Question: need post journal entrys from part one to the account in general ledger prepare 6 column work sheet that includes unadjusted trail balance 3can3. Assignment

![applles to the questions displayed below] Santana Rey created Business Solutions on](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66fa6aa2d6507_33066fa6aa276d21.jpg)

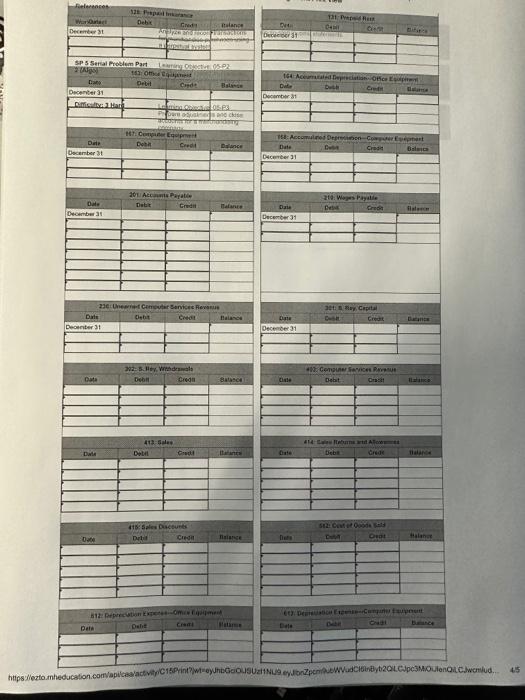

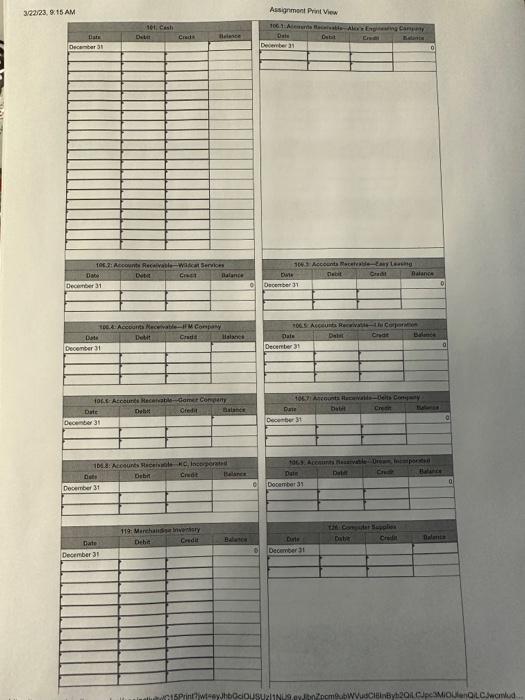

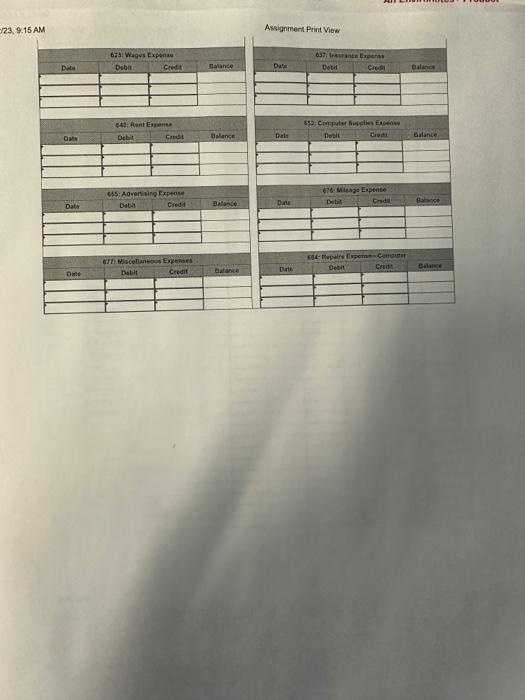

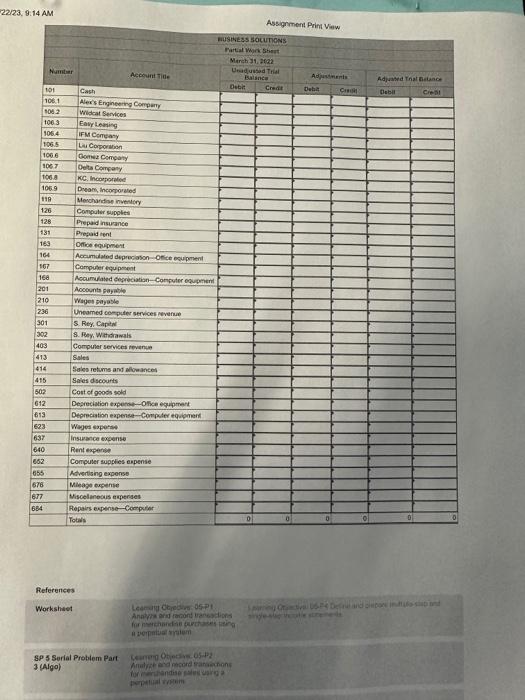

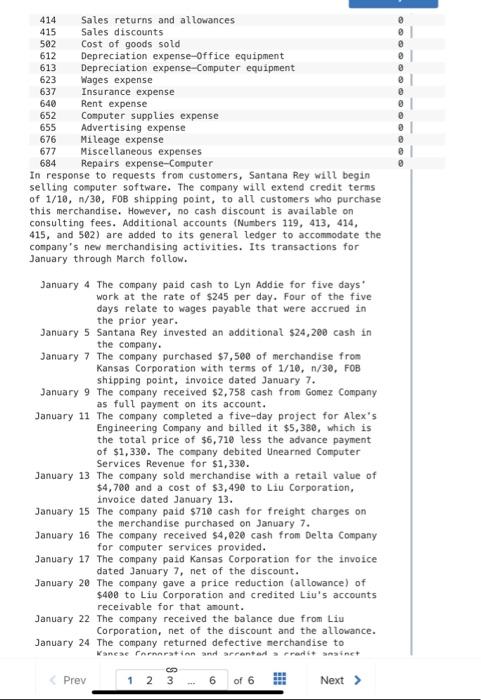

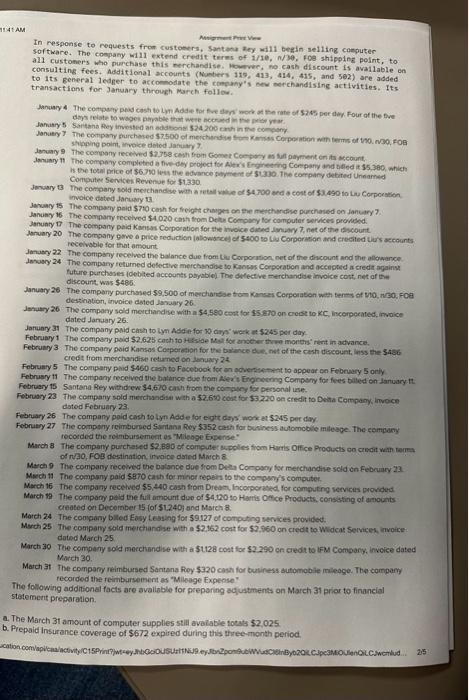

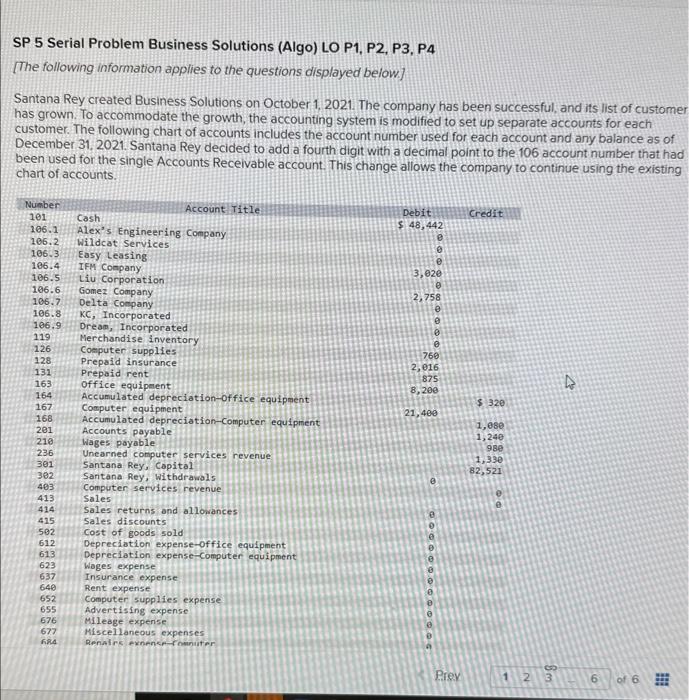

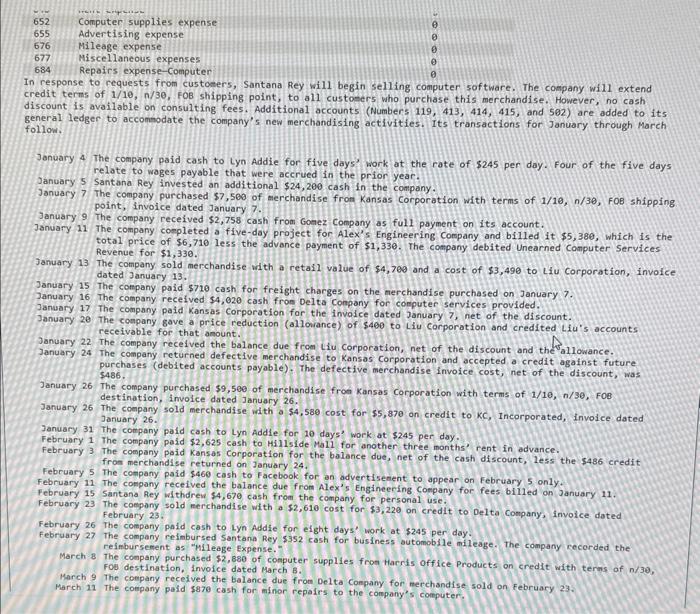

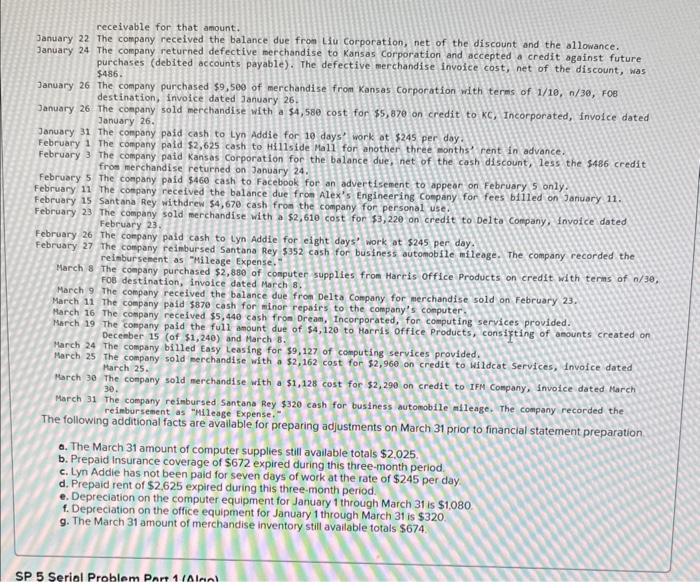

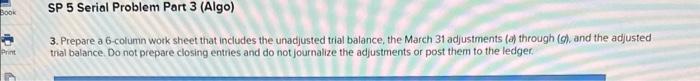

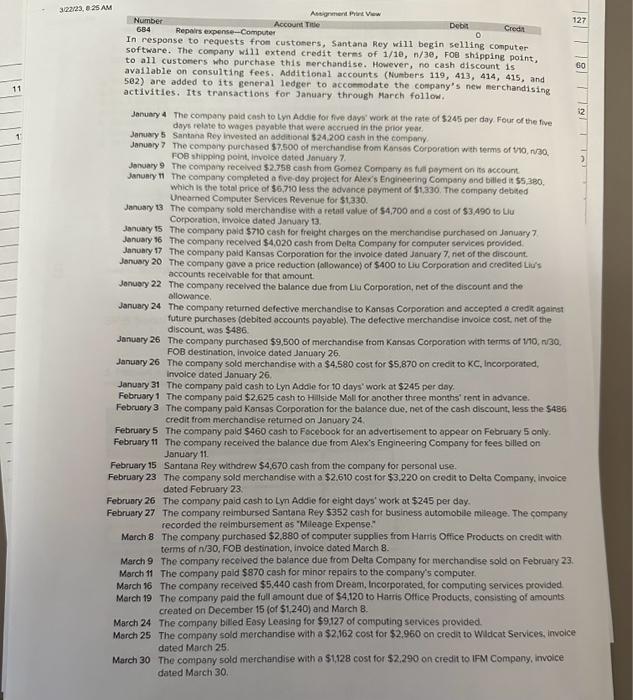

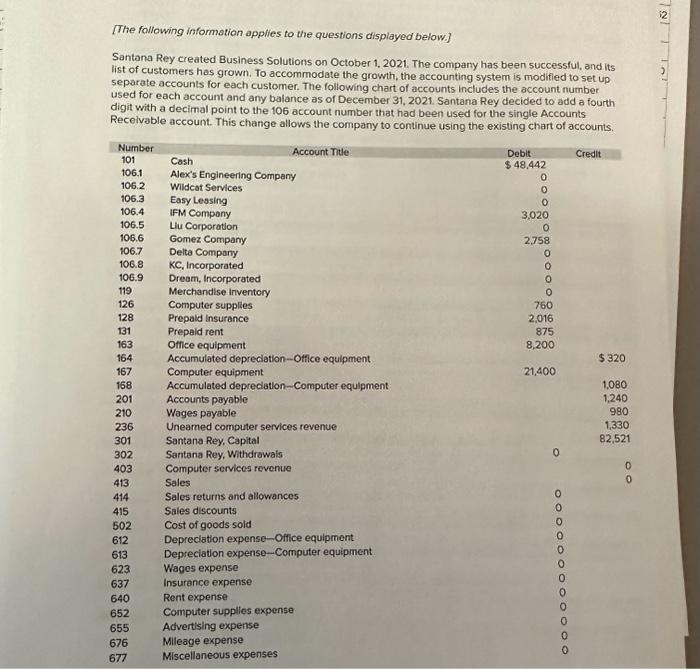

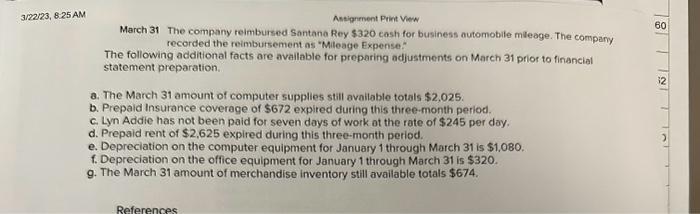

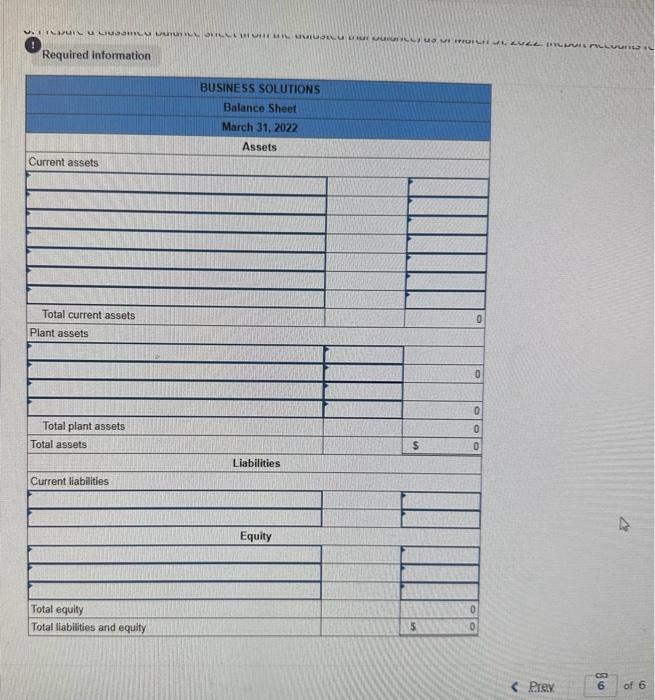

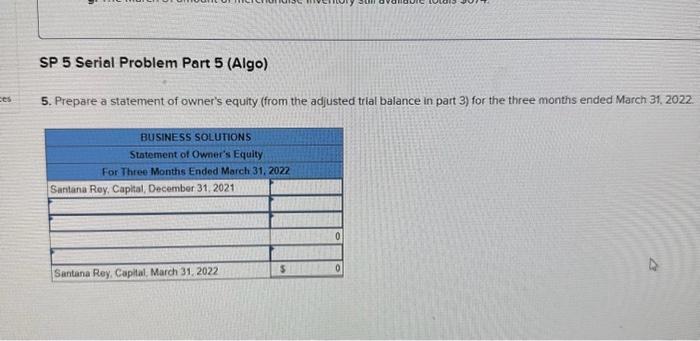

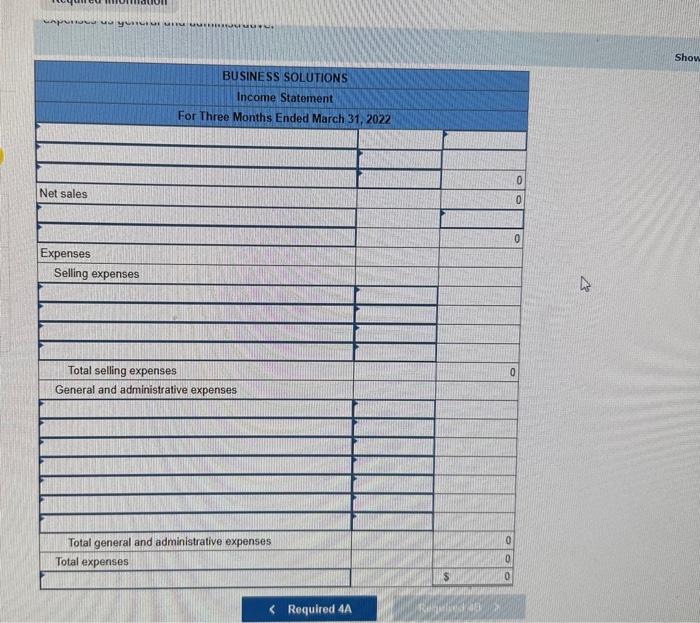

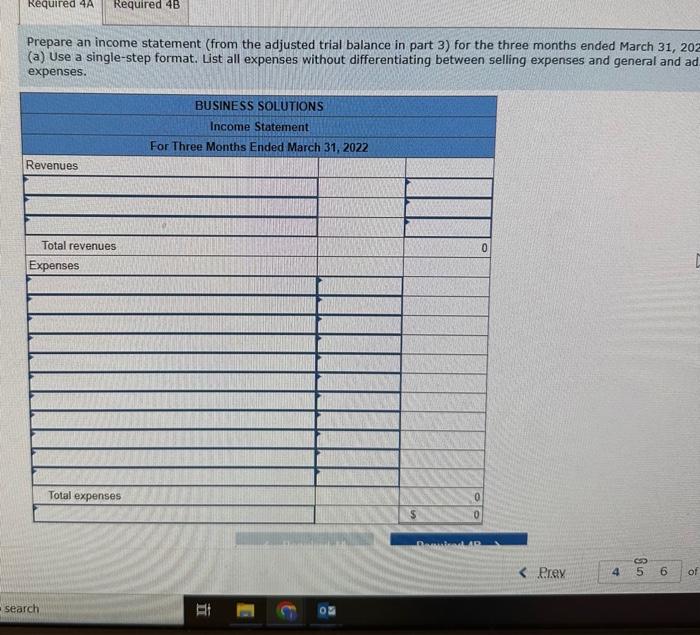

3can3. Assignment Print View 22/23. 9.14 AM Assignment Primt Vaw SP 5 Serial Problem Business Solutions (Algo) LO P1, P2, P3, P4 [The following information applles to the questions displayed below] Santana Rey created Business Solutions on October 1, 2021. The company has been successful, and its list of customers has grown. To accommodate the growth, the accounting system is modified to set up separate accounts for each customer, The following chart of accounts includes the account number used for each account and any balance as of December 31, 2021. Santana Rey decided to add a fourth digit with a decimal point to the 106 account number that had been used for the single Accounts Recelvable account. This change allows the company to continue using the existing chart of accounts In response to requests trom customers, santana key wath begin selling computer software. The company will extend credit terms of 1/10,n/30, FOB shipping point, to all custoners who purchase this merchandise. However, no cash discount is available on consulting fees. Additional accounts (Numbers 119, 413, 414, 415, and 502) are added to its general ledger to accommodate the company's new merchandising activities. Its transactions for January through March follow. January 4 The company paid cash to Lyn Addie for five days" work at the rate of $245 per day. Four of the five days relate to wages payable that were accrued in the prior year. January 5 Santana Rey invested an additional $24,260 cash in the company. January 7 The company purchased $7,500 of merchandise from Kansas Corporation with terms of 1/10,n/30, FOB shipping point, invoice dated January 7. January 9 The company received $2,758 cash from Gomez Company as full payment on its account. January 11 The company completed a five-day project for Alex"s Engineering Company and billed it $5,380, which is the total price of $6,710 less the advance payment of $1,330. The conpany debited Unearned Computer Services Revenue for $1,330. January 13 The company sold merchandise with a retail value of $4,700 and a cost of $3,490 to Liu Corporation, invoice dated January 13. January 15 The company paid $710 cash for freight charges on the merchandise purchased on January 7. January 16 The company received $4,020 cash from Delta Company for computer services provided. January 17 The company paid Kansas Corporation for the invoice dated January 7 , net of the discount. January 20 The company gave a price reduction (allowance) of $400 to Liu Corporation and credited Liu's accounts receivable for that anount. January 22 The company received the balance due from Liu Corporation, net of the discount and the allowance. January 24 The company returned defective merchandise to Waneae ramoratian and arrontad = rradit snatnet Prev 1236 of 6 m In response to requests from custosers, Santacu dey wil1 begin selling coeputer software. The coopany wil1 extend credit terms of 1/16,N/39, foe shippine polnt, to a11 custoners who purchase this merchandise. lootver, no casb discount is avallable on consulting fees. Additicnal accounts (Muobers 119, 413, 414, 415, and 502) are added to its general ledger to accomodate the comphny's nen nerchandising actlvities, Its transactions for January through mareh follow. ding relate to wapes pmpable that were ncoratd in the pertse year Janatry 5 Soritanio Aley impested an addsonsi 524200 cath in the compony shipging polm, irveice deted januaty ? denuary in the compery completed a five dey peopect for Aleris frymeeting Corperyy and beled it 35,380 , which is the foem price of $6710 iest the advance peymere of 51330 . The compary defited Unnarned Computee Senices Revenue for $1.330 Jonsary o3 The company sold metchandise wath in retal witue of 54 roo sed a cont of 53490 to Lu Corporation invoice dated January in danumy if the comparty recelved 54.020 cath thom Detur Company lor computer services provised. Januaty 17 The company paid Kareas Corporation for the Hvoice dibed dynumy t, net of the discount. Monuary 20 The company gww a price redurtian jalowatee] of 5400 to lis Corperiation and crecited vur's aceounts recelvble for that amount. Janaacy 22 The company recelved the balance due from thu Corporation net of the dincount and the allowarce. Insasy 24 The company retumed debective merchandbe to Kances Corpocation and aceeperd a credr agains: future purchases (oobled acceonts poyable) The difective merchandide invoice cout, ned af the discount was 5485 . danuary 26 . The company parchased 59,500 of mecchandse thom Kanses Corpoiaton wath fenmes of sto, nos, foe destination, invoice dated Jasuary 26 Jesuay 26 . The compory sold merchiandise with in $4,580 eod for 45 , 17 on crest to KC, incerperamed, invoice dated Jandary 26. January 34 The company poid cash to lyer Addie for 10 dirs" werk at 5245 per day credt from merchardise retumed on louaky 24 Fobruary 5The company paid $460 cish to Facebook for an scvertsentat to appear ce Fubibary 5 orily Februany 15 Santana Rey withd dew $4,610 cash from the con pany for personal use. Fobruary 23 The company sold merchandian w th a 52.6 to cont for 53220 oe credit to Deita Company imoce dated Februnty 23 Febraary 26 . The company poid cash to tyn Add e for egte days work at 5245 per day. Febnusy 27 The compony reimbined Santana Rey 5352 cash for busioss aulomobile milesge. The ecimpony tecorded the rolthibarsemert es Mileoge Eapenise" March 8 The company purchased 52,680 of computer supolies from Haris Olfice Proouets on crecit wath nenta of re30, FOB destination, irvoice dated Mweh 8 Mech 9 The company receired the balance due from Dilla Company for menchandire scid cn Febcuary 23. Mech 11 The compgny paid s870 cath for minor repain to the conpsoy's computer. March 16 The company recehed 55,440 cash fiom Dreat, Incorporated, for computng servicets provided. March of The compary paly the full amburt doe of 34,120 to Hontis 0 thce Produets. conssaing of arnounts created on Decornber 15 for \$1249) and March 8 . March 24 The company bliled Eosy Leasing for 59127 of computing tenices provided. Merch 25 The company sold merchandise with a 52.162 cont for 52.960 on credt to Widcas Setvices, mvoice: dated March 25 March 30 The company rold meicinandise with at $1.128 coat foe 52.290 on credt to leM Comgary, invoice dated Morch 30. March it The company reimbursed Santana fley 5320 cash for business sutomobie mileage. The company recorded the reinbursement as "Milcage Expense" The following additional facts are avalioble for preporing sdiustments on March priar to financial statement prepuration. The March 31 amount of computer supplies still avalable totats 52,025 . Prepaid Insurance coverage of $672 expired during this three-month period. SP 5 Serial Problem Business Solutions (Algo) LO P1, P2, P3, P4 [The following information applies to the questions displayed below] Santana Rey created Business Solutions on October 1, 2021. The company has been successful, and its list of customer has grown. To accommodate the growth, the accounting system is modified to set up separate accounts for each customer. The following chart of accounts includes the account number used for each account and any balance as of December 31, 2021. Santana Rey decided to add a fourth digit with a decimal point to the 106 account number that had been used for the single Accounts Receivable account. This change allows the company to continue using the existing chart of accounts. In response to pequests from custoeers, Santana Rey will begin selling computer software. The company will extend credit terms of 1/10,n/30, FoB shipping point, to all customers who purchase this merchandise. However, no cash discount is available on consulting fees. Additiona1 accounts (Numbers 119, 413, 414 , 415 , and 502 ) are added to its. general ledger to accomodate the company's new merchandising activities. Its transactions for January through March follow. January 4 The company paid cash to Lyn Addie for five days' work at the rate of $245 per day. Four of the five days relate to wages payable that were accrued in the prior year. January 5 Santana Rey invested an additional $24,200 cash in the company. January 7 The company purchased $7,560 of merchandise fron Kansas Corporation with terms of 1/16, n/30, Fob shipping point, invoice dated January 7. January 9 The company received $2,758 cash from Gomez company as full payment on its account. January 11 The company completed a five-day project for Alex's Engineering Company and billed it $5,380, which is the total price of $6,710 less the advance payment of $1,330. The conpany debited Unearned Computer Services Revenue for $1,330. January 13 The company sold merchandise with a retail value of $4,769 and a cost of $3,496 to L1u Corph January 13 . January 15 The company paid $710 cash for freight charges on the merchandise purchased on January 7. January 16 The company received $4,020 cash from Delta Conpany for computer services provided. January 17 The company paid Kansas Corporation far the invoice dated January 7 , net of the discount. January 20 The company gave a price reduction (allonance) of \$4e0 to Liu corporation and credited Liu's accounts receivable for that anount. January 22 The company received the balance due frcm Liu Corporation, net of the discount and the allowance. January 24 The company returned defective merchandise to Kansas corporation and accepted a credit against future purchases (debited accounts payable). The defective merchandise invoice cost, net of the discount, was \$486. January 26 The company purchased $9,500 of merchandise froe Kansas Corporation with termis of 1/10, n/36, FoB destination, involce dated January 26 . January 26 The company sold merchandise with a $4,580 cost for $5,870 on credit to kC, Incorporated, invoice dated January 31 The company paid cash to Lyn Addie for 10 days? work at $245 per day. February 1 The company paid $2,625 cash to Millside Mall for another three months' rent in advance. February 3 The company paid Kansas Corporation for the balance due, net of the cash discount, less the 5486 credit from merchandise returned on January 24 . February 5 The company paid $460 cash to Facebook for an advertisenent to appear on February 5 only. February 11. The conpany received the balance due from Alex's Engineering Company for fees billed on January 11. February 15 Santana Rey withdrew $4,670 cash from the company for personal use. February 23 The coepany sold merchandise with a 52,610 cost for $3,220 on credit to Delta company, involce dated February 23 February 26 the company paid cash to Lyn Addie for eight days' work at $245 per day. February 27 The company reimbursed Santana Rey $352 cash for business automobile mileage. The company recorded the reimbursement as "hileage Expense. March 8 The company purchased $2,880 of computer supplies froe Hacris office Products on credit with terns af n/30, Foo destination, Invoice dated March B. March 9 The company received the balance due from Delta Company for merchandise sold on February 23. March 11 The company paid $879 cash for minor repairs to the company's computer. receivable for that amount. January 22 The company received the balance due from Liu corporation, net of the discount and the allowance. January 24 The company returned defective merchandise to Kansas corporation and accepted a credit against future purchases (debited accounts payable). The defective merchandise invoice cost, net of the discount, was $486. January 26 The company purchased $9,500 of merchandise from Kansas corporation with terms of 1/10, n/36, F06 destination, invoice dated January 26. January 26 The conpany sold merchandise with a 54,580 cost fon $5,879 on credit to KC, Incorporated, Invoice dated January 26. January 31 The compony paid cash to Lyn Addie for 10 days' work ot $245 per day. February 1 The company paid $2,625 cash to Hi11side Mall for another three months? rent in advance. February 3 The company paid Kansas corporation for the balance due, net of the cash d1scount, less the s486 credit fros merchandise returned on January 24. February 5 The company paid $460 cash to facebook for an advertisement to appeor on February 5 anly. February 11 the company received the balance due from alex's Engineering Cospany fon fees billed on January 11. February 15 Santana Rey withdrew $4,670 cash from the company for personal use. February 23 The company sold merchandise with a $2,610 cost for $3,220 on credit to Delta company, invoice dated February 23. February 26 The company paid cash to Lyn Addie for eight days' work at $245 per day. February 27 the company reimbursed Santana Rey $352 cash for business automobile mileage. The company recorded the reimbursement as -Mileage Expense. March 8 the company purchased $2,880 of computer supplies from Harcis office Products on credit with terns of n/3e, FoB destination, invoice dated March 8 . March 9 The company received the balance due from Delta Company for merchandise sold on February 23. March 11 The company paid 5870 cash for minor repairs to the company's computer. March 16 The company received $5,440 cash from Oream, Incorporated, for computing seryices provided. March 19 The company paid the fu1l amount due of $4,120 to Horris office Products, consizting of anounts created on Decenber 15 (of $1,240 ) and March 8 . March 24 the compony billed Easy leasing for $9,127 of computing services provided. Harch 25 The company sold merchandise with a $2,162 cost for $2,960 on credit to iildeat Services, invoice dated Harch 25 . March 30 The company sold merchandise with a $1,128 cost for \$2,290 on credit to IFM Company, invoice dated March 30. March 31 The company reimbursed Santana Rey $320cash for business automobile mileage. The company recorded the reimbursement as "Mileage Expense." The following additional facts are available for preparing adjustments on March 31 prior to financial statement preparation a. The March 31 amount of computer supplies still available totals $2,025. b. Prepaid insurance coverage of $672 expired during this three-month period. c. Lyn Addie has not been paid for seven days of work at the rate of $245 per day. d. Prepaid rent of $2.625 expired during this three-month period. e. Depreciation on the computer equipment for January 1 through March 31 is $1,080. f. Depreciation on the office equipment for January 1 through March 31 is $320. g. The March 31 amount of merchandise inventory still available totals $674. 3. Prepare a 6 -column work sheet that includes the unadjusted trial balance, the March 31 adjustments (a) through (g). and the adjusted thal balance. Do not prepare closing entries and do not journalize the adjustments or post them to the ledger. In response to requests from custoners, Santana Roy will begin selling computer software. The conpany will extend credit terms of 1/10,n/3e, Foe shipping point, to a11 custoners who purchase this merchandise. However, no cash discount is available on consulting fees. Additional accounts (Numbers 119,413,414,415, and 502) are added to its general ledger to accoemodate the company's new merchandising activities, Its transactions for January through Harch follod, January 4 The company paid cash to tin Addle for five days' work at the rate of $245 per day. Four of the five days relate to wages poyable that were accrued in the prior year. January 5 Santana Roy invested an additional 524200cosh in the company Januery? The compony purchnsed $7,500 of merchanatise from Kansos Corporation wet terms of tro, n30. FOB shipping point, Invoice doted January ?. Jenuacy 9 The compeny recelved $2.758 cash from Gamez Compary as full poyment on its aceount. Januniy in The company completed a five-doy project for Alex's Engineering Company ond billed it 55380 , Which is the total price of \$6,710 less the advance payment of 51,330 . The company debbued Unearned Compuater Services Revenue for $1,330. Janusry i3. The compamy cold merchandise with a retali value of 54,700 and a cost of 53,490 to Uu Corporation, Imvolce dated January 13 . annubcy 15 The compony paid 5710 cash for freight charges on the merchandise purchased on January? January 16 The company recelved \$4,020 cash from Dela Company for computer sarvices provided. Janunty 17 The company paid Kansas Corporation for the invoice dated January 7 , net of the discount. January 20 The company gave a price reduction (allowance) of $400 to Liu Corporation and credited Lid's accounts recelvable for that amount. Jonuary 22 The company recelved the balance due from Liu Corporation, net of the discount and the allowance. January 24 The company returned defective merchandise to Kansas Corporation and accepted a credit against future purchases (debited accounts poyable). The defective merchandise invoice cost net of the discount, was $486 January 26 The company purchased $9,500 of merchandise from Kansas Corporation with terms of 1/10, n/30, FOB destination, involce dated January 26 January 26 The company sold merchandise with a $4,580 cost for $5,870 on credit to KC, Incorporated, Ifvolce dated Jontary 26. January 31 The compnny paid cash to Lyn Addie for 10 days' work at $245 per doy. Fobruary 1 The company paid $2,625 cash to Hillside Moll for another three month's' rent in advance. February 3 The company pald Kansas Corporation for the balance due, net of the cash discount, less the 5486 credit trom merchandise retumed on January 24 . February 5 The company paid $460 cash to Fscebook fot an advertisement to appear on February 5 only. Februnyy 11. The company recelved the balance dise from Alex's Engineering Company for fees billed on Jonuary 11. February 15 Santana Rey withdrew $4,670 cash from the company for personal use. February 23 The company sold merchandise with a $2.610 cost for $3,220 on credit to Delta Company, invoice dated February 23. Februory 26 The compony paid cash to Lyn Addie for eight days' work at $245 per day. February 27 The company reimbursed Santana Rey $352 cash for businets automobile mileage. The company recorded the reimbursement as "Mileage Expense:" March 8 . The company purchased $2,880 of computer supples from Harris Oftice Products on credi with terms of n/30,FOB destination, i woice doted March 8. March 9 The company recelved the balance due from Delta Company for merchandise sold on February 23. March 11 The company pald $870 cash for minor repairs to the company's computer. March 16 The company recelved $5.440 cash from Drean, Incorporated, for computing services provided March 19 The company pald the full amount due of $4,120 to Harris. Onfice Products, consisting of amounts. created on December 15 (of \$1,240) and March 8. March 24 The company bilted Easy Leasing for $9.127 of computing services provided. March 25 The company sold merchandise with a $2,162 cost for $2,960 on credit to Wildcat Services, imvoice dated March 25 March 30 The company soid merchandise with a $1,128 cost for $2,290 on-credit to IFM Company, imvoice dated March 30 [The following information applies to the questions displayed below.] Santana Rey created Business Solutions on October 1, 2021. The company has been successful, and its list of customers has grown. To accommodate the growth, the accounting system is modifled to set up separate accounts for each customer. The following chart of accounts includes the account number used for each account and any balance as or December 31, 2021. Santana Rey decided to add a fourth digit with a decimal point to the 106 account number that had been used for the single Accounts Recelvable account. This change allows the companv to continue usinn the existina chart of accounte 5AM Astignment Pript View March 31 The company reimbursed Santana Rey $320 cash for business automobile maleoge. The company recorded the reimbursement as "Miteage Expense:" The following additional facts are available for preparing adjustments on March 31 prior to financial statement preparation. a. The March 31 amount of computer supplies still available totals $2,025. b. Prepaid Insurance coverage of $672 expired during this three-month period. c. Lyn Addie has not been paid for seven days of work ot the rate of $245 per day. d. Prepaid rent of $2,625 expired during this three-month period. e. Depreciation on the computer equipment for January 1 through March 31 is $1,080. f. Depreciation on the office equipment for January 1 through March 31 is $320. g. The March 31 amount of merchandise inventory still available totals $674. Required information SP 5 Serial Problem Part 5 (Algo) 5. Prepare a statement of owner's equity (from the adjusted trial balance in part 3) for the three months ended March 3,2022 . BUSINESS SOLUTIONS Income Statement For Three Months Ended March 31, 2022 Prepare an income statement (from the adjusted trial balance in part 3) for the three months ended March 31 , 20 (a) Use a single-step format. List all expenses without differentiating between selling expenses and general and ac expenses. 3can3. Assignment Print View 22/23. 9.14 AM Assignment Primt Vaw SP 5 Serial Problem Business Solutions (Algo) LO P1, P2, P3, P4 [The following information applles to the questions displayed below] Santana Rey created Business Solutions on October 1, 2021. The company has been successful, and its list of customers has grown. To accommodate the growth, the accounting system is modified to set up separate accounts for each customer, The following chart of accounts includes the account number used for each account and any balance as of December 31, 2021. Santana Rey decided to add a fourth digit with a decimal point to the 106 account number that had been used for the single Accounts Recelvable account. This change allows the company to continue using the existing chart of accounts In response to requests trom customers, santana key wath begin selling computer software. The company will extend credit terms of 1/10,n/30, FOB shipping point, to all custoners who purchase this merchandise. However, no cash discount is available on consulting fees. Additional accounts (Numbers 119, 413, 414, 415, and 502) are added to its general ledger to accommodate the company's new merchandising activities. Its transactions for January through March follow. January 4 The company paid cash to Lyn Addie for five days" work at the rate of $245 per day. Four of the five days relate to wages payable that were accrued in the prior year. January 5 Santana Rey invested an additional $24,260 cash in the company. January 7 The company purchased $7,500 of merchandise from Kansas Corporation with terms of 1/10,n/30, FOB shipping point, invoice dated January 7. January 9 The company received $2,758 cash from Gomez Company as full payment on its account. January 11 The company completed a five-day project for Alex"s Engineering Company and billed it $5,380, which is the total price of $6,710 less the advance payment of $1,330. The conpany debited Unearned Computer Services Revenue for $1,330. January 13 The company sold merchandise with a retail value of $4,700 and a cost of $3,490 to Liu Corporation, invoice dated January 13. January 15 The company paid $710 cash for freight charges on the merchandise purchased on January 7. January 16 The company received $4,020 cash from Delta Company for computer services provided. January 17 The company paid Kansas Corporation for the invoice dated January 7 , net of the discount. January 20 The company gave a price reduction (allowance) of $400 to Liu Corporation and credited Liu's accounts receivable for that anount. January 22 The company received the balance due from Liu Corporation, net of the discount and the allowance. January 24 The company returned defective merchandise to Waneae ramoratian and arrontad = rradit snatnet Prev 1236 of 6 m In response to requests from custosers, Santacu dey wil1 begin selling coeputer software. The coopany wil1 extend credit terms of 1/16,N/39, foe shippine polnt, to a11 custoners who purchase this merchandise. lootver, no casb discount is avallable on consulting fees. Additicnal accounts (Muobers 119, 413, 414, 415, and 502) are added to its general ledger to accomodate the comphny's nen nerchandising actlvities, Its transactions for January through mareh follow. ding relate to wapes pmpable that were ncoratd in the pertse year Janatry 5 Soritanio Aley impested an addsonsi 524200 cath in the compony shipging polm, irveice deted januaty ? denuary in the compery completed a five dey peopect for Aleris frymeeting Corperyy and beled it 35,380 , which is the foem price of $6710 iest the advance peymere of 51330 . The compary defited Unnarned Computee Senices Revenue for $1.330 Jonsary o3 The company sold metchandise wath in retal witue of 54 roo sed a cont of 53490 to Lu Corporation invoice dated January in danumy if the comparty recelved 54.020 cath thom Detur Company lor computer services provised. Januaty 17 The company paid Kareas Corporation for the Hvoice dibed dynumy t, net of the discount. Monuary 20 The company gww a price redurtian jalowatee] of 5400 to lis Corperiation and crecited vur's aceounts recelvble for that amount. Janaacy 22 The company recelved the balance due from thu Corporation net of the dincount and the allowarce. Insasy 24 The company retumed debective merchandbe to Kances Corpocation and aceeperd a credr agains: future purchases (oobled acceonts poyable) The difective merchandide invoice cout, ned af the discount was 5485 . danuary 26 . The company parchased 59,500 of mecchandse thom Kanses Corpoiaton wath fenmes of sto, nos, foe destination, invoice dated Jasuary 26 Jesuay 26 . The compory sold merchiandise with in $4,580 eod for 45 , 17 on crest to KC, incerperamed, invoice dated Jandary 26. January 34 The company poid cash to lyer Addie for 10 dirs" werk at 5245 per day credt from merchardise retumed on louaky 24 Fobruary 5The company paid $460 cish to Facebook for an scvertsentat to appear ce Fubibary 5 orily Februany 15 Santana Rey withd dew $4,610 cash from the con pany for personal use. Fobruary 23 The company sold merchandian w th a 52.6 to cont for 53220 oe credit to Deita Company imoce dated Februnty 23 Febraary 26 . The company poid cash to tyn Add e for egte days work at 5245 per day. Febnusy 27 The compony reimbined Santana Rey 5352 cash for busioss aulomobile milesge. The ecimpony tecorded the rolthibarsemert es Mileoge Eapenise" March 8 The company purchased 52,680 of computer supolies from Haris Olfice Proouets on crecit wath nenta of re30, FOB destination, irvoice dated Mweh 8 Mech 9 The company receired the balance due from Dilla Company for menchandire scid cn Febcuary 23. Mech 11 The compgny paid s870 cath for minor repain to the conpsoy's computer. March 16 The company recehed 55,440 cash fiom Dreat, Incorporated, for computng servicets provided. March of The compary paly the full amburt doe of 34,120 to Hontis 0 thce Produets. conssaing of arnounts created on Decornber 15 for \$1249) and March 8 . March 24 The company bliled Eosy Leasing for 59127 of computing tenices provided. Merch 25 The company sold merchandise with a 52.162 cont for 52.960 on credt to Widcas Setvices, mvoice: dated March 25 March 30 The company rold meicinandise with at $1.128 coat foe 52.290 on credt to leM Comgary, invoice dated Morch 30. March it The company reimbursed Santana fley 5320 cash for business sutomobie mileage. The company recorded the reinbursement as "Milcage Expense" The following additional facts are avalioble for preporing sdiustments on March priar to financial statement prepuration. The March 31 amount of computer supplies still avalable totats 52,025 . Prepaid Insurance coverage of $672 expired during this three-month period. SP 5 Serial Problem Business Solutions (Algo) LO P1, P2, P3, P4 [The following information applies to the questions displayed below] Santana Rey created Business Solutions on October 1, 2021. The company has been successful, and its list of customer has grown. To accommodate the growth, the accounting system is modified to set up separate accounts for each customer. The following chart of accounts includes the account number used for each account and any balance as of December 31, 2021. Santana Rey decided to add a fourth digit with a decimal point to the 106 account number that had been used for the single Accounts Receivable account. This change allows the company to continue using the existing chart of accounts. In response to pequests from custoeers, Santana Rey will begin selling computer software. The company will extend credit terms of 1/10,n/30, FoB shipping point, to all customers who purchase this merchandise. However, no cash discount is available on consulting fees. Additiona1 accounts (Numbers 119, 413, 414 , 415 , and 502 ) are added to its. general ledger to accomodate the company's new merchandising activities. Its transactions for January through March follow. January 4 The company paid cash to Lyn Addie for five days' work at the rate of $245 per day. Four of the five days relate to wages payable that were accrued in the prior year. January 5 Santana Rey invested an additional $24,200 cash in the company. January 7 The company purchased $7,560 of merchandise fron Kansas Corporation with terms of 1/16, n/30, Fob shipping point, invoice dated January 7. January 9 The company received $2,758 cash from Gomez company as full payment on its account. January 11 The company completed a five-day project for Alex's Engineering Company and billed it $5,380, which is the total price of $6,710 less the advance payment of $1,330. The conpany debited Unearned Computer Services Revenue for $1,330. January 13 The company sold merchandise with a retail value of $4,769 and a cost of $3,496 to L1u Corph January 13 . January 15 The company paid $710 cash for freight charges on the merchandise purchased on January 7. January 16 The company received $4,020 cash from Delta Conpany for computer services provided. January 17 The company paid Kansas Corporation far the invoice dated January 7 , net of the discount. January 20 The company gave a price reduction (allonance) of \$4e0 to Liu corporation and credited Liu's accounts receivable for that anount. January 22 The company received the balance due frcm Liu Corporation, net of the discount and the allowance. January 24 The company returned defective merchandise to Kansas corporation and accepted a credit against future purchases (debited accounts payable). The defective merchandise invoice cost, net of the discount, was \$486. January 26 The company purchased $9,500 of merchandise froe Kansas Corporation with termis of 1/10, n/36, FoB destination, involce dated January 26 . January 26 The company sold merchandise with a $4,580 cost for $5,870 on credit to kC, Incorporated, invoice dated January 31 The company paid cash to Lyn Addie for 10 days? work at $245 per day. February 1 The company paid $2,625 cash to Millside Mall for another three months' rent in advance. February 3 The company paid Kansas Corporation for the balance due, net of the cash discount, less the 5486 credit from merchandise returned on January 24 . February 5 The company paid $460 cash to Facebook for an advertisenent to appear on February 5 only. February 11. The conpany received the balance due from Alex's Engineering Company for fees billed on January 11. February 15 Santana Rey withdrew $4,670 cash from the company for personal use. February 23 The coepany sold merchandise with a 52,610 cost for $3,220 on credit to Delta company, involce dated February 23 February 26 the company paid cash to Lyn Addie for eight days' work at $245 per day. February 27 The company reimbursed Santana Rey $352 cash for business automobile mileage. The company recorded the reimbursement as "hileage Expense. March 8 The company purchased $2,880 of computer supplies froe Hacris office Products on credit with terns af n/30, Foo destination, Invoice dated March B. March 9 The company received the balance due from Delta Company for merchandise sold on February 23. March 11 The company paid $879 cash for minor repairs to the company's computer. receivable for that amount. January 22 The company received the balance due from Liu corporation, net of the discount and the allowance. January 24 The company returned defective merchandise to Kansas corporation and accepted a credit against future purchases (debited accounts payable). The defective merchandise invoice cost, net of the discount, was $486. January 26 The company purchased $9,500 of merchandise from Kansas corporation with terms of 1/10, n/36, F06 destination, invoice dated January 26. January 26 The conpany sold merchandise with a 54,580 cost fon $5,879 on credit to KC, Incorporated, Invoice dated January 26. January 31 The compony paid cash to Lyn Addie for 10 days' work ot $245 per day. February 1 The company paid $2,625 cash to Hi11side Mall for another three months? rent in advance. February 3 The company paid Kansas corporation for the balance due, net of the cash d1scount, less the s486 credit fros merchandise returned on January 24. February 5 The company paid $460 cash to facebook for an advertisement to appeor on February 5 anly. February 11 the company received the balance due from alex's Engineering Cospany fon fees billed on January 11. February 15 Santana Rey withdrew $4,670 cash from the company for personal use. February 23 The company sold merchandise with a $2,610 cost for $3,220 on credit to Delta company, invoice dated February 23. February 26 The company paid cash to Lyn Addie for eight days' work at $245 per day. February 27 the company reimbursed Santana Rey $352 cash for business automobile mileage. The company recorded the reimbursement as -Mileage Expense. March 8 the company purchased $2,880 of computer supplies from Harcis office Products on credit with terns of n/3e, FoB destination, invoice dated March 8 . March 9 The company received the balance due from Delta Company for merchandise sold on February 23. March 11 The company paid 5870 cash for minor repairs to the company's computer. March 16 The company received $5,440 cash from Oream, Incorporated, for computing seryices provided. March 19 The company paid the fu1l amount due of $4,120 to Horris office Products, consizting of anounts created on Decenber 15 (of $1,240 ) and March 8 . March 24 the compony billed Easy leasing for $9,127 of computing services provided. Harch 25 The company sold merchandise with a $2,162 cost for $2,960 on credit to iildeat Services, invoice dated Harch 25 . March 30 The company sold merchandise with a $1,128 cost for \$2,290 on credit to IFM Company, invoice dated March 30. March 31 The company reimbursed Santana Rey $320cash for business automobile mileage. The company recorded the reimbursement as "Mileage Expense." The following additional facts are available for preparing adjustments on March 31 prior to financial statement preparation a. The March 31 amount of computer supplies still available totals $2,025. b. Prepaid insurance coverage of $672 expired during this three-month period. c. Lyn Addie has not been paid for seven days of work at the rate of $245 per day. d. Prepaid rent of $2.625 expired during this three-month period. e. Depreciation on the computer equipment for January 1 through March 31 is $1,080. f. Depreciation on the office equipment for January 1 through March 31 is $320. g. The March 31 amount of merchandise inventory still available totals $674. 3. Prepare a 6 -column work sheet that includes the unadjusted trial balance, the March 31 adjustments (a) through (g). and the adjusted thal balance. Do not prepare closing entries and do not journalize the adjustments or post them to the ledger. In response to requests from custoners, Santana Roy will begin selling computer software. The conpany will extend credit terms of 1/10,n/3e, Foe shipping point, to a11 custoners who purchase this merchandise. However, no cash discount is available on consulting fees. Additional accounts (Numbers 119,413,414,415, and 502) are added to its general ledger to accoemodate the company's new merchandising activities, Its transactions for January through Harch follod, January 4 The company paid cash to tin Addle for five days' work at the rate of $245 per day. Four of the five days relate to wages poyable that were accrued in the prior year. January 5 Santana Roy invested an additional 524200cosh in the company Januery? The compony purchnsed $7,500 of merchanatise from Kansos Corporation wet terms of tro, n30. FOB shipping point, Invoice doted January ?. Jenuacy 9 The compeny recelved $2.758 cash from Gamez Compary as full poyment on its aceount. Januniy in The company completed a five-doy project for Alex's Engineering Company ond billed it 55380 , Which is the total price of \$6,710 less the advance payment of 51,330 . The company debbued Unearned Compuater Services Revenue for $1,330. Janusry i3. The compamy cold merchandise with a retali value of 54,700 and a cost of 53,490 to Uu Corporation, Imvolce dated January 13 . annubcy 15 The compony paid 5710 cash for freight charges on the merchandise purchased on January? January 16 The company recelved \$4,020 cash from Dela Company for computer sarvices provided. Janunty 17 The company paid Kansas Corporation for the invoice dated January 7 , net of the discount. January 20 The company gave a price reduction (allowance) of $400 to Liu Corporation and credited Lid's accounts recelvable for that amount. Jonuary 22 The company recelved the balance due from Liu Corporation, net of the discount and the allowance. January 24 The company returned defective merchandise to Kansas Corporation and accepted a credit against future purchases (debited accounts poyable). The defective merchandise invoice cost net of the discount, was $486 January 26 The company purchased $9,500 of merchandise from Kansas Corporation with terms of 1/10, n/30, FOB destination, involce dated January 26 January 26 The company sold merchandise with a $4,580 cost for $5,870 on credit to KC, Incorporated, Ifvolce dated Jontary 26. January 31 The compnny paid cash to Lyn Addie for 10 days' work at $245 per doy. Fobruary 1 The company paid $2,625 cash to Hillside Moll for another three month's' rent in advance. February 3 The company pald Kansas Corporation for the balance due, net of the cash discount, less the 5486 credit trom merchandise retumed on January 24 . February 5 The company paid $460 cash to Fscebook fot an advertisement to appear on February 5 only. Februnyy 11. The company recelved the balance dise from Alex's Engineering Company for fees billed on Jonuary 11. February 15 Santana Rey withdrew $4,670 cash from the company for personal use. February 23 The company sold merchandise with a $2.610 cost for $3,220 on credit to Delta Company, invoice dated February 23. Februory 26 The compony paid cash to Lyn Addie for eight days' work at $245 per day. February 27 The company reimbursed Santana Rey $352 cash for businets automobile mileage. The company recorded the reimbursement as "Mileage Expense:" March 8 . The company purchased $2,880 of computer supples from Harris Oftice Products on credi with terms of n/30,FOB destination, i woice doted March 8. March 9 The company recelved the balance due from Delta Company for merchandise sold on February 23. March 11 The company pald $870 cash for minor repairs to the company's computer. March 16 The company recelved $5.440 cash from Drean, Incorporated, for computing services provided March 19 The company pald the full amount due of $4,120 to Harris. Onfice Products, consisting of amounts. created on December 15 (of \$1,240) and March 8. March 24 The company bilted Easy Leasing for $9.127 of computing services provided. March 25 The company sold merchandise with a $2,162 cost for $2,960 on credit to Wildcat Services, imvoice dated March 25 March 30 The company soid merchandise with a $1,128 cost for $2,290 on-credit to IFM Company, imvoice dated March 30 [The following information applies to the questions displayed below.] Santana Rey created Business Solutions on October 1, 2021. The company has been successful, and its list of customers has grown. To accommodate the growth, the accounting system is modifled to set up separate accounts for each customer. The following chart of accounts includes the account number used for each account and any balance as or December 31, 2021. Santana Rey decided to add a fourth digit with a decimal point to the 106 account number that had been used for the single Accounts Recelvable account. This change allows the companv to continue usinn the existina chart of accounte 5AM Astignment Pript View March 31 The company reimbursed Santana Rey $320 cash for business automobile maleoge. The company recorded the reimbursement as "Miteage Expense:" The following additional facts are available for preparing adjustments on March 31 prior to financial statement preparation. a. The March 31 amount of computer supplies still available totals $2,025. b. Prepaid Insurance coverage of $672 expired during this three-month period. c. Lyn Addie has not been paid for seven days of work ot the rate of $245 per day. d. Prepaid rent of $2,625 expired during this three-month period. e. Depreciation on the computer equipment for January 1 through March 31 is $1,080. f. Depreciation on the office equipment for January 1 through March 31 is $320. g. The March 31 amount of merchandise inventory still available totals $674. Required information SP 5 Serial Problem Part 5 (Algo) 5. Prepare a statement of owner's equity (from the adjusted trial balance in part 3) for the three months ended March 3,2022 . BUSINESS SOLUTIONS Income Statement For Three Months Ended March 31, 2022 Prepare an income statement (from the adjusted trial balance in part 3) for the three months ended March 31 , 20 (a) Use a single-step format. List all expenses without differentiating between selling expenses and general and ac expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts