Question: need p8-5 using the numbers from p8-4 use the numbers from p8-4 for p8-5 this is all the info needed P8-4. Percentage-of-completion Method. Bigelow Contractors

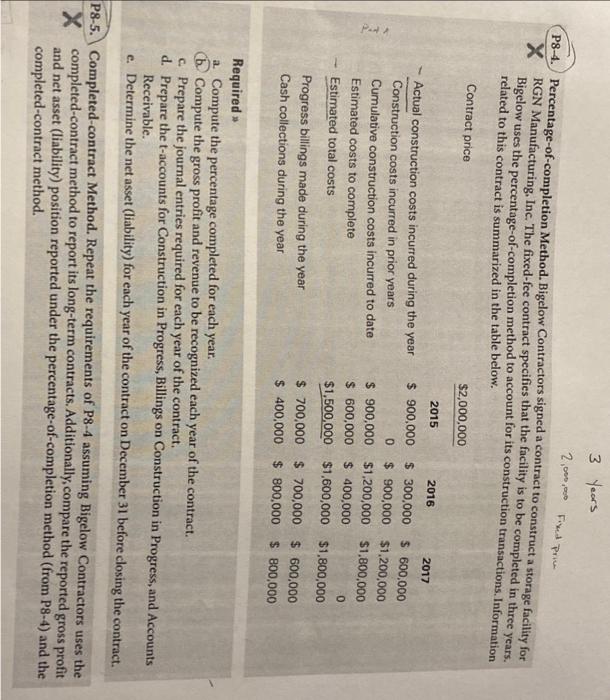

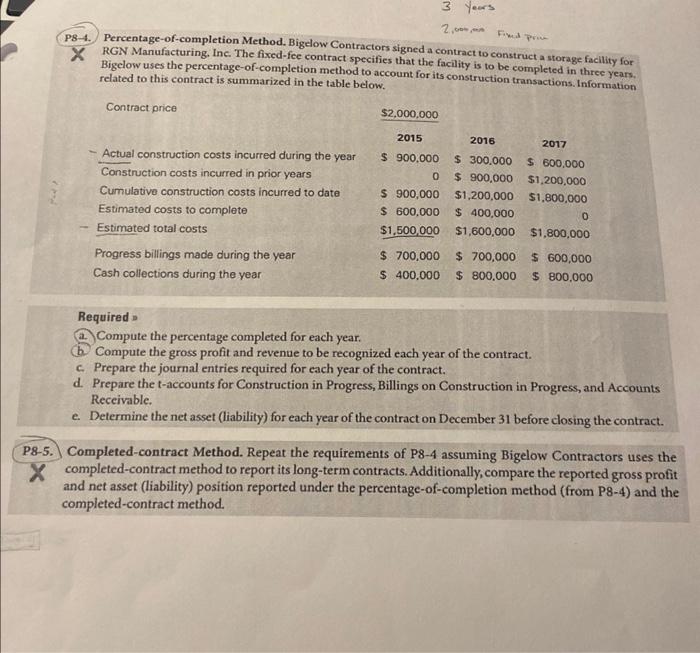

P8-4. Percentage-of-completion Method. Bigelow Contractors signed a contract to construct a storage facility for RGN Manufacturing. Inc. The fixed-fee contract specifies that the facility is to be completed in three years. Bigelow uses the percentage-of-completion method to account for its construction transactions. Information related to this contract is summarized in the table below. Required a. Compute the percentage completed for each year. (b. Compute the gross profit and revenue to be recognized each year of the contract. c. Prepare the journal entries required for each year of the contract. d. Prepare the t-accounts for Construction in Progress, Billings on Construction in Progress, and Accounts Reccivable. e. Determine the net asset (liability) for each year of the contract on December 31 before closing the contract. 5. Completed-contract Method. Repeat the requirements of P8-4 assuming Bigelow Contractors uses the completed-contract method to report its long-term contracts. Additionally, compare the reported gross profit and net asset (liability) position reported under the percentage-of-completion method (from P8-4) and the completed-contract method. P8-4. Percentage-of-completion Method. Bigclow Contractors signed a contract to construct a storage facility for RGN Manufacturing. Inc. The fixed-fee contract specifies that the facility is to be completed in three years. Bigelow uses the percentage-of-completion method to account for its construction transactions. Information related to this contract is summarized in the table below. Required (a.) Compute the percentage completed for each year. (b. Compute the gross profit and revenue to be recognized each year of the contract. c. Prepare the journal entries required for each year of the contract. d. Prepare the t-accounts for Construction in Progress, Billings on Construction in Progress, and Accounts Reccivable. e. Determine the net asset (liability) for each year of the contract on December 31 before closing the contract. 8-5. Completed-contract Method. Repeat the requirements of P8-4 assuming Bigelow Contractors uses the completed-contract method to report its long-term contracts. Additionally, compare the reported gross protit and net asset (liability) position reported under the percentage-of-completion method (from P8-4) and the completed-contract method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts