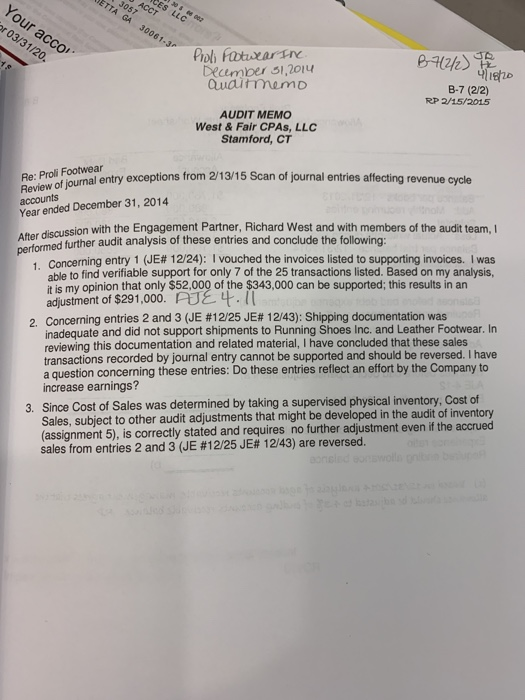

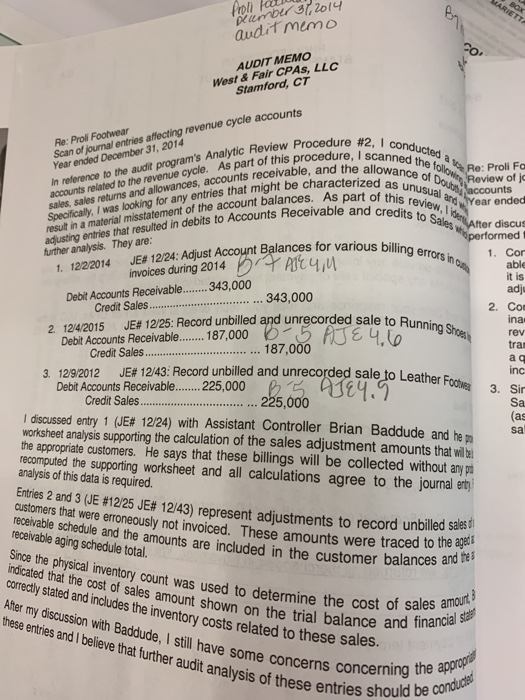

030 $ 6802 SERVICES LLC ERATING ACCT PO BOX 3057 MARIETTA GA 30061-305- SOI 410 Proli footweeer, the Bull December 31, 2014 Management Letter comments - Proli Footwear acants Receidean Management Letter Comments - Accounts Receivable and Sales December 31, 2014 Comment Number Reference Auditor Observation/ Recommendation Benefit to Client DOR ETTA GA 30061-3 3057 Your acco 03/31/20. Proli Footwear Inc December 31, 2014 Quduimmemo B7(2/2) 1912 B-7 (2/2) RP 2/15/2015 AUDIT MEMO West & Fair CPAs, LLC Stamford, CT entry exceptions from 2/13/15 Scan of journal entries affecting revenue cycle Re: Proll Footwear Review of journal entry exceptions from accounts Year ended December 31, 2014 After discussion with the Engagem esion with the Engagement Partner, Richard West and with members of the audit team, ned further audit analysis of these entries and conclude the following: concerning entry 1 (JE# 12/24): 1 vouched the invoices listed to supporting invoices. I was shle to find verifiable support for only 7 of the 25 transactions listed. Based on my analysis. it is my opinion that only $52,000 of the $343,000 can be supported; this results in an adjustment of $291,000. AJE 4.11 2. Concerning entries 2 and 3 (JE #12/25 JE# 12/43): Shipping documentation was inadequate and did not support shipments to Running Shoes Inc. and Leather Footwear. In reviewing this documentation and related material, I have concluded that these sales transactions recorded by journal entry cannot be supported and should be reversed. I have a question concerning these entries: Do these entries reflect an effort by the Company to increase earnings? 3. Since Cost of Sales was determined by taking a supervised physical inventory. Cost of Sales, subject to other audit adjustments that might be developed in the audit of inventory (assignment 5), is correctly stated and requires no further adjustment even if the accrued sales from entries 2 and 3 (JE #12/25 JE# 12/43) are reversed. % Proli laulu piember 1, 2014 audit memo 0 AUDIT MEMO West & Fair CPAs, LLC Stamford, CT dure #2, I conducted Re: Proll Footwear Scan of journal entries affecting revenue cycle accounts Year ended December 31, 2014 In reference to the audit program's Analytic Review Procede accounts related to the revenue cycle. As part of this procedu sales, sales returns and allowances, accounts receivable, and the Specifically, I was looking for any entries that might be characte result in a material misstatement of the account balances. As adjusting entries that resulted in debits to Accounts Receivable further analysis. They are: d the allowance of Do acterized as unusual As part of this reviews ivable and credits to Sa is billing errors in 1. 122/2014 procedure, I scanned the the follRe: Proli Fa Review of i accounts and Year ended Sales After discus performed JE# 12/24: Adjust Account Balances for various bill 1. Cor invoices during 2014 A144, " able it is Debit Accounts Receivable........ 343,000 ....... 343,000 adju Credit Sales .......... 2. Com 2 12/4/2015 JE# 12/25: Record unbilled and unrecorded sale to Run ina: Debit Accounts Receivable........ 187,000 D A TE 4.1 rev Credit Sales..... ... 187,000 tra 3. 12/9/2012 JE# 12/43. Record unbilled and unrecorded sale to Leather Debit Accounts Receivable........ 225,000 5 184.9 3. Sir Credit Sales.. I discussed entry 1 (JE# 12/24) with Assistant Controller Brian Baddude and he (as worksheet analysis supporting the calculation of the sales adjustment amounts that will be sa to Running Shoes e to Leather Foch ................... 225.000 U14.7 the appropriate customers. He says that these billings will be collected without any p recomputed the supporting worksheet and all calculations agree to the journal ert analysis of this data is required. Entries 2 and 3 (JE #12/25 JE# 12/43) represent adjustments to record unbilled customers that were erroneously not invoiced. These amounts were traced to receivable schedule and the amounts are included in the customer Da receivable aging schedule total. Since the physical inventory count was used to determine the cost indicated that the cost of sales amount shown on the tra correctly stated and includes the inventory costs related to these sales: were traced to the aged customer balances and the ount shown on the trial balance and finan After my discussion with Baddude, I still have some concerns a these entries and I believe that further audit analysis of these entes the cost of sales amount 1d financial state oncerns concerning the approp se entries should be conduce 030 $ 6802 SERVICES LLC ERATING ACCT PO BOX 3057 MARIETTA GA 30061-305- SOI 410 Proli footweeer, the Bull December 31, 2014 Management Letter comments - Proli Footwear acants Receidean Management Letter Comments - Accounts Receivable and Sales December 31, 2014 Comment Number Reference Auditor Observation/ Recommendation Benefit to Client DOR ETTA GA 30061-3 3057 Your acco 03/31/20. Proli Footwear Inc December 31, 2014 Quduimmemo B7(2/2) 1912 B-7 (2/2) RP 2/15/2015 AUDIT MEMO West & Fair CPAs, LLC Stamford, CT entry exceptions from 2/13/15 Scan of journal entries affecting revenue cycle Re: Proll Footwear Review of journal entry exceptions from accounts Year ended December 31, 2014 After discussion with the Engagem esion with the Engagement Partner, Richard West and with members of the audit team, ned further audit analysis of these entries and conclude the following: concerning entry 1 (JE# 12/24): 1 vouched the invoices listed to supporting invoices. I was shle to find verifiable support for only 7 of the 25 transactions listed. Based on my analysis. it is my opinion that only $52,000 of the $343,000 can be supported; this results in an adjustment of $291,000. AJE 4.11 2. Concerning entries 2 and 3 (JE #12/25 JE# 12/43): Shipping documentation was inadequate and did not support shipments to Running Shoes Inc. and Leather Footwear. In reviewing this documentation and related material, I have concluded that these sales transactions recorded by journal entry cannot be supported and should be reversed. I have a question concerning these entries: Do these entries reflect an effort by the Company to increase earnings? 3. Since Cost of Sales was determined by taking a supervised physical inventory. Cost of Sales, subject to other audit adjustments that might be developed in the audit of inventory (assignment 5), is correctly stated and requires no further adjustment even if the accrued sales from entries 2 and 3 (JE #12/25 JE# 12/43) are reversed. % Proli laulu piember 1, 2014 audit memo 0 AUDIT MEMO West & Fair CPAs, LLC Stamford, CT dure #2, I conducted Re: Proll Footwear Scan of journal entries affecting revenue cycle accounts Year ended December 31, 2014 In reference to the audit program's Analytic Review Procede accounts related to the revenue cycle. As part of this procedu sales, sales returns and allowances, accounts receivable, and the Specifically, I was looking for any entries that might be characte result in a material misstatement of the account balances. As adjusting entries that resulted in debits to Accounts Receivable further analysis. They are: d the allowance of Do acterized as unusual As part of this reviews ivable and credits to Sa is billing errors in 1. 122/2014 procedure, I scanned the the follRe: Proli Fa Review of i accounts and Year ended Sales After discus performed JE# 12/24: Adjust Account Balances for various bill 1. Cor invoices during 2014 A144, " able it is Debit Accounts Receivable........ 343,000 ....... 343,000 adju Credit Sales .......... 2. Com 2 12/4/2015 JE# 12/25: Record unbilled and unrecorded sale to Run ina: Debit Accounts Receivable........ 187,000 D A TE 4.1 rev Credit Sales..... ... 187,000 tra 3. 12/9/2012 JE# 12/43. Record unbilled and unrecorded sale to Leather Debit Accounts Receivable........ 225,000 5 184.9 3. Sir Credit Sales.. I discussed entry 1 (JE# 12/24) with Assistant Controller Brian Baddude and he (as worksheet analysis supporting the calculation of the sales adjustment amounts that will be sa to Running Shoes e to Leather Foch ................... 225.000 U14.7 the appropriate customers. He says that these billings will be collected without any p recomputed the supporting worksheet and all calculations agree to the journal ert analysis of this data is required. Entries 2 and 3 (JE #12/25 JE# 12/43) represent adjustments to record unbilled customers that were erroneously not invoiced. These amounts were traced to receivable schedule and the amounts are included in the customer Da receivable aging schedule total. Since the physical inventory count was used to determine the cost indicated that the cost of sales amount shown on the tra correctly stated and includes the inventory costs related to these sales: were traced to the aged customer balances and the ount shown on the trial balance and finan After my discussion with Baddude, I still have some concerns a these entries and I believe that further audit analysis of these entes the cost of sales amount 1d financial state oncerns concerning the approp se entries should be conduce

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts