Question: Need the last 4 yellowed boxes PLEASE, and be specific with your answers. Stocks X and Y have the following probability distributions of expected future

Need the last 4 yellowed boxes PLEASE, and be specific with your answers.

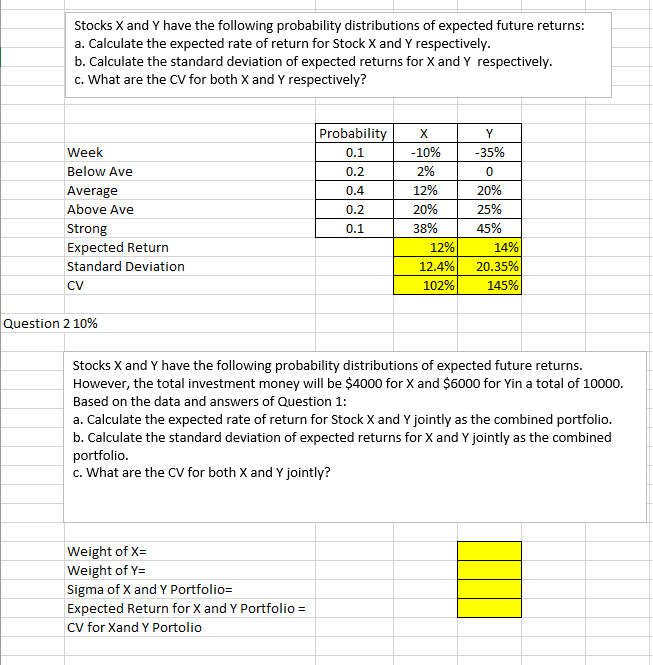

Stocks X and Y have the following probability distributions of expected future returns: a. Calculate the expected rate of return for Stock X and Y respectively. b. Calculate the standard deviation of expected returns for X and Y respectively. c. What are the CV for both X and Y respectively? Probability 0.1 0.2 0.4 Week Below Ave Average Above Ave Strong Expected Return Standard Deviation X -10% 2% 12% 20% 38% 12% 12.4% 102% Y -35% 0 20% 25% 45% 14% 20.35% 145% 0.1 CV Question 2 10% Stocks X and Y have the following probability distributions of expected future returns. However, the total investment money will be $4000 for X and $6000 for Yin a total of 10000. Based on the data and answers of Question 1: a. Calculate the expected rate of return for Stock X and Y jointly as the combined portfolio. b. Calculate the standard deviation of expected returns for X and Y jointly as the combined portfolio c. What are the CV for both X and Y jointly? Weight of X= Weight of Y= Sigma of X and Y Portfolio= Expected Return for X and Y Portfolio = CV for Xand Y Portolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts