Question: needed ASAP Read the case study below and answer ALL the questions that follow. CAPITEC - PROVIDING CHEAP AND SIMPLE BANKING SOLUTIONS Capitec entered the

needed ASAP

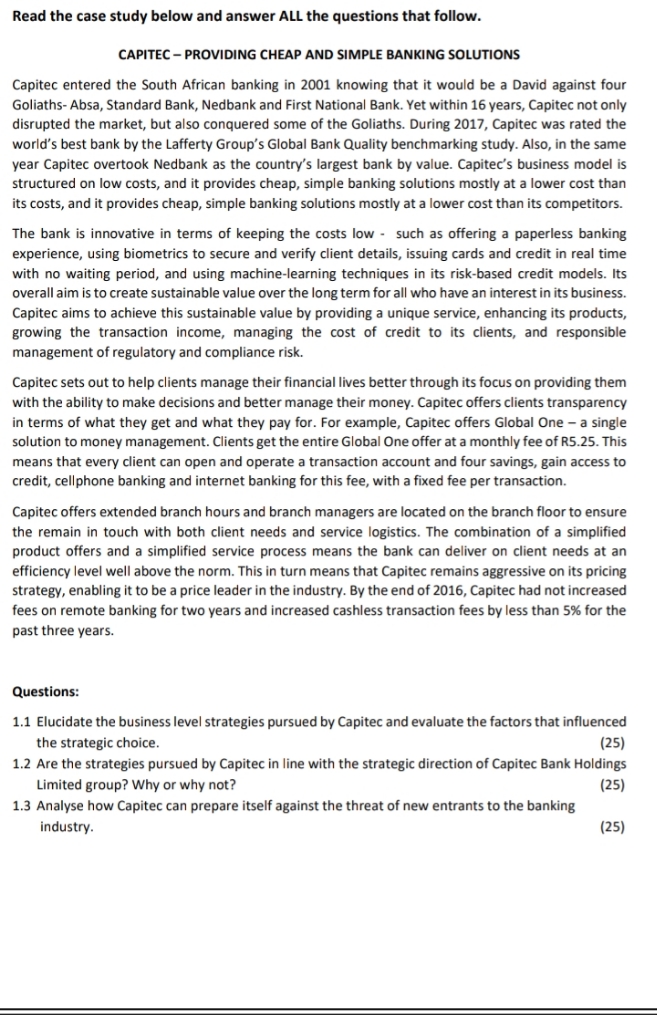

Read the case study below and answer ALL the questions that follow. CAPITEC - PROVIDING CHEAP AND SIMPLE BANKING SOLUTIONS Capitec entered the South African banking in 2001 knowing that it would be a David against four Goliaths- Absa, Standard Bank, Nedbank and First National Bank. Yet within 16 years, Capitec not only disrupted the market, but also conquered some of the Goliaths. During 2017, Capitec was rated the world's best bank by the Lafferty Group's Global Bank Quality benchmarking study. Also, in the same year Capitec overtook Nedbank as the country's largest bank by value. Capitec's business model is structured on low costs, and it provides cheap, simple banking solutions mostly at a lower cost than its costs, and it provides cheap, simple banking solutions mostly at a lower cost than its competitors. The bank is innovative in terms of keeping the costs low - such as offering a paperless banking experience, using biometrics to secure and verify client details, issuing cards and credit in real time with no waiting period, and using machine-learning techniques in its risk-based credit models. Its overall aim is to create sustainable value over the long term for all who have an interest in its business. Capitec aims to achieve this sustainable value by providing a unique service, enhancing its products, growing the transaction income, managing the cost of credit to its clients, and responsible management of regulatory and compliance risk. Capitec sets out to help clients manage their financial lives better through its focus on providing them with the ability to make decisions and better manage their money. Capitec offers clients transparency in terms of what they get and what they pay for. For example, Capitec offers Global One - a single solution to money management. Clients get the entire Global One offer at a monthly fee of R5.25. This means that every client can open and operate a transaction account and four savings, gain access to credit, cellphone banking and internet banking for this fee, with a fixed fee per transaction. Capitec offers extended branch hours and branch managers are located on the branch floor to ensure the remain in touch with both client needs and service logistics. The combination of a simplified product offers and a simplified service process means the bank can deliver on client needs at an efficiency level well above the norm. This in turn means that Capitec remains aggressive on its pricing strategy, enabling it to be a price leader in the industry. By the end of 2016, Capitec had not increased fees on remote banking for two years and increased cashless transaction fees by less than 5% for the past three years. Questions: 1.1 Elucidate the business level strategies pursued by Capitec and evaluate the factors that influenced the strategic choice. (25) 1.2 Are the strategies pursued by Capitec in line with the strategic direction of Capitec Bank Holdings Limited group? Why or why not? (25) 1.3 Analyse how Capitec can prepare itself against the threat of new entrants to the banking industry. (25)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts