Question: Need it in the table or an understanding format. The selling and admin expenses can be separated into fixed and variable portions as follows: Fixed

Need it in the table or an understanding format.

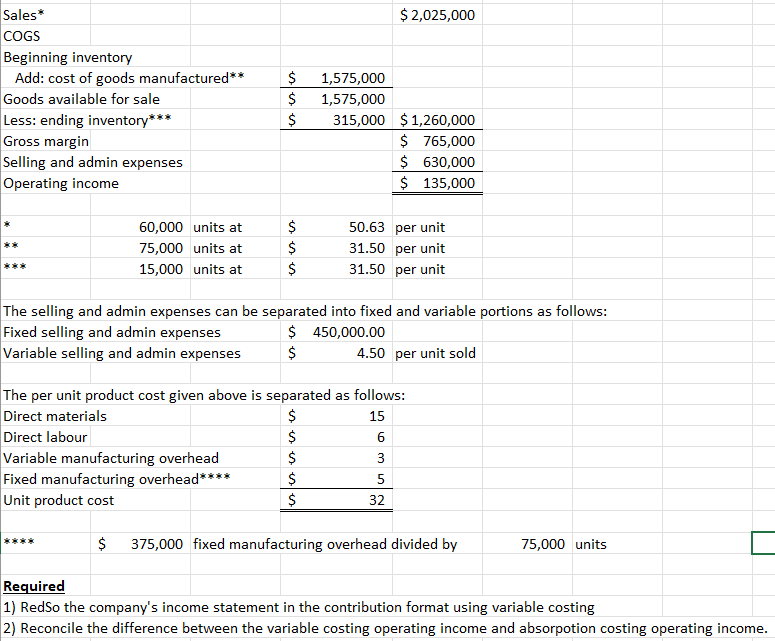

The selling and admin expenses can be separated into fixed and variable portions as follows: Fixed selling and admin expenses $450,000.00 Variable selling and admin expenses $4.50 per unit sold The per unit product cost given above is separated as follows: \begin{tabular}{l|rr} Direct materials & $ & 15 \\ Direct labour & $ & 6 \\ Variable manufacturing overhead & $ & 3 \\ \hline Fixed manufacturing overhead**** & $ & 5 \\ \hline Unit product cost & $ & 32 \\ \hline \hline \end{tabular} $375,000 fixed manufacturing overhead divided by 75,000 units Required 1) RedSo the company's income statement in the contribution format using variable costing 2) Reconcile the difference between the variable costing operating income and absorpotion costing operating income. The selling and admin expenses can be separated into fixed and variable portions as follows: Fixed selling and admin expenses $450,000.00 Variable selling and admin expenses $4.50 per unit sold The per unit product cost given above is separated as follows: \begin{tabular}{l|rr} Direct materials & $ & 15 \\ Direct labour & $ & 6 \\ Variable manufacturing overhead & $ & 3 \\ \hline Fixed manufacturing overhead**** & $ & 5 \\ \hline Unit product cost & $ & 32 \\ \hline \hline \end{tabular} $375,000 fixed manufacturing overhead divided by 75,000 units Required 1) RedSo the company's income statement in the contribution format using variable costing 2) Reconcile the difference between the variable costing operating income and absorpotion costing operating income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts