Question: need part 2 and 3 please answer right Problem 8 Intro The table below shows the expected rates of return for three stocks and their

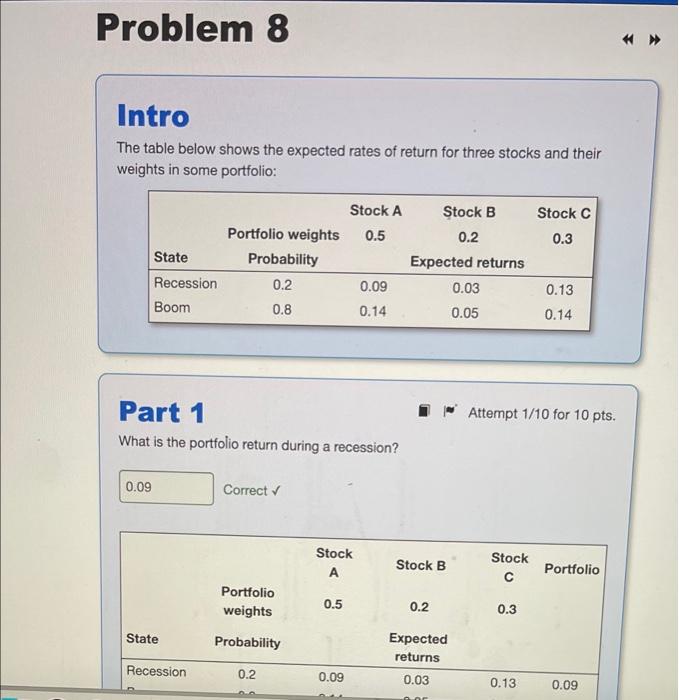

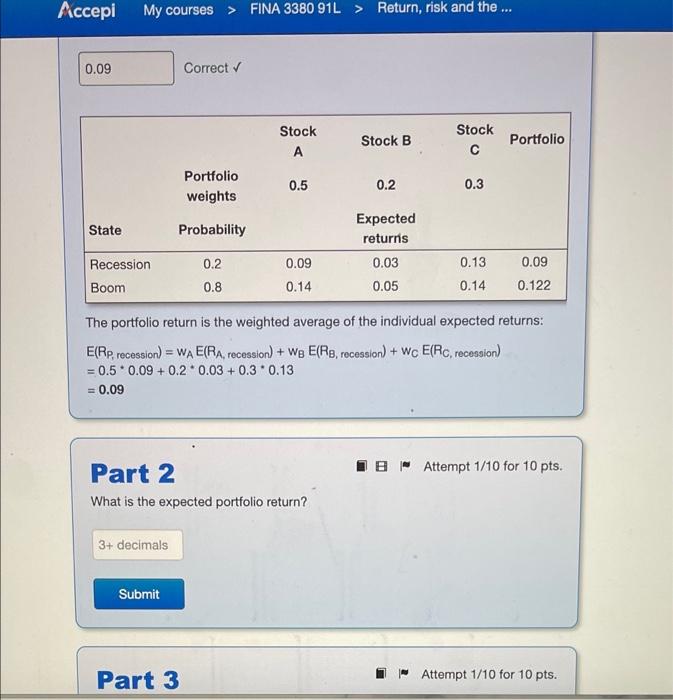

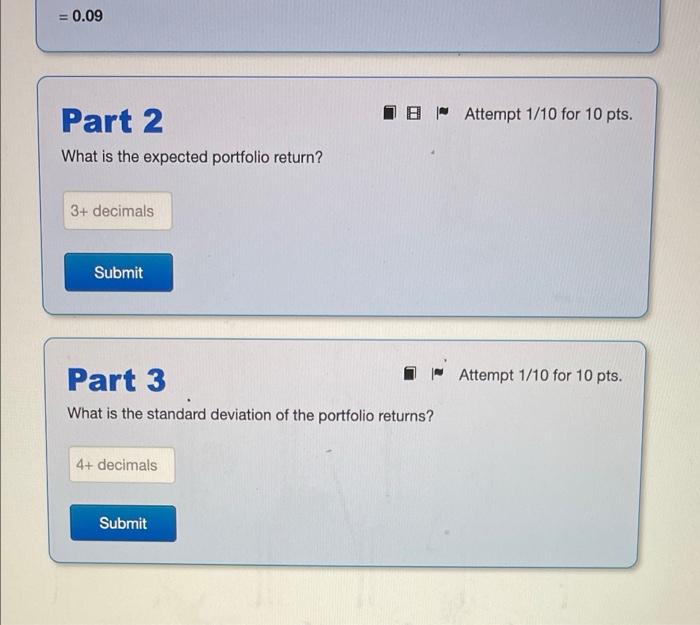

Problem 8 Intro The table below shows the expected rates of return for three stocks and their weights in some portfolio: Stock A Stock C 0.3 0.5 State Recession Boom Portfolio weights Probability 0.2 Stock B 0.2 Expected returns 0.03 0.09 0.14 0.8 0.13 0.14 0.05 at Attempt 1/10 for 10 pts. Part 1 What is the portfolio return during a recession? 0.09 Correct Stock A Stock B Stock Portfolio Portfolio weights 0.5 0.2 0.3 State Probability Expected returns Recession 0.2 0.09 0.03 0.13 0.09 or Accepi My courses > FINA 3380 91L > Return, risk and the ... 0.09 Correct Stock A Stock B Stock Portfolio Portfolio weights 0.5 0.2 0.3 State Probability Expected returns 0.03 0.05 Recession Boom 0.2 0.8 0.09 0.14 0.13 0.14 0.09 0.122 The portfolio return is the weighted average of the individual expected returns: E(Rp recession) = WAE(RA, recession) + Wg E(Re, recession) + Wc E(Rc, recession) = 0.5 0.09 +0.2.0.03 +0.3 0.13 = 0.09 IS Attempt 1/10 for 10 pts. Part 2 What is the expected portfolio return? 3+ decimals Submit Part 3 Attempt 1/10 for 10 pts. = 0.09 - Attempt 1/10 for 10 pts. Part 2 What is the expected portfolio return? 3+ decimals Submit Part 3 - Attempt 1/10 for 10 pts. What is the standard deviation of the portfolio returns? 4+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts