Question: Need the Answer to Question 2. Please make the answer simple and clear. Do not copy the answer that is already on chegg as it

Need the Answer to Question 2. Please make the answer simple and clear. Do not copy the answer that is already on chegg as it isn't very clear. I need a new answer. Thanks in Advance!!

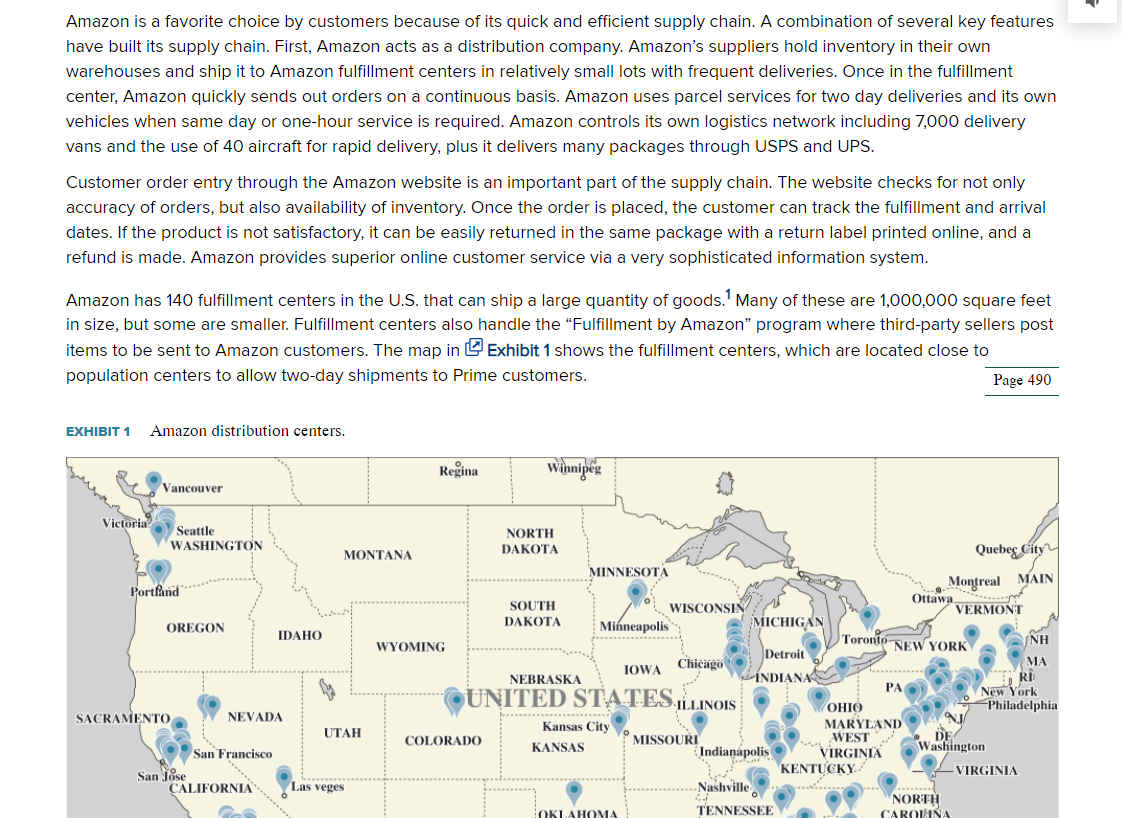

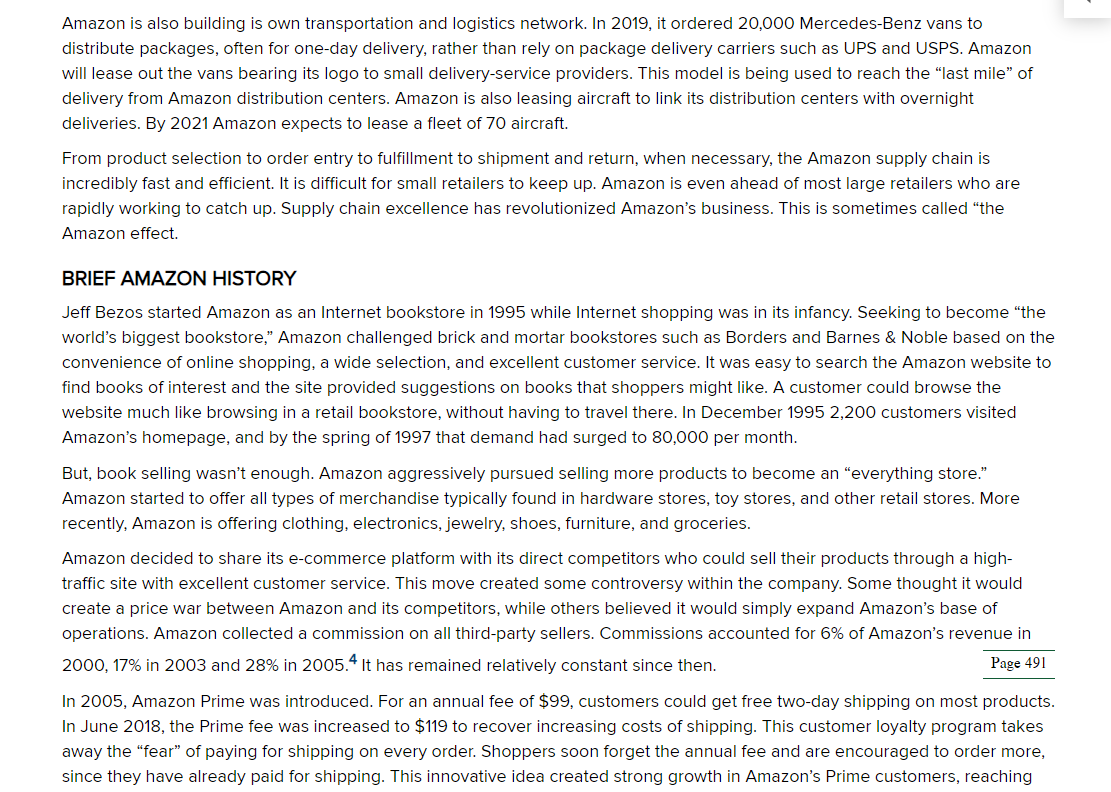

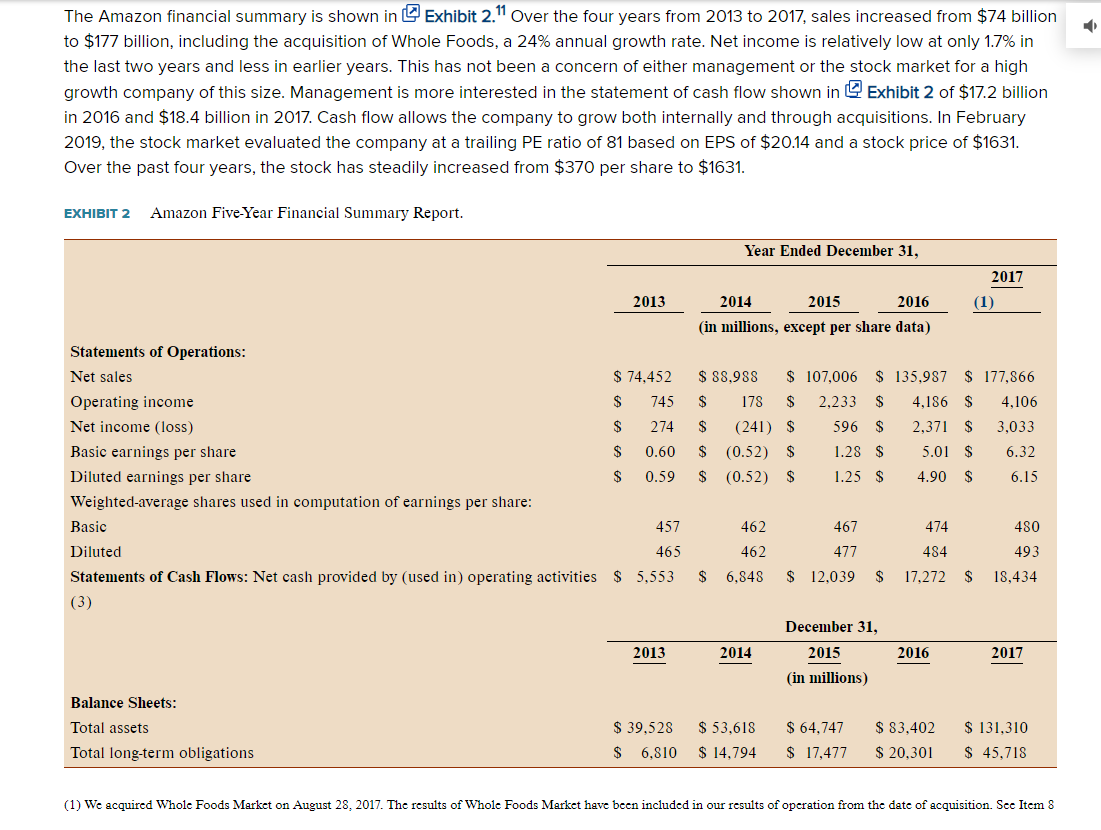

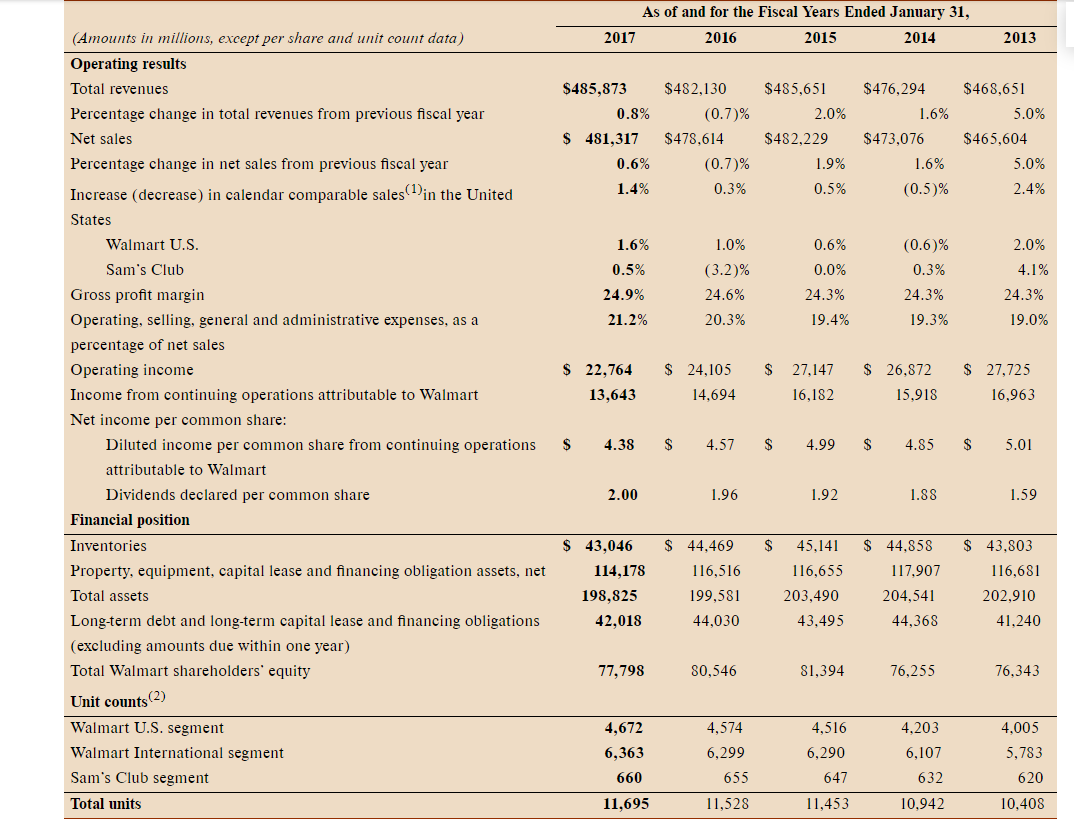

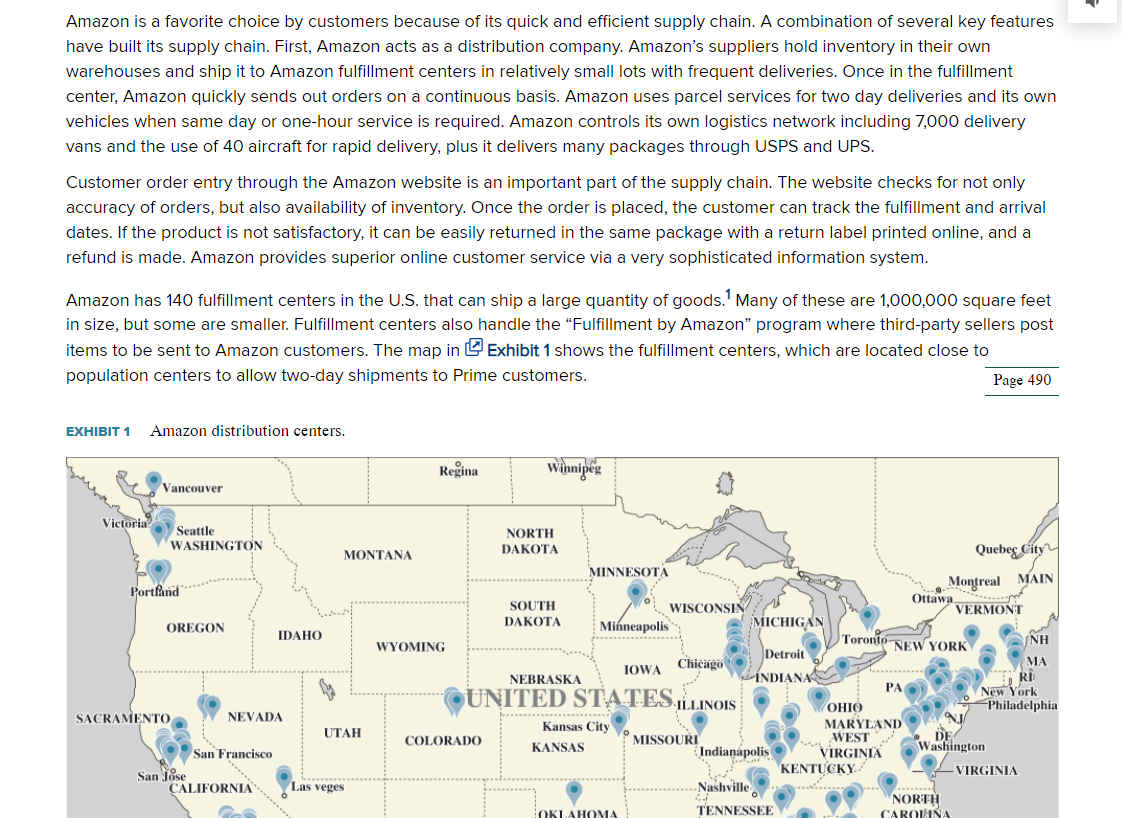

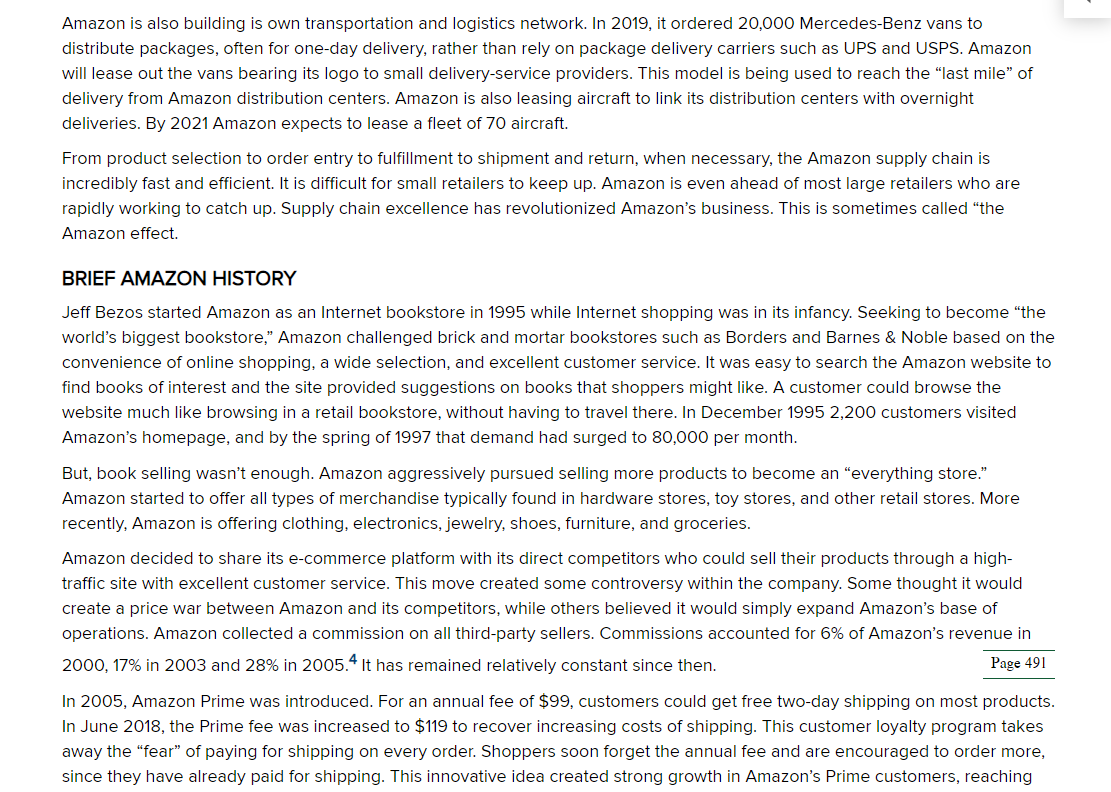

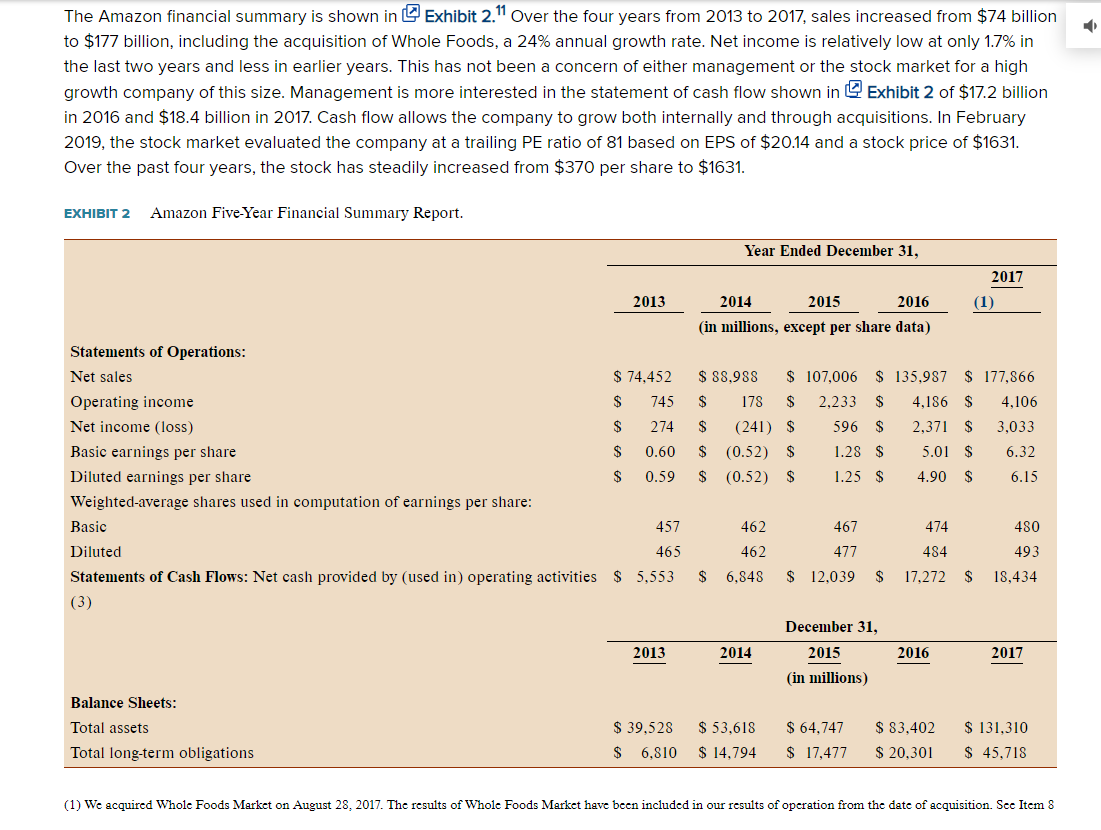

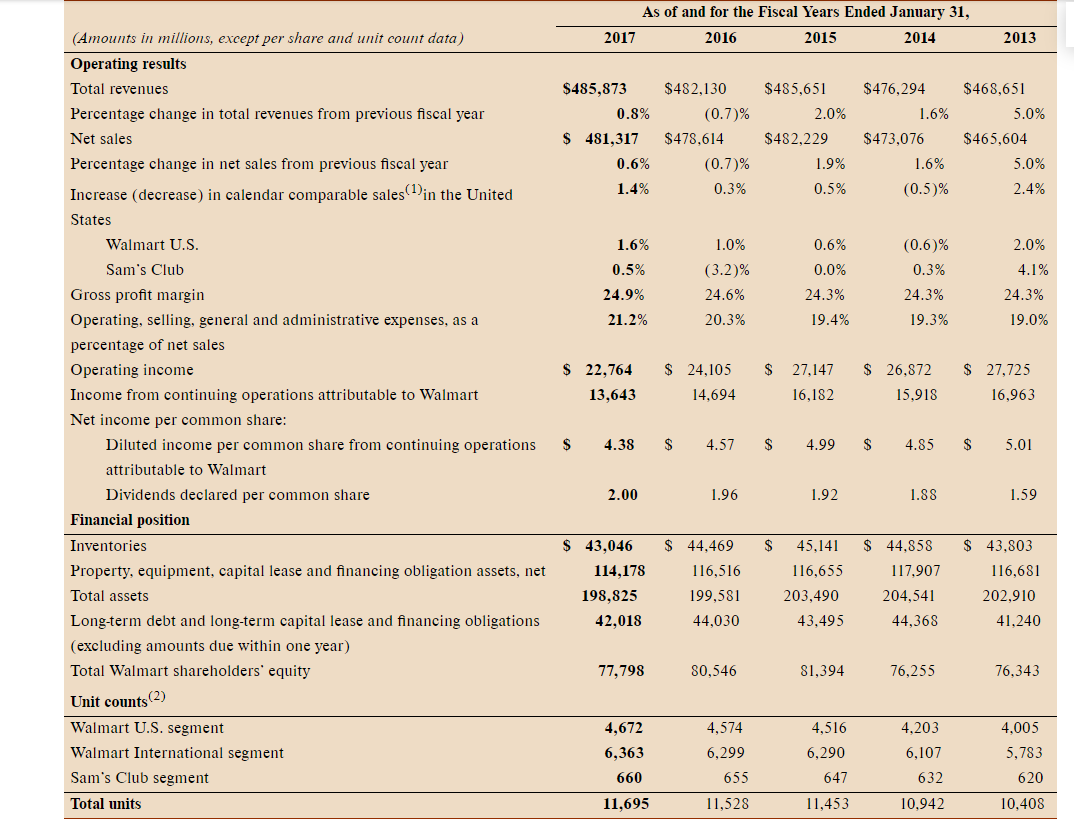

Case Study Amazon Revolutionizes Supply Chain Management 0 Beginning from a small start-up company in 1995, Amazon has revolutionized supply chain management. It dominates Page 489 e-commerce by providing online ordering for all of its products, and it has revolutionized the retail industry with omni- channel marketing. How Amazon has accomplished these changes through innovative supply chain practices is discussed here, along with how traditional retailers are responding. Amazon has fundamentally changed the basis of competition in the retail industry. This case challenges you to think about how Amazon should move forward in the future and how traditional retailers, such as Walmart, should respond from both a strategic and supply chain point-of-view. HOW AMAZON IS REVOLUTIONIZING SUPPLY CHAIN MANAGEMENT Amazon has changed supply chain management forever by providing convenience for the customer. When Amazon started, no one thought customers would pay the shipping costs for convenience. After inventing Amazon Prime, which offered free two- day shipping on most orders for a flat rate of $99 per year, revenue exploded from $7 billion in 2004 to $177 billion in 2017, a growth rate of 27% per year. Growth was facilitated by Amazon's revolutionary supply chain strategy. amazon Amazon is a favorite choice by customers because of its quick and efficient supply chain. A combination of several key features have built its supply chain. First, Amazon acts as a distribution company. Amazon's suppliers hold inventory in their own warehouses and ship it to Amazon fulfillment centers in relatively small lots with frequent deliveries. Once in the fulfillment center, Amazon quickly sends out orders on a continuous basis. Amazon uses parcel services for two day deliveries and its own vehicles when same day or one-hour service is required. Amazon controls its own logistics network including 7,000 delivery vans and the use of 40 aircraft for rapid delivery, plus it delivers many packages through USPS and UPS. Customer order entry through the Amazon website is an important part of the supply chain. The website checks for not only accuracy of orders, but also availability of inventory. Once the order is placed, the customer can track the fulfillment and arrival dates. If the product is not satisfactory, it can be easily returned in the same package with a return label printed online, and a refund is made. Amazon provides superior online customer service via a very sophisticated information system. Amazon has 140 fulfillment centers in the U.S. that can ship a large quantity of goods. Many of these are 1,000,000 square feet in size, but some are smaller. Fulfillment centers also handle the "Fulfillment by Amazon" program where third-party sellers post items to be sent to Amazon customers. The map in Exhibit 1 shows the fulfillment centers, which are located close to population centers to allow two-day shipments to Prime customers. Page 490 EXHIBIT 1 Amazon distribution centers. Regina Winnipeg Vancouver 0 Victoria Seattle WASHINGTON NORTH DAKOTA MONTANA MINNESOTA Quebec City Montreal MAIN . VERMONT Portland Ottawa SOUTH DAKOTA WISCONSIN Minneapolis MICHIGAN OREGON IDAHO Toronto NEW YORK WYOMING Detroit IOWA Chicago NEBRASKA INDIANA NH MA RI New York Philadelphia UNITED STATES ILLINOIS PA OHIO SACRAMENTO NEVADA Kansas City UTAH COLORADO MISSOURI Indianapolis KANSAS MARYLAND WEST VIRGINIA KENTUCKY DE Washington San Francisco San Jose CALIFORNIA - VIRGINIA Las veges Nashville NORTH CAROLINA TENNESSEE With the recent addition of Whole Foods, Amazon acquired 470 stores located through-out the country. While these stores provide groceries, they can also store goods from Amazon.com for transfer to customers. The stores can provide delivery of groceries and Amazon merchandise within two hours for Prime customers or for curb-side pickup by the customers. Curb-side pickup does not require an Amazon Prime membership and the associated cost. The Whole Foods and fulfillment center network provides a very fast and reliable delivery system. Fulfillment centers are highly automated and efficient. Orders are filled in real-time, not in batches at the end of the day. These centers operate on a twenty-four hour cycle. As soon as an order is received, it is sent for picking and packaging and then sent to an available package delivery truck. These trucks constantly load packages for delivery and are frequently dispatched. Gone are the order cut-off times and queueing of packages for end of the day pickup. amazon PrimeAir amazon AMAZON/UPI/Newscom Fulfillment centers use the latest robotic technology to move and pick products for packaging. In 2012 Amazon acquired Kiva Systems, a provider of automated robotic warehouse systems, now renamed Amazon Robotics. Over the years, Amazon has increased in usage of robots. As of 2017 Amazon had 30,000 robots operating in its fulfilment centers.3 Another type of automation is using drones to deliver packages. Drones are being tested for short-range delivery to customers from its fulfillment centers. Amazon is also building is own transportation and logistics network. In 2019, it ordered 20,000 Mercedes-Benz vans to distribute packages, often for one-day delivery, rather than rely on package delivery carriers such as UPS and USPS. Amazon will lease out the vans bearing its logo to small delivery-service providers. This model is being used to reach the "last mile" of delivery from Amazon distribution centers. Amazon is also leasing aircraft to link its distribution centers with overnight deliveries. By 2021 Amazon expects to lease a fleet of 70 aircraft. From product selection to order entry to fulfillment to shipment and return, when necessary, the Amazon supply chain is incredibly fast and efficient. It is difficult for small retailers to keep up. Amazon is even ahead of most large retailers who are rapidly working to catch up. Supply chain excellence has revolutionized Amazon's business. This is sometimes called "the Amazon effect. BRIEF AMAZON HISTORY Jeff Bezos started Amazon as an Internet bookstore in 1995 while Internet shopping was in its infancy. Seeking to become "the world's biggest bookstore," Amazon challenged brick and mortar bookstores such as Borders and Barnes & Noble based on the convenience of online shopping, a wide selection, and excellent customer service. It was easy to search the Amazon website to find books of interest and the site provided suggestions on books that shoppers might like. A customer could browse the website much like browsing in a retail bookstore, without having to travel there. In December 1995 2,200 customers visited Amazon's homepage, and by the spring of 1997 that demand had surged to 80,000 per month. But, book selling wasn't enough. Amazon aggressively pursued selling more products to become an "everything store." Amazon started to offer all types of merchandise typically found in hardware stores, toy stores, and other retail stores. More recently, Amazon is offering clothing, electronics, jewelry, shoes, furniture, and groceries. Amazon decided to share its e-commerce platform with its direct competitors who could sell their products through a high- traffic site with excellent customer service. This move created some controversy within the company. Some thought it would create a price war between Amazon and its competitors, while others believed it would simply expand Amazon's base of operations. Amazon collected a commission on all third-party sellers. Commissions accounted for 6% of Amazon's revenue in 2000, 17% in 2003 and 28% in 2005.4 It has remained relatively constant since then. Page 491 In 2005, Amazon Prime was introduced. For an annual fee of $99, customers could get free two-day shipping on most products. In June 2018, the Prime fee was increased to $119 to recover increasing costs of shipping. This customer loyalty program takes away the "fear" of paying for shipping on every order. Shoppers soon forget the annual fee and are encouraged to order more, since they have already paid for shipping. This innovative idea created strong growth in Amazon's Prime customers, reaching D 100 million in 2018, outnumbering non-Prime members. Fully 60% of American households have at least one prime member.5 Prime built strong customer relationships and has been difficult for competitors to imitate. Amazon Web Service (AWS) was introduced as a result of the massive use of cloud computing by Amazon for its own business. Amazon offers the use of its cloud computing capability and platform to other customers. This improves Amazon's economies of scale in a key technology that supports its business. By 2015, AWS had one million customers including businesses, government agencies, and non-profit organizations. The AWS business is larger than all other competitors combined and one of Amazon's most profitable lines. Jeff Bezos David Ryder/Stringer/Getty Images Amazon also introduced its own proprietary products including Kindle e-readers, Fire tablets, Echo smart speakers, and the Alexa virtual assistant, with more to come. In addition to free shipping, Amazon Prime offers free downloads of some books, streaming videos, and movies. But, not all of Amazon's innovations have been successful. Amazon launched two products that were market and financial failures and had to be discontinued after a few years. Fire phone was a cellphone that never gained traction in the market. A general search engine (A9) was developed and abandoned after four years, even though some parts of it are still used internally. Amazon's latest new venture is the purchase of Whole Foods in 2017 for $13.7 billion. Amazon is aggressively moving into groceries with the 470 Whole Foods stores. It had three objectives in buying Whole Foods: lowering the prices of organic and wholesome foods; fast delivery of groceries directly to customers; and extending its e-commerce website into groceries. Amazon realized it needed a very large geographic footprint to enable it to deliver fresh groceries quickly to end customers. These stores double as dispersed warehouses for delivery of groceries and many other Amazon items. WHLE FOODS MARKET Sundry Photography/Shutterstock Prior to Amazon's acquisition, Whole Foods had two years of poor performance and declining same-store sales. Investors had been pushing Whole Foods for weeks to sell itself to a large grocery retailer such as Kroger. They were surprised by the Amazon acquisition, an e-commerce company, buying into brick-and-mortar stores, especially because groceries are known to be a low-margin business with intense competition. One pundit quipped that Whole Foods would be "Amazon's Waterloo." Amazon noted that they planned many changes for Whole Foods including lower prices and more lower-priced groceries. While online grocery shopping is gaining momentum, it is still a small portion-about 2% of the $674 billion market for edible groceries in the U.S.8 Shortly after purchasing Whole Foods, Amazon cut prices on some products; for example, the price of organic salmon was cut by 34%, eggs were reduced 7%, and bananas were marked down from 79 cents to 49 cents per pound. Amazon offers a 5% discount to Prime customers who use a Prime Rewards Visa card. Yet Whole Foods continues to face a problem in attracting more buyers who are budget conscious. Can Whole Foods ditch its "whole paycheck reputation to compete with traditional retailers? Page 492 A price comparison was done between Walmart and Whole Foods, after the acquisition and price adjustments of Whole Foods already mentioned. Thirty-one nearly identical items were compared. The bill came to $137.89 at Whole Foods and $107.87 at Walmart. Whole Foods was 30% more expensive. 10 Walmart's prices were less than Whole Foods's on almost every item. There were a few products where Whole Foods charged less: bananas, peanut butter, and organic peanut butter. Some other grocery items, such as grapes, watermelon, and eggs, came within a few cents of Walmart's price. Whole Foods had been trying to win over value-oriented customers for two years before the acquisition, but without success. Prime customers are offered two-hour free grocery delivery in some markets when they order $35 or more in groceries, or they pay $4.99 for shipping delivery on smaller orders. The order is delivered by a contract driver within a two-hour window. In some stores, lockers have been added for in-store pickup of purchases made on amazon.com. Whole Foods stores include kiosks selling Echo, Fire TV, and Kindle products. Whole Foods also added curb-side pickup to match what traditional stores are already doing. Amazon's strategy is to offer customer choice and convenience at the high end of the grocery business, where customers can choose to shop in-store, shop online, pick up groceries at the store, or have them delivered. Will this strategy work? Walmar D The Amazon financial summary is shown in Exhibit 2.11 Over the four years from 2013 to 2017, sales increased from $74 billion to $177 billion, including the acquisition of Whole Foods, a 24% annual growth rate. Net income is relatively low at only 1.7% in the last two years and less in earlier years. This has not been a concern of either management or the stock market for a high growth company of this size. Management is more interested in the statement of cash flow shown in Exhibit 2 of $17.2 billion in 2016 and $18.4 billion in 2017. Cash flow allows the company to grow both internally and through acquisitions. In February 2019, the stock market evaluated the company at a trailing PE ratio of 81 based on EPS of $20.14 and a stock price of $1631. Over the past four years, the stock has steadily increased from $370 per share to $1631. EXHIBIT 2 Amazon Five-Year Financial Summary Report. Year Ended December 31, 2017 (1) 2013 2014 2015 2016 (in millions, except per share data) Statements of Operations: Net sales $ 74,452 Operating income $ 745 Net income (loss) $ 274 Basic earnings per share $ 0.60 Diluted earnings per share $ 0.59 Weighted-average shares used in computation of earnings per share: Basic 457 Diluted 465 Statements of Cash Flows: Net cash provided by (used in) operating activities $ 5,553 (3) $ 88,988 $ 107,006 $ 135,987 $ 177,866 $ 178 $ 2,233 $ 4,186 $ 4,106 $ (241) $ 596 $ 2,371 $ 3,033 $ (0.52) $ 1.28 $ 5.01 $ 6.32 $ (0.52) $ 1.25 $ 4.90 $ 6.15 462 467 474 480 477 493 462 6,848 484 17,272 $ $ $ 12.039 $ 18,434 2013 2014 December 31, 2015 (in millions) 2016 2017 Balance Sheets: Total assets Total long-term obligations $ 39,528 $ 6,810 $ 53,618 $ 14,794 $ 64,747 $ 17,477 $ 83,402 $ 20,301 $ 131,310 $ 45,718 (1) We acquired Whole Foods Market on August 28, 2017. The results of Whole Foods Market have been included in our results of operation from the date of acquisition. See Item 8 D The future of Amazon is not without substantial risks, as with all businesses. Some of the risks stated in the 10-K annual report are: . Our ability to offer products on favorable terms, manage inventory, and fulfill orders. Timing, effectiveness, and costs of expansion and upgrades of our systems and infrastructures. The success of our geographic, service, and product line extensions. Variations in the mix of products and services we sell. The extent to which we offer free shipping, continue to reduce prices, and provide additional benefits to our customers. . The extent to which our services are not affected by spyware, viruses and cybercrime. . Our ability to manage new businesses that we acquire and integrate them into our system. Brick-and-mortar stores have been aggressively implementing online systems to compete with Amazon. Walmart, Target and other retailers are fighting back. WALMART ONLINE COMPETITION WITH AMAZON Walmart, and most other retailers, have developed online shopping sites. They are using their brick-and-mortar locations to their advantage. This includes shopping online while picking up orders at curb side, or fast delivery at low cost, or with a customer loyalty program at no cost. In other words, they attempt to offer the same advantages of convenience as Amazon. Today, Walmart employs more than 1.5 million associates at more than 5,000 stores in the U.S. Their business strategy in the beginning was always low prices" and has morphed to its current "save money, live better" with everyday low prices. Walmart has 150 distribution centers in the U.S. They operate their own transportation fleet with 6,100 trucks and 61,000 trailers. The distribution system ships general merchandise, dry groceries, perishable groceries, and specialty categories to stores daily. Their transportation fleet is highly efficient by reducing "empty miles driven and back-hauls. Their largest website, Walmart.com, has up to 100 million visitors each month. With their mobile apps, Easy Reorder and shipping options like free two-day shipping (orders over $35) and Pickup Discount, they provide customers with a variety of ways to save money and improve convenience. Page 493 Fulfillment centers are strategically located across the U.S. with access to 98% of customers with direct two-day shipping or less. Many who thought that Walmart could not provide lower prices with better service have been proven wrong. They have done this by saving on corporate overhead, transportation costs and economies of scale with suppliers, and cost savings everywhere in the company. Walmart started a digital transition along with the emergence of online ordering in the economy. To compete with Amazon and other online retailers, Walmart started a massive overhaul of its online systems in 2012. This included changing everything from the website to underlying software, databases and servers, and the backend data center tools. Walmart built new cloud infrastructure and data centers to support its systems. Since 2012, Walmart has poured $8 billion into this transformation. 12 Walmart sees financial promise in omni-channel customers, who spend more than customers who shop at stores only or online only. Omni-channel customers spend $2,500 per year on average, while online-only buyers spend $200 annually and store- only customers spend $1,400 annually. "We're combining the accessibility of our stores with e-commerce to provide new and exciting ways for customers to shop," Walmart Stores CEO Doug McMillan said. 13 Not everyone is optimistic about Walmart's online future. "We still believe Amazon's lead in online retail is insurmountable," said a Moody's retail analyst. "However, Walmart continues to widen the gap between itself and all other brick-and- mortar retailers by leveraging its unmatched physical resources." 14 To date, Walmart has e-commerce sales of $13.7 billion in the U.S. and plans for growth of up to 20-40% per year. They are especially aggressive in slowing intrusion into their grocery business which is 60% of in-store sales. Walmart's same-store sales rose 2.6% in 2017 and in-store traffic increased. This was buoyed by multibillion dollar investments in making stores more appealing, giving associates raises in hourly wages and more training, while expanding the assortment available on Walmart.co m.15 in 2017, Walmart had a 25.3% share of supermarket chain sales in the U.S. while Whole Foods had just a 1.6% share. By comparison, Kroger Co. had an 8.2% share and Albertson's a 5.4% share. Page 494 The Walmart financial summary is shown in Exhibit 3.16 Walmart's revenue in 2017 was $485 billion, 2.7 times Amazon revenues of $177 billion. Walmart reported net income of $13.6 billion vs. 3.0 billion for Amazon in 2017. Walmart is a much larger company with larger earnings, but much smaller revenue growth of only 13% per year. The capitalization of Walmart is $262 billion while Amazon's market cap is $764 billion. This reflects the market's confidence in Amazon to continue to grow earnings at a high rate. As of and for the Fiscal Years Ended January 31, 2017 2016 2015 2014 2013 $482,130 $485,873 0.8% $ 481,317 0.6% 1.4% (0.7)% $478.614 (0.7)% 0.3% $485,651 2.0% $482.229 1.9% 0.5% $476,294 1.6% $473,076 1.6% (0.5% $468,651 5.0% $465,604 5.0% 2.4% 1.0% 0.6% (0.6% 0.3% 0.0% 1.6% 0.5% 24.9% 21.2% (3.2)% 24.6% 20.3% 2.0% 4.1% 24.3% 24.3% 19.4% 24.3% 19.3% 19.0% $ 22,764 $ 24,105 $ 27,147 16,182 $ 26,872 15,918 $ 27,725 16,963 13,643 14,694 (Amounts in millions, except per share and unit count data) Operating results Total revenues Percentage change in total revenues from previous fiscal year Net sales Percentage change in net sales from previous fiscal year Increase (decrease) in calendar comparable sales(1)in the United States Walmart U.S. Sam's Club Gross profit margin Operating, selling, general and administrative expenses, as a percentage of net sales Operating income Income from continuing operations attributable to Walmart Net income per common share: Diluted income per common share from continuing operations attributable to Walmart Dividends declared per common share Financial position Inventories Property, equipment, capital lease and financing obligation assets, net Total assets Long-term debt and long-term capital lease and financing obligations (excluding amounts due within one year) Total Walmart shareholders' equity Unit counts (2) Walmart U.S. segment Walmart International segment Sam's Club segment Total units S 4.38 $ 4.57 $ 4.99 $ 4.85 $ 5.01 2.00 1.96 1.92 1.88 1.59 $ $ 43,046 114,178 198,825 42,018 $ 44,469 116,516 199,581 44,030 45,141 116,655 203,490 43,495 $ 44.858 117,907 204,541 44,368 $ 43,803 116,681 202,910 41.240 77,798 80,546 81,394 76,255 76,343 4,672 4,516 4,203 4,005 6,363 4,574 6,299 655 6,290 647 6,107 632 5,783 620 660 11,695 11,528 11,453 10,942 10,408 2. What should Walmart do to compete with Amazon's Whole Foods? What is Walmart's best strategy to compete